Across the board, dollar is experiencing some short term selling, with commodity currency among the strongest, albeit also confined to tight ranges. Nevertheless, market is extremely quiet at the time being, and if something, US data later on the day can trigger some intraday moves.

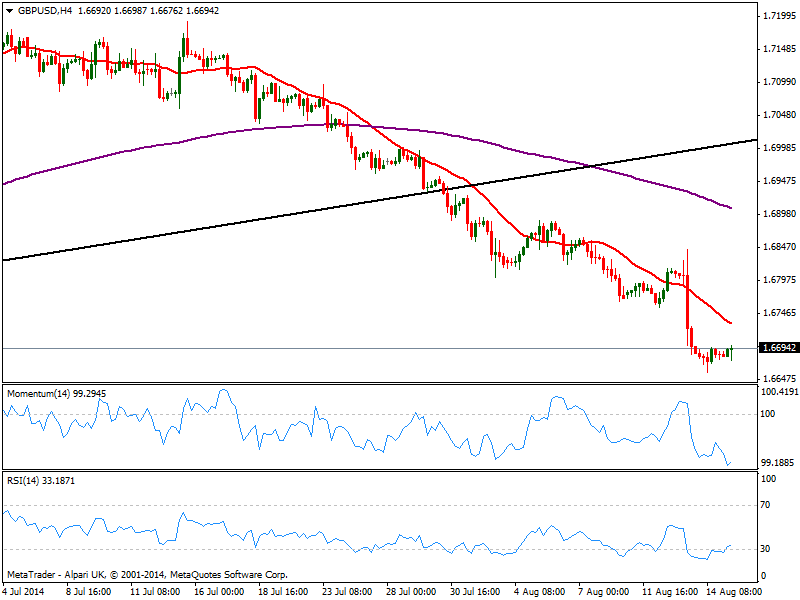

Technically, the GBP/USD maintains its bearish bias, as per trading near the 4 months low posted earlier this week, albeit the 4 hours chart shows indicators exhausted in oversold levels and RSI attempting an upward correction. In the same time frame, 20 SMA presents a strong bearish slope, offering dynamic resistance around 1.6730, and as long as below upward movements will remain as corrective. An unlikely break above it may see the pair extending to the 1.6760/70 price zone, but the downside remains favored: below 1.6650, the pair will likely accelerate its slide, eyeing 1.6590/1.6610 price zone.

View Live Chart for GBP/USD

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700 as USD struggles ahead of data

EUR/USD is posting small gains above 1.0700 in the European session on Thursday. The pair remains underpinned by a sustained US Dollar weakness, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD stays firm above 1.2500 amid US Dollar weakness

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair's uptick is supported by a broadly weakness US Dollar on dovish Fed signals. A mixed market mood could cap the GBP/USD upside ahead of mid-tier US data.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.