GBP/USD Forecast: Sellers struggle to take control

- GBP/USD stays below 1.3200 after closing in negative territory on Wednesday.

- The technical outlook is yet to point to a buildup of bearish momentum.

- Investors await US Q2 GDP revision and weekly Initial Jobless Claims data.

GBP/USD turned south and fell over 0.5% on the day on Wednesday after reaching its highest level since March 2022 at 1.3266 on Tuesday. The pair finds it difficult to regain its traction early Thursday but it manages to limit its losses.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the weakest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.88% | 0.17% | 0.27% | -0.38% | -0.33% | -0.88% | -0.43% | |

| EUR | -0.88% | -0.76% | -0.61% | -1.23% | -1.30% | -1.71% | -1.28% | |

| GBP | -0.17% | 0.76% | 0.06% | -0.53% | -0.54% | -1.04% | -0.58% | |

| JPY | -0.27% | 0.61% | -0.06% | -0.64% | -0.52% | -0.92% | -0.60% | |

| CAD | 0.38% | 1.23% | 0.53% | 0.64% | 0.05% | -0.46% | -0.05% | |

| AUD | 0.33% | 1.30% | 0.54% | 0.52% | -0.05% | -0.45% | 0.01% | |

| NZD | 0.88% | 1.71% | 1.04% | 0.92% | 0.46% | 0.45% | 0.45% | |

| CHF | 0.43% | 1.28% | 0.58% | 0.60% | 0.05% | -0.01% | -0.45% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

In the absence of high-tier data releases, the risk-averse market atmosphere helped the US Dollar (USD) gather strength on Wednesday, triggering an overdue correction in GBP/USD. The USD Index, which tracks the USD's performance against a basket of six major currencies, rose 0.5% on the day.

Although the USD Index continues to stretch higher early Thursday, GBP/USD's downside remains limited for now. The sharp decline seen in EUR/USD pair following the soft regional inflation data from Germany suggests that the USD is capturing capital outflows out of the Euro. However, EUR/GBP is down 0.3% on the day and trading at its lowest level in a month near 0.8400 in the European session, highlighting Pound Sterling's strength against the Euro.

Later in the day, the weekly Initial Jobless Claims data from the US will be looked upon for fresh impetus. Investors expect the number of first-time application for unemployment benefits remain unchanged at 232,000 in the week ending August 26. In case this data declines to 220,000, or lower, the USD could gather further strength with the immediate reaction and weigh on GBP/USD.

GBP/USD Technical Analysis

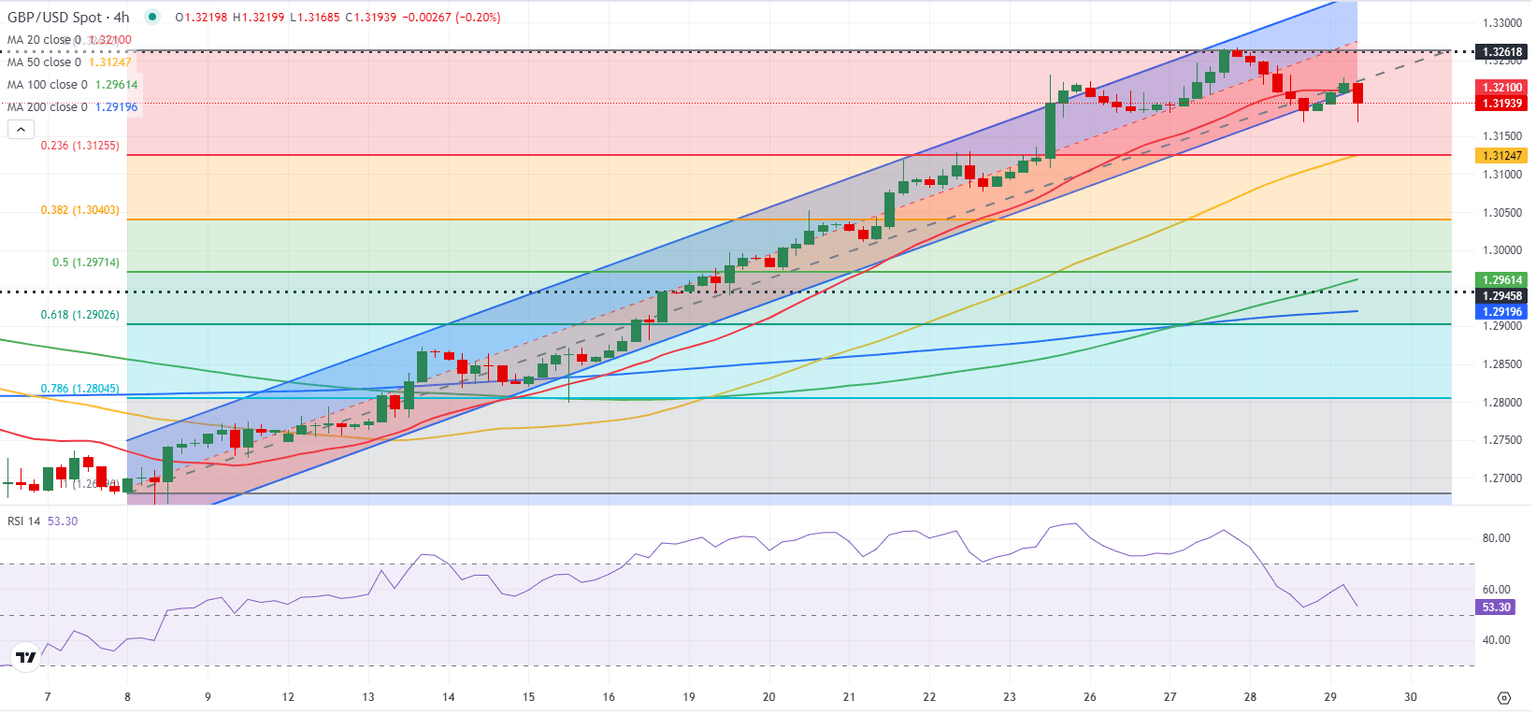

GBP/USD declined below the lower limit of the ascending channel, suggesting that the uptrend could be coming to an end. The Relative Strength Index (RSI) indicator on the 4-hour chart, however, holds above 50, reflecting a lack of bearish momentum.

On the downside, 1.3130 (50-period Simple Moving Average (SMA), Fibonacci 23.6% retracement of the latest uptrend) and 1.3100 (psychological level, static level) could be seen as next support levels. In case GBP/USD stabilizes above 1.3200 (lower limit of the ascending channel), sellers could be discouraged. In this scenario, 1.3260 (static level, mid-point of the ascending channel) could be seen as next resistance before 1.3300 (psychological level, static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.