- Brexit uncertainty has risen after the EU and UK laid opposing visions to post-Brexit relations.

- The coronavirus outbreak is boosting the safe-haven dollar.

- The greenback is gaining after upbeat US figures.

- Tuesday's four-hour chart is pointing to oversold conditions.

Every party has its hangover – and Brexit is no exception. Fresh tensions between London and Brussels explain part of GBP/USD's downfall – near 300 pips since Friday and hitting the lowest levels since mid-December.

Here are three reasons for the crash:

1) Brexit bites

After the UK officially left the EU on January 31, both sides laid down their visions for post-Brexit relations after the transition period expires at year-end, The differences are stark.

Michel Barnier, the EU's Chief Negotiator, said that to have easy market access, the UK would have to align itself with EU rules, including adhering to the European Court of Justice. On the other hand, UK Prime Minister Boris Johnson rejects taking any rules from the bloc and maintained a combative tone.

Both sides are also at loggerheads over fisheries and other topics. If they fail to strike an agreement, Britain will deal with the EU on World Trade Organization terms (WTO) which would be a shock to the economy. The near simultaneous speeches from both sides of the Channel sparked cable's sell-off.

2) Coronavirus is mostly dollar-positive

The coronavirus outbreak continues raging, claiming the lives of over 400 people and infecting over 20,000. A second death outside China was reported in Hong Kong while Belgium reported its first infection. Economic activity in Asia and elsewhere is under pressure.

While stocks are moving from falls to recoveries, the greenback is one of the currencies of choice. Contrary to last week's dollar dumping – correlated with sliding US bond yields – the world's reserve currency is enjoying higher demand now.

Further headlines are set to impact markets.

3) Upbeat US data

The ISM Manufacturing Purchasing Managers' Index beat expectations by rising to 50.9 – a jump of over three points and reflecting a return to growth. It seems that the US consumer was able to push forward despite industry dragging the economy down 0 and now manufacturing is on its feet again.

The figure also serves as a hint toward Friday's Non-Farm Payrolls. The US publishes Factory Orders for December later on Tuesday, and a bounce is on the cards there as well.

Overall, GBP/USD has many reasons to fall these seem to outweigh initial signs of recovery in the British economy. Markit's Manufacturing PMI for December was upgraded to 50 – exactly the threshold that separates expansion from contraction.

GBP/USD Technical Analysis

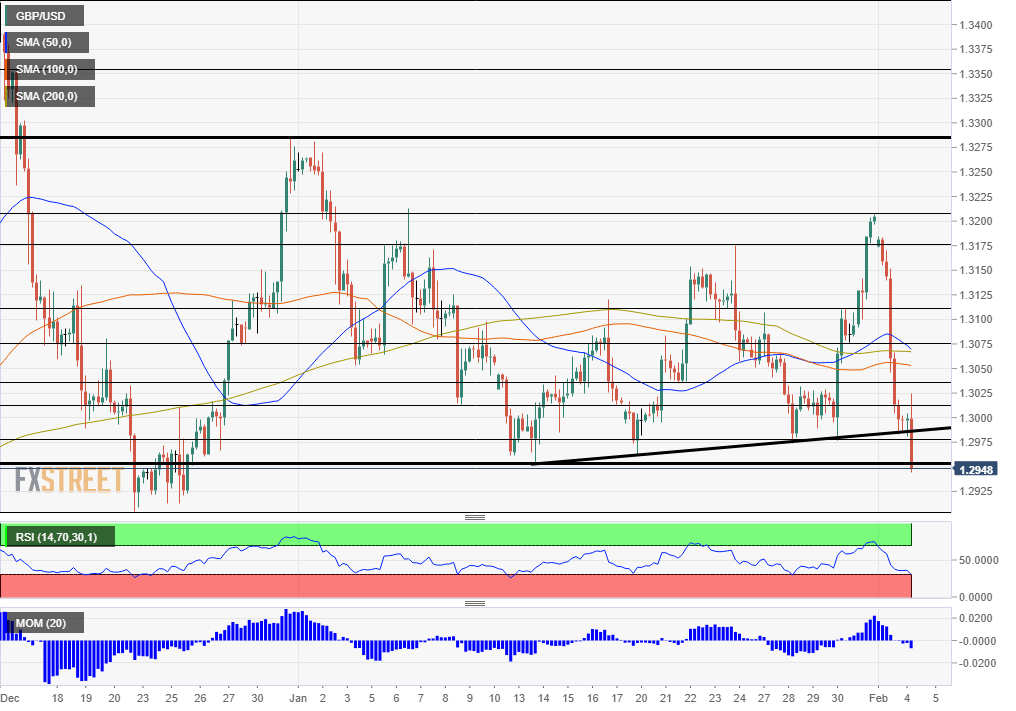

On its way down, pound/dollar fell below the 50, 100, and 200 Simple Moving Averages on the four-hour chart. Moreover, it dropped below the uptrend support line that had accompanied it since mid-January and momentum turned negative.

However, the Relative Strength Index is close to 30 – near oversold conditions. This development implies that an upside correction may be coming soon. A correction could be temporary.

GBP/USD continues battling 1.2955, the low point in January. Further down, 1.29 is a round level and also worked as support in mid-December. It is followed by 1.2875, 1.2820, and 1.2775.

Looking up, resistance awaits at 1.2975, which was a cushion in late January. Next, 1.3010 is a veteran resistance line, and it is followed by 1.3035, which held GBP/US down in late January. 1.3075, 1.3110, and 1.3175 are next.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price (XAU/USD) struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.