GBP/USD Forecast: Pound Sterling could push higher once it clears 1.3000

- GBP/USD struggles to build on Thursday's gains, trades near 1.2950.

- The BoE and the Fed both opted for 25 bps rate cuts.

- The pair could attract buyers if it clears 1.3000 resistance.

GBP/USD gathered bullish momentum on Thursday and erased a large portion of Wednesday's losses. The pair, however, lost its traction after failing to stabilize above 1.3000 and was last seen trading in negative territory near 1.2950.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.45% | -0.33% | 0.18% | -0.28% | -1.32% | -0.37% | 0.57% | |

| EUR | -0.45% | -0.81% | -0.69% | -1.12% | -1.46% | -1.22% | -0.28% | |

| GBP | 0.33% | 0.81% | -0.14% | -0.31% | -0.65% | -0.40% | 0.53% | |

| JPY | -0.18% | 0.69% | 0.14% | -0.45% | -0.95% | -0.34% | 0.70% | |

| CAD | 0.28% | 1.12% | 0.31% | 0.45% | -0.84% | -0.10% | 0.85% | |

| AUD | 1.32% | 1.46% | 0.65% | 0.95% | 0.84% | 0.24% | 1.19% | |

| NZD | 0.37% | 1.22% | 0.40% | 0.34% | 0.10% | -0.24% | 0.94% | |

| CHF | -0.57% | 0.28% | -0.53% | -0.70% | -0.85% | -1.19% | -0.94% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

The Bank of England (BoE) said on Thursday that it cut the bank rate by 25 basis points (bps) to 4.75%, with eight policymakers voting in favor of the decision, against Catherine Mann, who voted to leave the policy rate unchanged at 5%. This decision came in line with the market expectation.

In its policy statement, the BoE announced that it revised its forecast for the Consumer Price Index inflation in one year's time to 2.7% from 2.4% in August's projections, adding that the new budget is provisionally expected to boost inflation by just under 0.5 percentage points at peak between mid 2026 and early 2027. The revision to inflation projections helped Pound Sterling stay resilient against the US Dollar (USD).

In the second half of the day, the Federal Reserve (Fed) lowered the policy rate by 25 bps to the range of 4.5%-4.75%. The US central bank repeated in the policy statement that risks to the job market and inflation were "roughly in balance." In the post-meeting press conference, Fed Chairman Jerome Powell refrained from hinting whether they will opt for another rate cut in December. When asked about Donald Trump's victory in the presidential election, Powell explained that the results of the election will not have an effect on the monetary policy in the near term. GBP/USD retreated slightly from the session highs after the event but still ended the day with a gain of more than 0.8%.

Early Friday, the cautious market stance makes it difficult for GBP/USD to build on Thursday's gains. At the time of press, US stock index futures were trading mixed. If risk flows return ahead of the weekend, the USD could have a hard time finding demand and open the door for an extended rebound in GBP/USD.

GBP/USD Technical Analysis

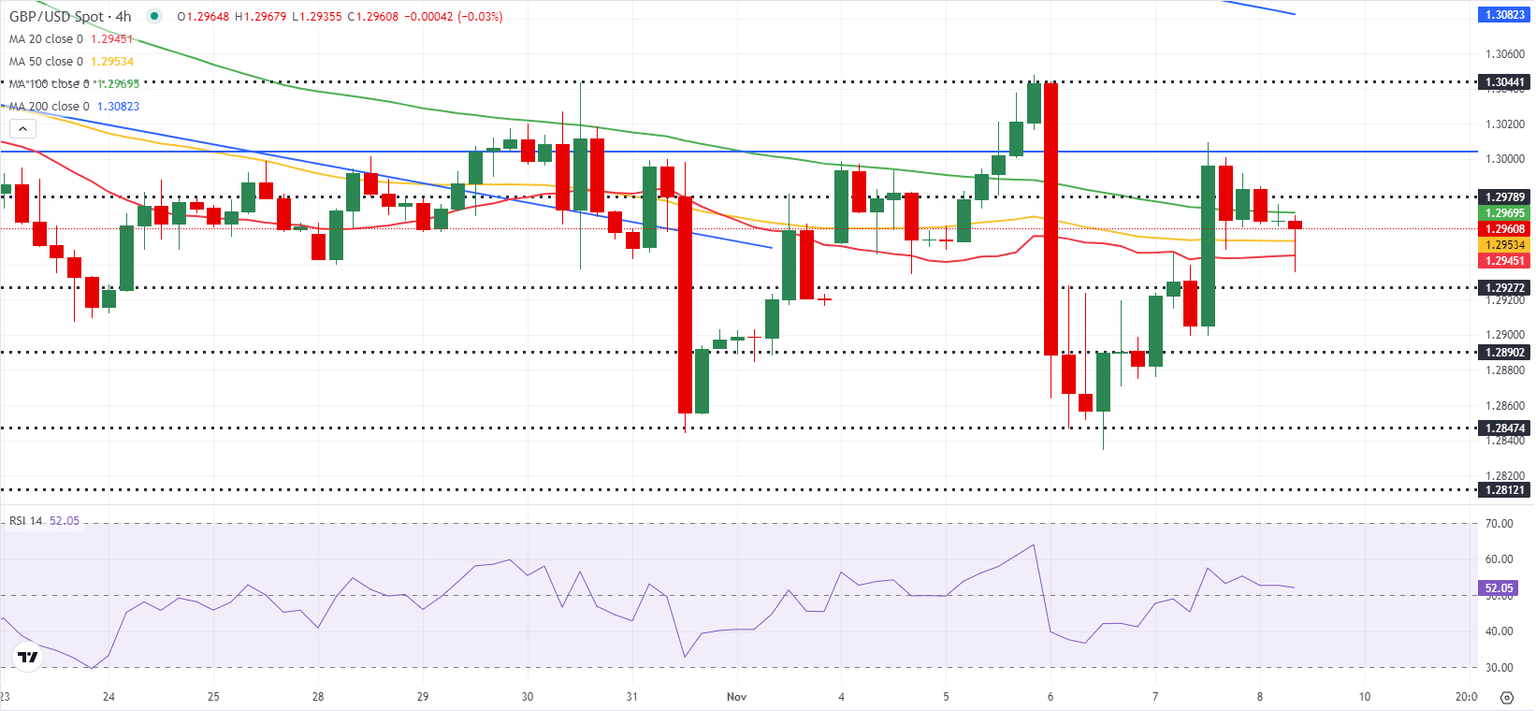

The Relative Strength Index (RSI) indicator on the 4-hour chart stays slightly above 50, reflecting sellers' hesitancy. On the upside, the 100-day Simple Moving Average (SMA) forms a key resistance level at 1.3000. A weekly close above this level could attract technical buyers. In this scenario, 1.3050 (static level) could be the next hurdle before 1.3100 (50-day SMA).

Looking south, first support could be spotted at 1.2900 (static level) ahead of 1.2820 (200-day SMA).

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.