GBP/USD Current price: 1.3936

- Upbeat UK employment-related data provided temporal support to the pound.

- The United Kingdom will publish Mach inflation figures on Wednesday.

- GBP/USD retreated sharply from around 1.4000, further declines likely below 1.3880.

The GBP/USD pair extended its rally to 1.4008 but was unable to hold on to gains and fell to 1.3925 on the back of a dismal market’s mood. UK employment-related data gave a temporal boost to the pound at the beginning of the European session, as the March Claimant Count Change came in at 10.1K, much better than the expected 24.5K. The ILO unemployment rate for the three months to February printed at 4.9%, improving from 5% in the previous month and beating the expected 5.1%.

On Tuesday, the UK will publish March inflation-related figures. The Consumer Price Index is foreseen at 0.8% YoY, while the core reading is expected at 1.1%, up from the previous 0.9%. On the other hand, producer prices are expected to have contracted in the same month.

GBP/USD short-term technical outlook

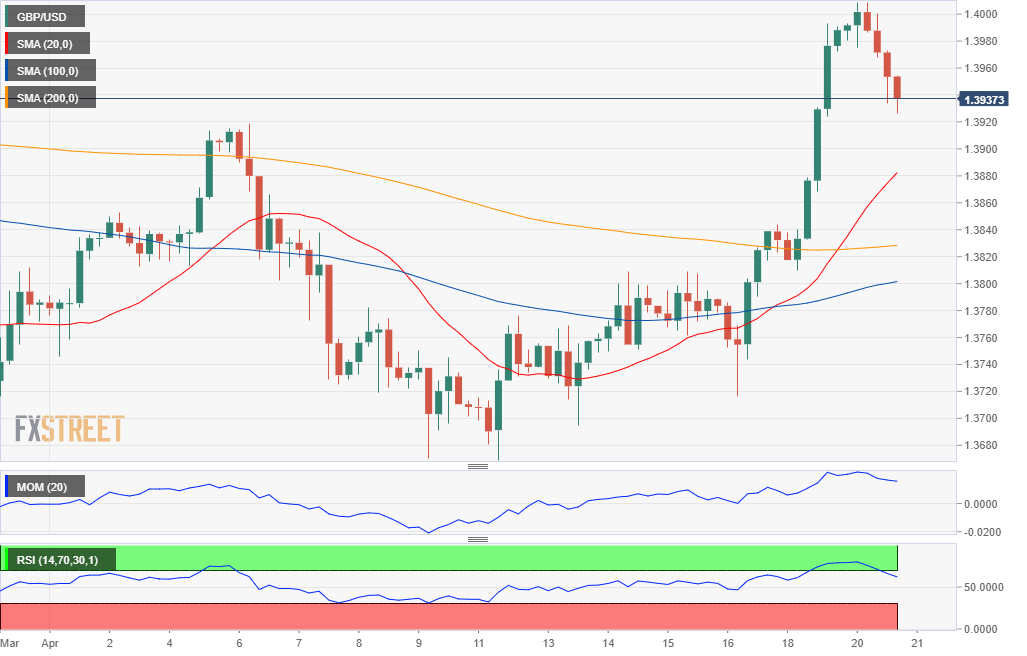

The GBP/USD pair fell after advancing for six days in-a-row, correcting extreme readings in the near-term. Chances of continued decline are still limited, at least as long as the pair holds above the 1.3900 price zone. Still, a steeper decline seems more likely on a break below 1.3880, where in the 4-hour chart, a bullish 20 SMA provides dynamic support. Technical indicators head firmly lower but remain well above their midlines, anyway indicating decreased buying interest.

Support levels: 1.3880 1.3835 1.3790

Resistance levels: 1.3970 1.4020 1.4065

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD advances toward 1.1200 on renewed US Dollar weakness

EUR/USD is extending gains toward 1.1200 on Friday, finding fresh demand near 1.1150. Risk sentiment improves and weighs on the US Dollar, allowing the pair to regain traction. The Greenback also reels from the pain of the dovish Fed outlook, with Fedspeak back on tap.

Gold price advances further beyond $2,600 mark, fresh record high

Gold price (XAU/USD) gains positive traction for the second successive day on Friday and advances to a fresh record high, beyond the $2,600 mark during the early European session.

USD/JPY recovers to 143.00 area during BoJ Governor Ueda's presser

USD/JPY stages a recovery toward 143.00 in the European morning following the initial pullback seen after the BoJ's decision to maintain status quo. In the post-meeting press conference, Governor Ueda reiterated that they will adjust the degree of easing if needed.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.