The GBP/USD pair trades near its weekly low set at 1.5666, on renewed dollar demand, and with another day with no relevant macroeconomic data in the UK. Later on in the day, the US will release its personal income and expenditures figures, the favorite FED's measure of inflation, alongside with weekly unemployment claims and manufacturing figures. The data needs to beat expectations to improve investors' mood towards the greenback, and local share markets.

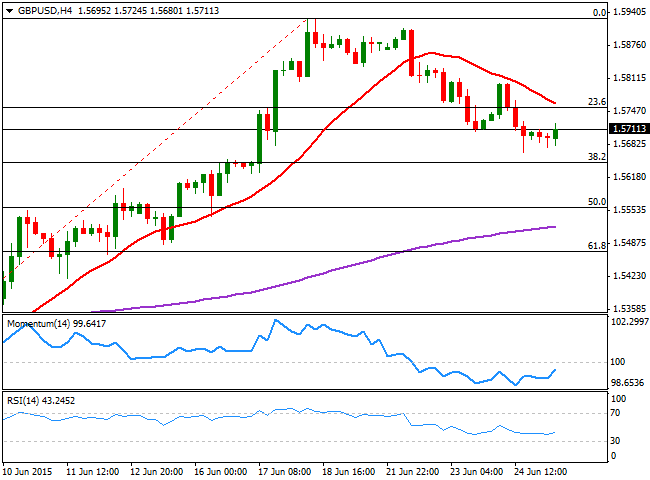

In the meantime, the GBP/USD pair presents a limited bearish tone in its 4 hours chart, as the 20 SMA has accelerated its decline and approaches 1.5750, the 23.6% retracement of its latest bullish run and a strong resistance level, whilst the RSI continues heading lower around 39, but the Momentum indicator aims higher in negative territory, limiting for now, the downside. The 1.5650 level is the 38.2% retracement of the same rally, and a critical support for the upcoming hours, as a break below it should see the price accelerating lower, with 1.5600 as the next bearish target.

To the upside, the pair needs to recover above 1.5700 to test the 1.5750/60 region, although selling interest may likely contain advances around this last.

View live chart of the GBP/USD

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.