GBP/USD Forecast: Critical support at 1.2980

GBP/USD Current price: 1.2989

- UK PM Johnson considering to row back on parts of the Withdrawal Agreement.

- The EU and the UK keep playing the blame-game, with just one month to reach a deal.

- GBP/USD is bearish despite extremely oversold, poised to pierce August low.

The GBP/USD pair traded as low as 1.2985 this Tuesday settling at the end of the American session a few pips above this last. The pound remained in sell-off mode on the back of Brexit jitters, as chances of a no-trade deal increased sharply in the last couple of days, and neither the UK nor the EU seem willing to give up on their demands. UK PM Johnson’s spokesman said this Tuesday that, while the government still thinks a deal is possible, the EU needs to be more realistic.

Concerns were exacerbated by news that the head of the UK’s legal department, Jonathan Jones, quit after PM Johnson proposed to row back on parts of the Withdrawal Agreement relating to Northern Ireland. The UK didn’t publish macroeconomic data, and the calendar will remain empty on Wednesday.

GBP/USD short-term technical outlook

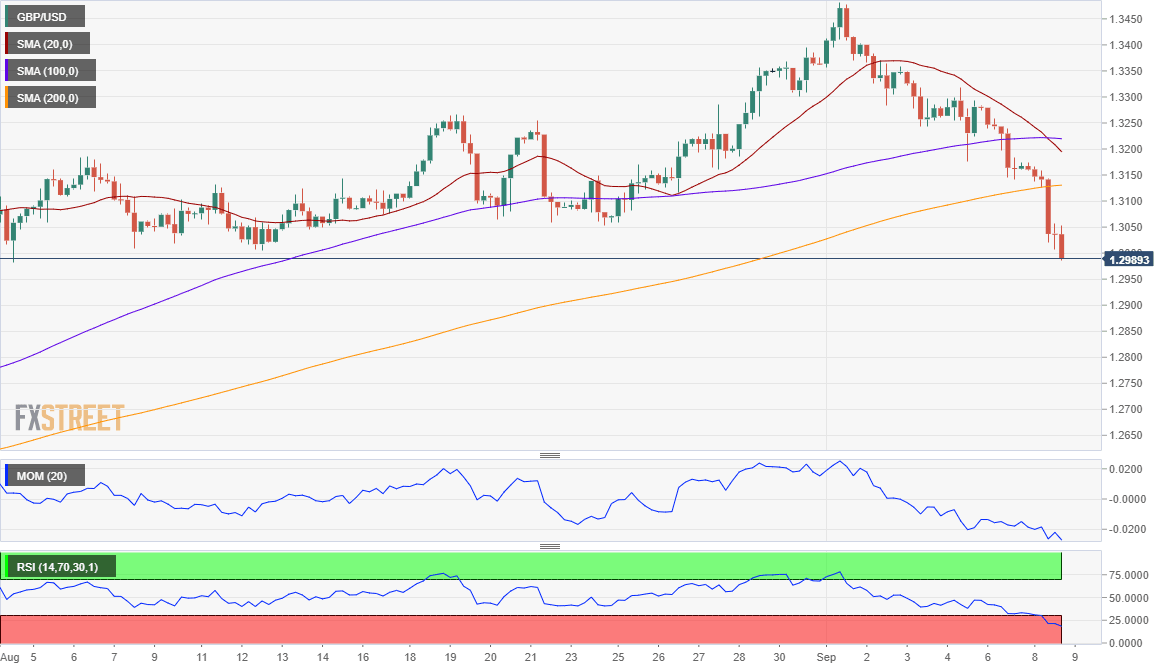

The GBP/USD pair is extremely oversold yet still bearish. A clear break below the 1.2980, August monthly low, will likely exacerbate the ongoing slump. The 4-hour chart shows that the pair has broken below all of its moving averages, with the 20 SMA heading south below the 100 SMA. The Momentum indicator has bounced modestly from daily lows, but the RSI indicator keeps heading south, despite being at 23.

Support levels: 1.2980 1.2930 1.2890

Resistance levels: 1.3055 1.3095 1.3140

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.