- GBP/USD has ignored Mid-East related dollar strength and resumed its rises.

- The UK parliament resumes its deliberations over the Brexit bill.

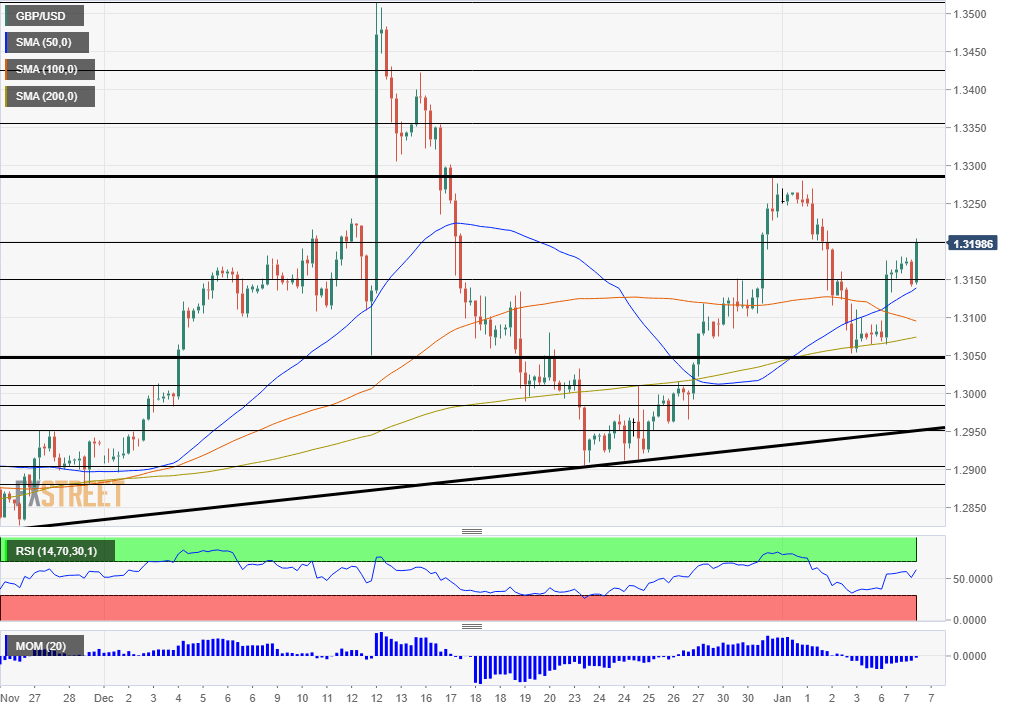

- Tuesday's four-hour chart is painting a mixed picture.

"Historic nightmare" is what Iran has promised the US – and markets seem to end their calm, sending the safe-haven US dollar higher. Investors had seemed to move away from focusing on the Middle East on Monday, allowing for a relief rally.

Iranian officials added that they are monitoring US bases that surround it, sending a warning sign of a potential escalation. Iraq – where the US killing of Iranian general Qassem Suleimani took place – is the main battleground. An erroneous Pentagon letter hinting at the possible evacuation of American forces from the war-torn country caused confusion on Monday.

While the fresh threats from Tehran have rattled markets, investors' fears may diminish again without imminent military action. In that case, GBP/USD has room to rise.

Brexit is back

The UK House of Commons returns from the holidays and is set to advance the Brexit Withdrawal Bill. Prime Minister Boris Johnson's Conservatives command a broad majority in parliament, so any opposition amendments will likely be rejected swiftly.

The UK is set to leave the EU on January 31 but investors are already eyeing the next phase – the future trade relationship. Without a new deal, Britain will fall back to World Trade Organization (WTO) rules at the end of the year, when the transition period ends.

Ursula von der Leyen, President of the European Commission, heads to London on Wednesday to meet the PM and kick off discussions on the next phase.

The UK economy received an encouraging sign on Monday. Markit's final Purchasing Managers' Index for the services sector was revised higher to 50 points – the threshold separating expansion from contraction.

The parallel US ISM Non-Manufacturing PMI for December will likely rock markets later on. The forward-looking gauge serves as a hint toward Friday's Non-Farm Payrolls report and is set to rise. However, some fear that it will follow the footsteps of the manufacturing PMI, which fell to the lowest levels since 2009.

See ISM Non-Manufacturing PMI Preview: Last call for the concerned?

Overall, Mid-East tensions, Brexit deliberations, and data are all set to move pound/dollar.

GBP/USD Technical Analysis

Cable is trading above the 50, 100, and 200 Simple Moving Averages on the four-hour chart and downside momentum is waning. All in all, the picture is moderately bullish.

Immediate resistance awaits at the fresh high of 1.32, which is also a round number. It is followed by the late 2019 peak of 1.3285. The mid-December peaks of 1.3355, 1.3425, and 1.3510 are next.

Support is at 1.3150, which held GBP/USD down in late December. Next, we find 1.3050, which provided support in early January and was a swing low in December. 1.3010 and 1.2985 are next.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD trades on a stronger note 1.2530, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The United States Employment report will be released by the Bureau of Labor Statistics at 12:30 GMT. The US Dollar looks to employment data after the Fed signaled its intention to hold rates higher for longer on Wednesday.