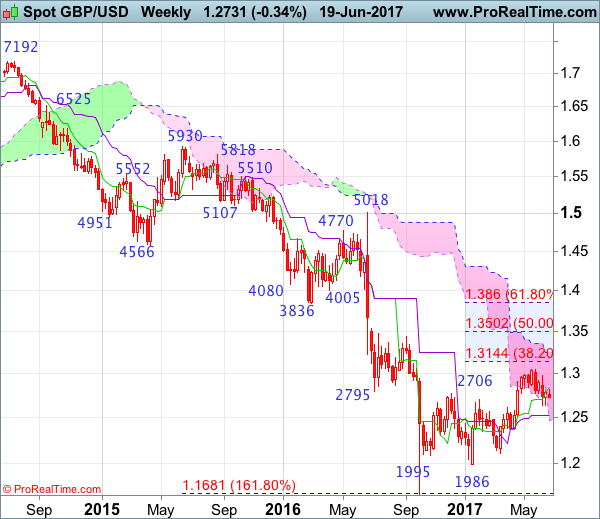

Weekly

-

Last Candlesticks pattern: Long white candlestick

-

Time of formation: 16 Jan 2017

-

Trend bias: Down

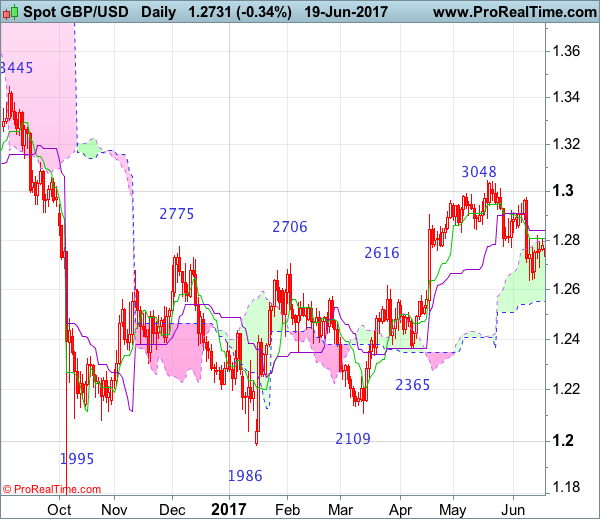

Daily

-

Last Candlesticks pattern: Long white candlestick

-

Time of formation: 18 Apr 2017

-

Trend bias: Near term up

GBP/USD – 1.2655

Although cable did recover after falling to 1.2635 earlier this month and consolidation above this level would be seen, still reckon upside would be limited to the Kijun-Sen (now at 1.2842) and bearishness remains of the fall from 1.3048 top to bring retracement of recent upmove, below 1.2635 support would add credence to this near term bearish view, bring correction of recent upmove to previous resistance at 1.2616, a daily close below this level would encourage for further weakness to 1.2550, then 1.2500 support but oversold condition should limit downside to 1.2440-50 and price should stay well above key support at 1.2365, bring rebound later.

On the upside, expect recovery to be limited to 1.2818 resistance and the Kijun-Sen (now at 1.2842) should hold, bring another decline. A daily close above the Kijun-Sen (now at 1.2842) would defer and risk a stronger rebound to 1.2885-90 but price should falter well below said resistance at 1.2978 and bring another decline later. Only a sustained breach above this level would suggest the correction from 1.3048 top has ended and bring further gain towards this level, a break of this level would revive bullishness and extend recent upmove from 1.1986 low (Jan low) for retracement of early downtrend to 1.3050-60, then 1.3100. having said that, loss of near term upward momentum should prevent sharp move beyond 1.3140-50 (38.2% Fibonacci retracement of 1.5018-1.1986) and reckon 1.3200 would hold.

Recommendation: Hold short entered at 1.2800 for 1.2600 with stop above 1.2900.

For intraday and daily ideas, visit trade ideas section.

On the weekly chart, as cable has continued trading within near term established range, suggesting further sideways trading would be seen, however, if our view that a temporary top possibly formed at 1.3048 is correct, upside would be limited to the Tenkan-Sen (now at 1.2842) and bring another test of 1.2635 support, below there would bring further fall to previous resistance at 1.2616, a sustained breach below this level would add credence to this view and signal correction of recent upmove has commenced for subsequent weakness to 1.2550-60, however, still reckon downside would be limited and previous support at 1.2515 should remain intact, bring rebound later.

On the upside, expect recovery to be limited to 1.2818 and the Tenkan-Sen (now at 1.2842) should hold, bring another decline. Above 1.2900 would defer but only break of resistance at 1.2978 would signal the retreat from 1.3048 has ended, bring retest of this level first, once this recent high is penetrated, this would signal the erratic upmove from 1.1986 low (2017 low) has resumed, bring retracement of early decline to 1.3090-00, then towards 1.3140-50 (38.2% Fibonacci retracement of 1.5018-1.1986) but price should falter well below 1.3200-10, risk from there is seen for a retreat to take place later.

Content in ActionForex.com website is for informational purposes only. Contributors submitted forecast, commentaries, analysis, articles are based upon information gathered from various sources believed to be reliable, complete, and accurate. However, no guarantee can be made as to the validity of the believed sources. All statements and expressions in the website are opinions, and not meant as investment advice or solicitation. Forex Markets can be volatile and opinions may change without notice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.