- GBP/USD has been rising on vaccine and Brexit optimism.

- Struggles around the next budget and concerns about lockdowns may weigh on the pound.

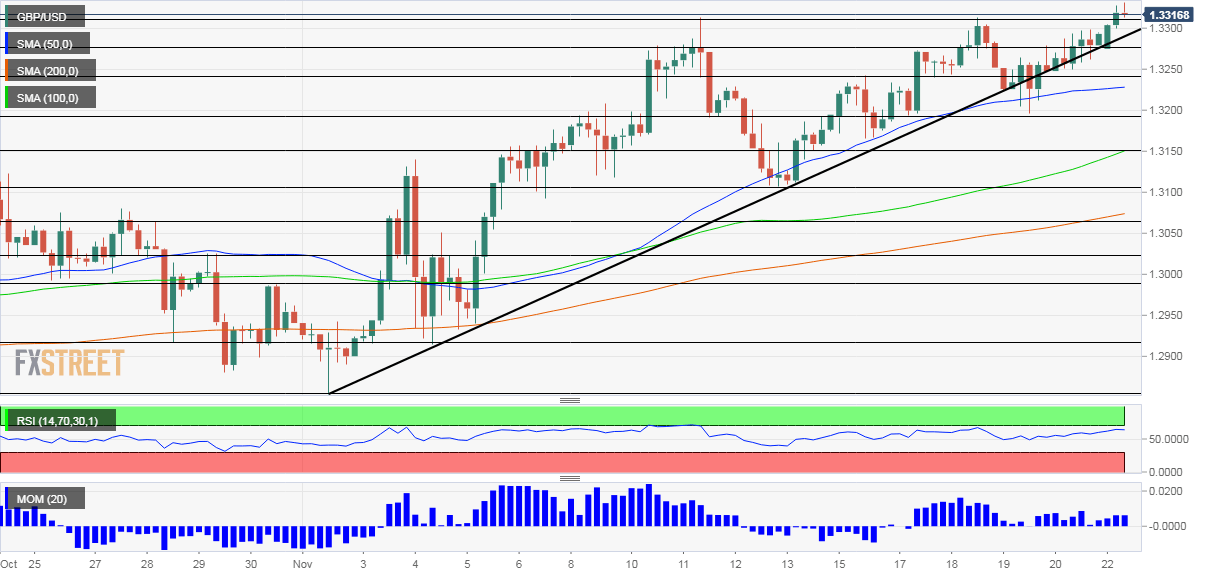

- Monday's four-hour chart is painting a bullish picture.

Back to normal some time after Easter – that is the promise from Matt Hancock, the UK's health minister. He has been speaking after AstraZeneca and the University of Oxford reported some results from their COVID-19 vaccine trial.

The average efficacy is around 70% – lower than the competition from Pfizer/BioNTech and Moderna. However, AstraZeneca says that a smaller dosing regimen of 1.5 shots instead of two is 90% efficient. Moreover, the material can be stored in regular fridge temperature and the firm says it can produce three billion doses next year.

Markets received another boost on the news, pushing the safe-haven dollar down. Moreover, as the British government has an agreement to purchase 100 million doses – potentially sufficient for vaccinating 66 million people – the pound also responded positively.

The news follows the UK government's strive to approve the usage of vaccines from Pfizer/BioNTech as early as early December, perhaps surpassing the US.

Sterling is also benefiting from optimism around Brexit. The British media has been reporting that an agreement is "95% done" and basically imminent. However, investors have known that most of the details of future EU-UK relations have been ready for some time, while that 5% – fisheries, state aid, and governance – remain sticking points.

An accord is not fully priced in and could boost the pound. However, if time passes by without white smoke from Brussels, sterling could suffer.

Another hurdle is the upcoming budget. While Chancellor of the Exchequer Rishi Sunak committed to refrain from austerity, he is reportedly considering a pay freeze for most public workers. Such a move is already angering unions and could weigh on consumption.

Circling back to coronavirus, its spread is far from over. British covid statistics have stabilized but are yet to bend lower. The current nationwide lockdown expires on December 2 and the government is set to return to a localized approach. However, the new tiers may include relatively robust restrictions.

Markit's preliminary Purchasing Managers' Indexes are set to decline amid the shuttering, yet remain above 50, reflecting growth. Later in the day, US PMIs are forecast to edge lower as well.

The focus in America remains on the virus, with a new peak of hospitalizations above 83,000. The mortality curve is also on the rise. On the political front, President-elect Joe Biden may announce his pick for Treasury Secretary on Tuesday. President Donald Trump has failed in his attempts to overturn the election results and is coming under growing pressure to allow a smooth transition.

Overall, the focus is on the UK, with reasons to be cheerful, yet hurdles remain.

GBP/USD Technical Analysis

Pound/dollar is benefiting from upside momentum on the four-hour chart and is trading above the uptrend support line that has been accompanying it from early November. It is also holding above the 50, 100 and 200 Simple Moving Averages.

However, the Relative Strength Index is on the verge of surpassing the 70 level – entering overbought territory.

Some resistance is at the daily high of 1.3360, followed by 1.3420 and 1.3510 seen in the summer.

Support awaits at the previous resistance line of 1.3310, see in mid-November. It is followed by 1.3280, which held the currency pair on its way up. The next levels to watch are 1.3195 and 1.3150.

More When the market shivers, the Fed delivers? Where next for markets

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.