GBP/USD Forecast: Pressuring weekly lows and at risk of falling

GBP/USD Current price: 1.3737

- The UK Markit Construction PMI jumped to 61.7 in March.

- Concerns related to the AstraZeneca covid vaccine weigh on the pound.

- GBP/USD remains under selling pressure and is poised to extend its slump.

The British Pound remained among the worst performers against the greenback, as the GBP/USD pair extended its weekly decline to 1.3718, ending the day around 1.3740. UK macroeconomic data was quite encouraging, as the March Markit Construction PMI hit 61.7, improving from 53.3 and largely surpassing the expected 54.6. Concerns surrounding the AstraZeneca vaccine keep weighing on sterling, as the EMA found a “rare link” between the jab and blood clots. Nevertheless, the UK has given at least one dose of a coronavirus vaccine to roughly 50% of the population, which brought sharply down the number of daily deaths and contagions.

The UK will publish on Friday Halifax House Prices for the three months to March, while the BOE will publish its Quarterly Bulletin for the first quarter of the year.

GBP/USD short-term technical outlook

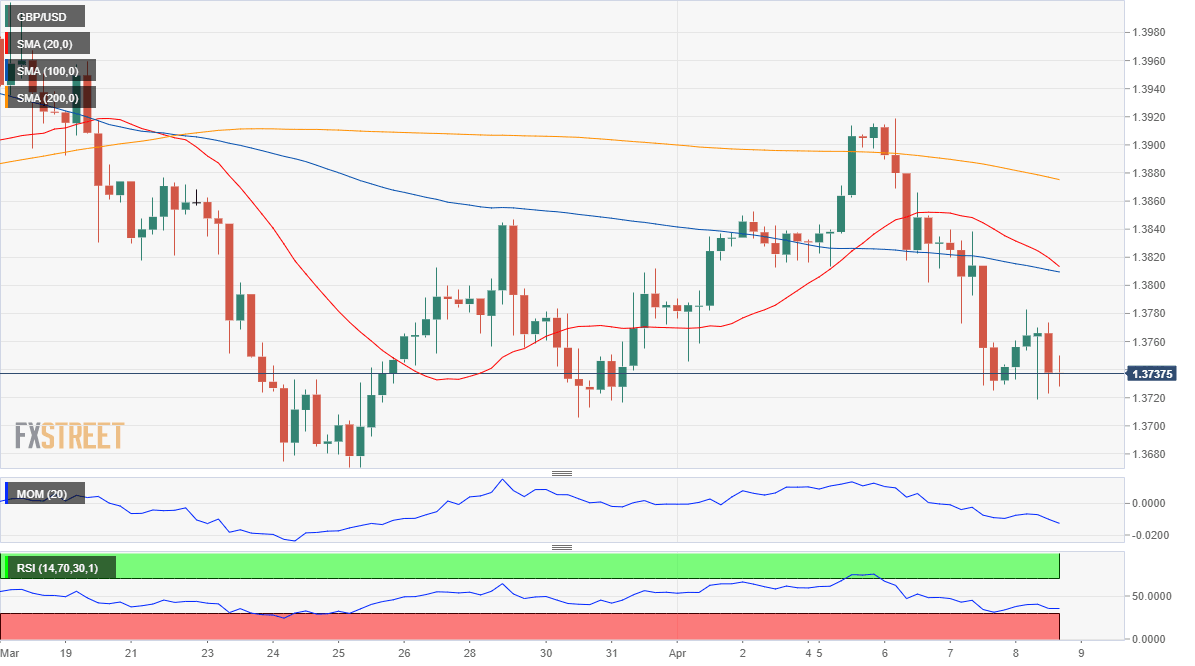

The GBP/USD pair is still at risk of falling according to intraday technical readings. The 4-hour chart shows that it keeps developing below all of its moving averages, with the 20 SMA accelerating south and about to cross below the 100 SMA, both around the 1.3815 level. The Momentum indicator bounced from daily lows but lost strength upward within negative levels, while the RSI indicator is stable around 38, indicating a lack of buying interest. A steeper decline is on the table on a break below 1.3720, the immediate support level.

Support levels: 1.3720 1.3680 1.3640

Resistance levels: 1.3770 1.3810 1.3865

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.