- GBP/USD has been retreating amid hopes for a large US stimulus package.

- The UK's vaccination drive and falling virus numbers could boost sterling.

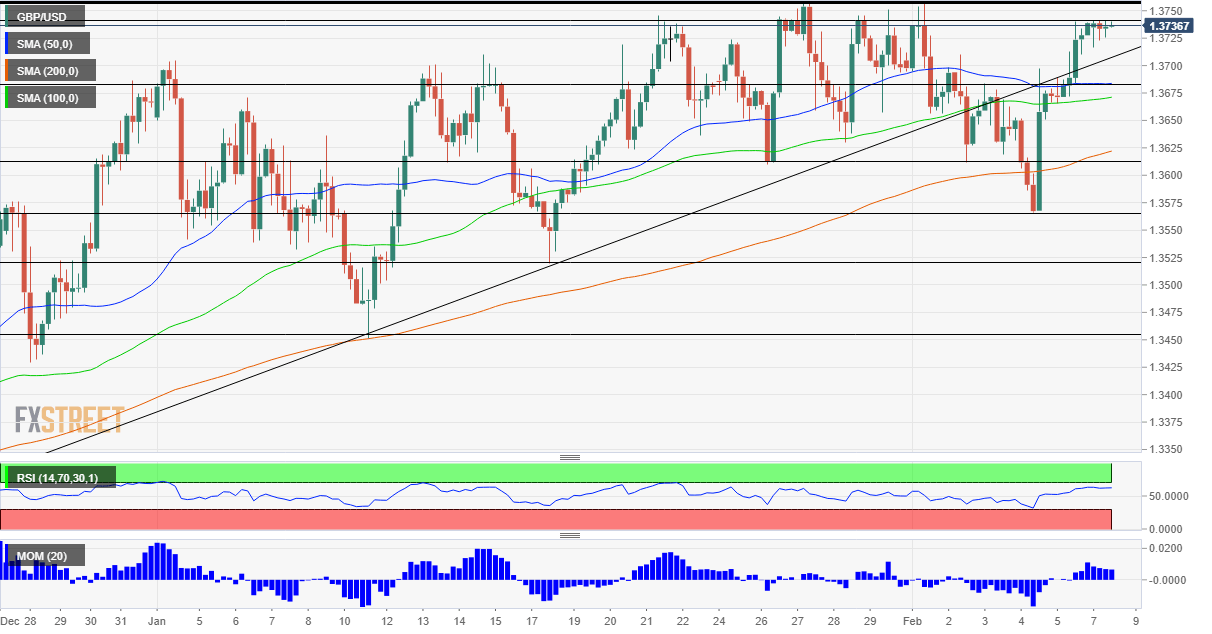

- Monday's four-hour chart is pointing to fresh gains for cable.

Betting on Biden – Markets are cheering President Joe Biden's push for passing a larger relief package, and the dollar advances with higher bond yields. However, sterling has room to recover.

Both the Commander-in-Chief and Treasury Secretary Janet Yellen have been urging Congress to "go big" in a series of media appearances following Friday's disappointing jobs report. The US gained only 49,000 positions in January, worse than expected.

While investors are not expecting the total plan to reach the original $1.9 trillion suggested by Biden, they are pricing prospects of a sum closer to that rather than near the Republican offer of roughly $600 billion Democrats have advanced a spending blueprint without GOP support and the outcome depends only on internal negotiations.

Stocks are on the rise on hopes for faster growth while bonds are sold off ahead of potentially elevated debt issuance. In turn, higher yields on Treasuries make the dollar more attractive. While the case for robust stimulus remains dollar positive, it is unlikely to pass immediately, allowing for the dollar to take a breather.

Yet the bullish case for GBP/USD is based on virus figures. First, the UK's vaccination drive is gaining pace, with over 17% of the population already having received one short, nearly double America's 9.1%. Secondly, Britain has borne the brunt of the B 1.1.7 strain – aka British variant – while that more contagious version of coronavirus is only beginning to spread in the US. Cases are falling on both sides of the Atlantic, but they may turn back up in America.

Looking forward, the week features UK Gross Domestic Product figures, which might beat estimates – at least according to the Bank of England's hints last week. The BOE specifically referred to the fourth quarter of 2020 and sounded optimistic.

All in all, GBP/USD has room to recover from the recent slide toward 1.37.

GBP/USD Technical Analysis

Pound/dollar is benefiting from upside momentum on the four-hour chart and trades above the 50, 100 and 200 Simple Moving Averages, a bullish sign.

Some resistance awaits at the daily high of 1.3740, closely followed by the 2021 peak of 1.3752. Further above, 1.3810 and 1.40 are eyed.

Support is seen at 1.3680, where the 50 SMA hits the price. The next cushion is 1.3615, which was a low point last week. The next level to watch is 1.3565, the February trough.

GBP/USD Price Forecast 2021: Cable braces for calendar comeback amid three exits

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.