- GBP/USD has surged after the second upbeat figure cast doubts about an imminent rate cut.

- Parliament approval of Brexit, the coronavirus outbreak and further BOE speculation is eyed.

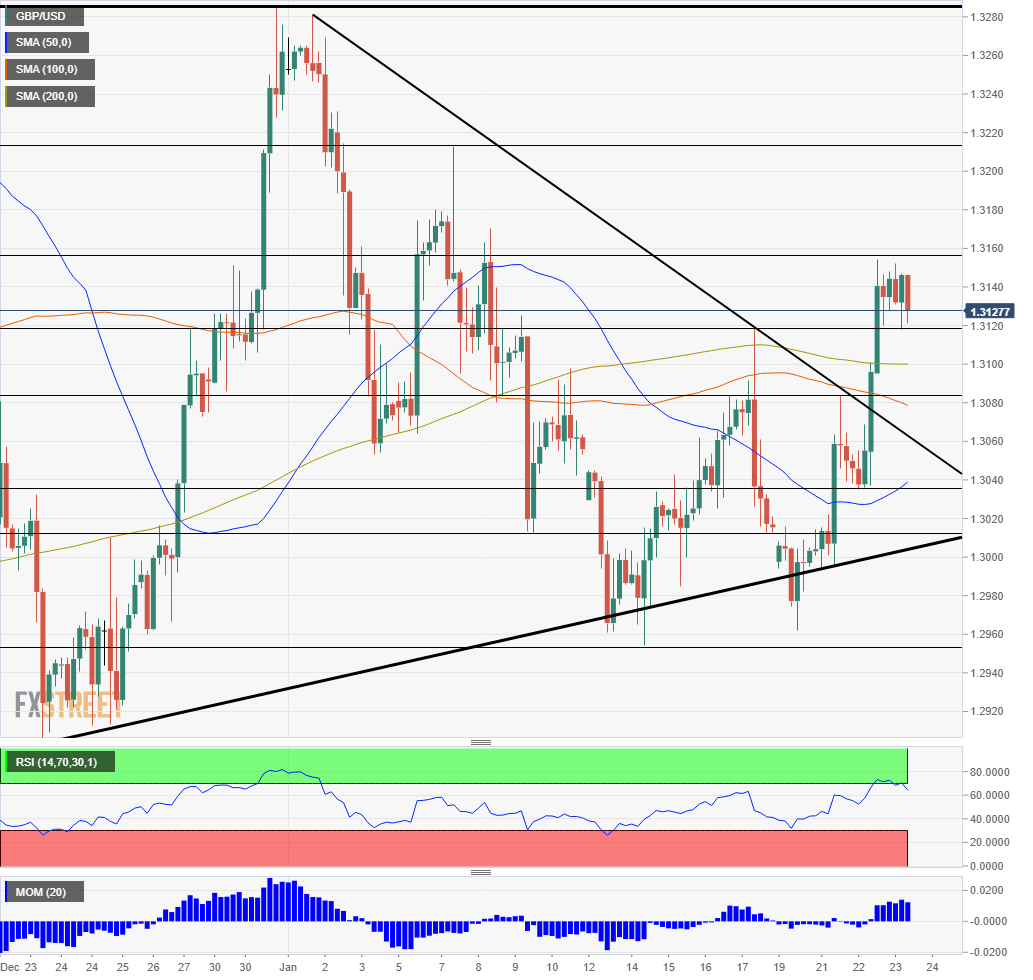

- Thursday's four-hour chart is pointing to overbought conditions after the wedge breakout.

The Bank of England may back away from the brink of cutting rates – that is some investors' impression after another positive UK economic figure sent sterling shooting higher. However, there is still one more critical publication awaiting the pound.

The Confederation of British Industry's Industrial Trends Survey – usually ignored by markets – beat expectations in and scored -22 points in January, the best since August 2019. That, alongside better-than-expected jobs figures published on Tuesday, triggered a massive rally in the pound.

GBP/USD hit a high of 1.3154 before consolidating its gains as bond markets began pricing out the chances of a rate cut in the BOE's upcoming January 30 meeting. Expectations for a rate cut had risen after weak inflation, retail sales, and Gross Domestic Product figures published last week – as well as dovish comments from members of the BOE.

Will the BOE cut or now or wait? The final word belongs to Friday's Purchasing Managers' Indexes from Makit. The preliminary statistics for January are forecast to show a bump in both the manufacturing and services sectors.

See PMIs preview: Cementing the BOE rate cut? Five GBP/USD scenarios

Beyond the BOE

The House of Lords gave its final seal of approval to the Withdrawal Bill, allowing the UK to leave the EU on January 31. Prime Minister Boris Johnson may celebrate getting Brexit done, but the road to a new trade deal – after the transition period expires at year-end – is still long. Any headlines related to future EU-UK relations may move the pound.

The coronavirus outbreak in China and other countries dominating headlines in broader markets, keeping the safe-haven US dollar bid. Authorities in the world's second-largest economy have shut down transport links to Wuhan, where the SARS-like virus originated from, a step seen as drastic. Additional headlines related to the disease may move markets.

Overall, speculation over the BOE, Brexit, and the coronavirus are set to move pound/dollar.

GBP/USD Technical Analysis

Pound/dollar has broken out of the wedge, or triangle, which has contained its price action since December. On its way up, the pair also surged above the 50, 100, and 200 Simple Moving Averages on the four-hour chart and momentum turned positive. However, the move may have gone too far. The Relative Strength Index is close to 70 – flirting with overbought conditions. This implies a correction.

Support awaits at 1.3120, the daily low, followed by 1.3080, which was a swing high earlier this week. NExt, 1.3135, 1.3110, and 1.2955 await the pair.

Resistance is at 1.3154, Thursday's peak, followed by 1.3210, a high point in early January. 1.3285, seen around Christmas, is next.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

GBP/USD recovers to 1.3300 ahead of UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers near the 1.3300 mark in the European morning on Friday. Traders digest the BoE and Fed policy decisions, awaiting the UK Retail Sales data for further trading impetus.

USD/JPY keeps BoJ-led losses below 142.50, Ueda's presser eyed

USD/JPY remains in the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.