GBP/USD Forecast: Falling on Friday? Failure to crack critical resistance and geopolitics point down

- GBP/USD has struggled to take advantage of dollar weakness amid a slew of British issues.

- Sino-American tensions, Brexit speculation, and end of month flows are all in play.

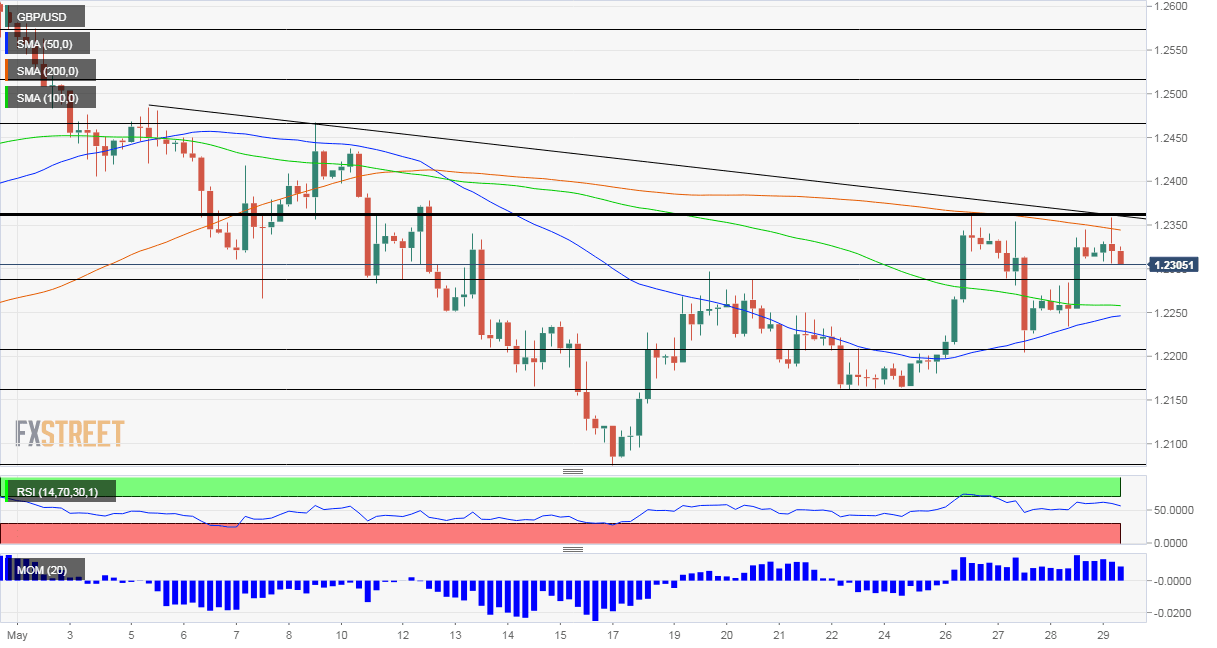

- Friday's four-hour chart is showing the currency pair's failure to crack critical resistance.

And then there were six – from Monday, relaxed restrictions will allow groups of six people to meet in England. However, this gradual reopening is of no solace to the pound, which is losing ground against the dollar, yen, and euro.

Brexit uncertainty looms over sterling – no news is bad news in this case. The UK's refusal to extend the transition period beyond year-end – with no deal on future relations in sight – raises the risk of falling back to World Trade Organization rules in 2021.

Another factor, albeit of diminishing impact, is the prospect of negative rates in the UK. Both Andrew Bailey, Governor of the Bank of England, and Andy Haldane, Chief Economist at the bank, kept the door open to setting sub-zero borrowing costs but hinted it is not imminent.

One downer that may be fading away is the political scandal around Dominic Cummings, the powerful adviser of Prime Minister Boris Johnson. It seems that MPs and the media are finally fading away, at least for now.

In broader markets, tensions between the US and China have intensified, as Washington pledged to respond to China's security law, tightening Beijing's hold on Hong Kong. The Asian financial hub may lose some preferential tariffs and the US may take further steps.

China's statement about aiming for a "peaceful reunification" with Taiwan also sent chills. President Donald Trump is set to lay out steps in a speech later in the day. While stock markets are on the back foot, the US dollar seems to have relinquished its safe-haven status, for now, allowing only the yen to advance.

The US economic calendar is packed with publications. Personal Income, Personal Spending, and Core Personal Consumption Expenditure (Core PCE) are all eyed.

Core PCE, Personal Spending and Income Preview: The fall of records, where the wage earner leads, the consumer is sure to follow

It is essential to note that Friday is the last day of the month, and may see some last-minute moves ahead of the close. Uncertainty about Trump's speech may add to volatility.

GBP/USD Technical Analysis

While cable has set higher lows and benefits from upside momentum, its failure to conquer the 1.2360 level for the third time in recent days may not bode well. That level also converges with downtrend resistance and also the 200 Simple Moving Average.

Some support awaits at 1.2240, which has been separating ranges in recent days. It is followed by 1.2210, a low point early in the week. The next level to watch is 1.2160.

Resistance beyond 1.2360 is only at 1.2470, followed by 1.2510.

More Looking toward the recovery: currency drivers and what to watch out for

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.