The GBP/USD pair is confined to a tight range this Monday, with a short lived spike up to 1.5506 attracting short term selling interest. The daily low has been set early Asia at 1.5458 and with London off, the pair presents a neutral intraday technical stance.

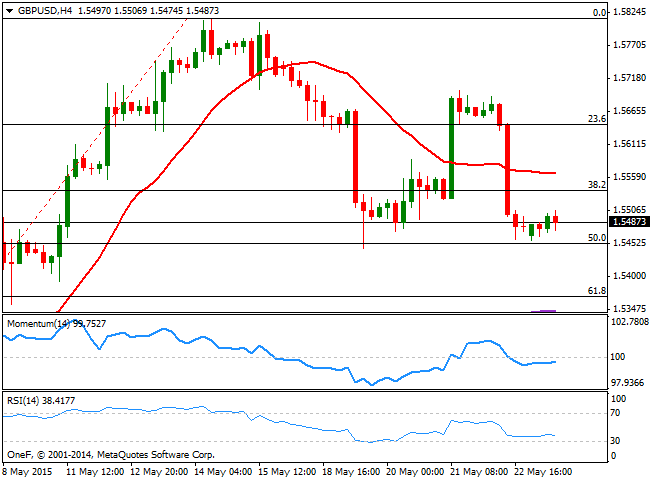

Nevertheless, the 4 hours chart for the pair shows that the price is pressuring the 50% retracement of its latest bullish run from 1.5088 to 1.5814, around 1.5440, level that triggered a strong come back when tested last week. In the same chart, the price is developing below a flat 20 SMA, whilst the technical indicators lack directional strength, keeping the risk towards the downside. Overall, the pair can extend its decline on dollar's strength, albeit the slides are expected to be limited, compared to other high yielders, considering the UK is also in the path of tightening its economic policy, albeit considering to start in 2016.

A break below the mentioned Fibonacci support should lead to additional declines that can extend intraday down to 1.5390, whilst below this last, the 61.8% retracement of the same rally is next, at 1.5360. The immediate strong resistance stands at 1.5540, 38.2% retracement of the same rally, and it will take a clear advance above it to deny the downside and see the pair recovering ground towards the 1.5620 price zone, quite unlikely for this Monday.

View live chart of the GBP/USD

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.