GBP/USD Forecast: Bulls encouraged by the improving pandemic situation in the UK

GBP/USD Current price: 1.3698

- The UK is among the top-three larger vaccinated nations.

- The Markit UK final January Manufacturing PMI is foreseen unchanged at 52.9.

- GBP/USD is neutral in the near-term, but the risk remains skew to the upside.

The GBP/USD pair closed the week with modest gains just below the 1.3700 level and not far from a fresh multi-year high of 1.3758. The pair spent the week consolidating amid a scarce UK calendar, while the pound was quite resilient to the dollar’s demand on risk-aversion.

Easing pandemic pressure provided support to the UK currency. Following a peak of almost 70K contagions per day, the number of daily new cases has averaged 25K this past week, taking off some pressure on the health system. Even further, nearly eight million people in the kingdom had already gotten their first shot, leaving the UK among the top-three larger vaccinated nations. On a down note, the EU imposed export restrictions on vaccines Friday after accusing the British- AstraZeneca of favoring its home market, in detriment of its contracts with the EU. On Monday, Markit will publish the UK final January Manufacturing PMI, foreseen unchanged at 52.9.

GBP/USD short-term technical outlook

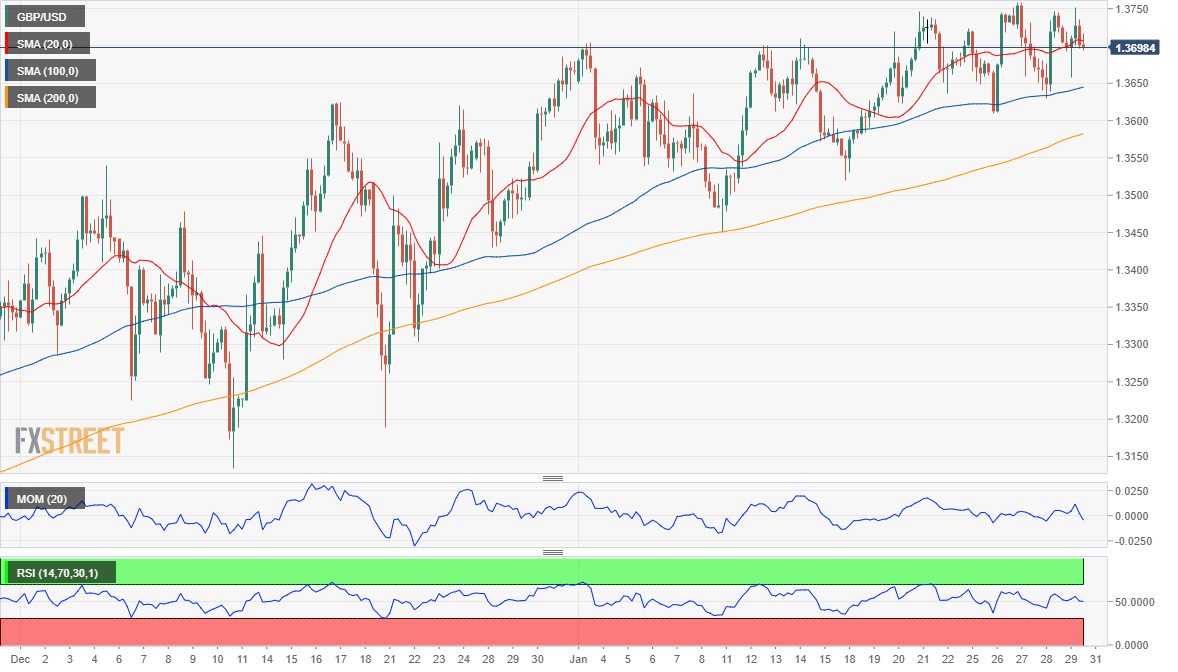

The GBP/USD pair has eased within range, maintaining its bullish stance in the daily chart, as a bullish 20 SMA continues to provide support, advancing above the larger ones. Technical indicators have lost their directional strength but hold within positive levels. In the 4-hour chart, the pair settled below its 20 SMA but above the 100 SMA, both directionless. Technical indicators hover around their midlines, lacking directional strength. A daily ascendant trend line coming from December 22 low provides support at around 1.3625, while the weekly low comes at 1.3609. A break below this last should open the doors for a steeper decline.

Support levels: 1.3655 1.3605 1.3560

Resistance levels: 1.3715 1.3760 1.3810

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.