The GBP/USD pair remained under some selling pressure for the second consecutive session on Friday and was corrected further from near seven-month tops, around mid-1.3300s, set on Wednesday. The British Pound was weighed down by softer UK manufacturing PMI, which fell to a four-month low level of 52.0 in February. This coupled with some renewed US Dollar buying interest, supported by a goodish pickup in the US Treasury bond yields and despite weaker US economic data, exerted some additional downward pressure and dragged the pair to an intraday low level of 1.3172.

However, expectations of a possible delay to the fast-approaching Brexkt deadline on March 29 and softer Brexit helped limit further downside. The sudden turnaround in the Brexit outlook, especially after the UK PM Theresa May's confirmation last week that the parliament will have an opportunity to vote for a no-deal Brexit or Brexit extension if her revised Brexit deal again gets rejected on March 12, has been perceived as better than a no-deal outcome and continued underpinning the Sterling.

The pair finally settled near the 1.3200 handle, off around 30-pips from daily lows, and posted strong gains for the second consecutive week. Meanwhile, a report from the Wall Street Journal on Sunday, saying that the US & China could reach a formal agreement at a summit around March 27, further fueled the recent optimism over a possible resolution to the long-standing US-China trade disputes and provided a minor boost to the major at the start of a new trading week.

The pair opened with a bullish gap of over 30-pips, albeit lacked any strong follow-through as market participants now look forward to the release of UK construction PMI for some short-term trading impetus. Adding to this, the incoming Brexit-related headlines might continue to influence sentiment surrounding the British Pound and remain an exclusive driver of the pair's momentum amid absent relevant market moving economic releases from the US.

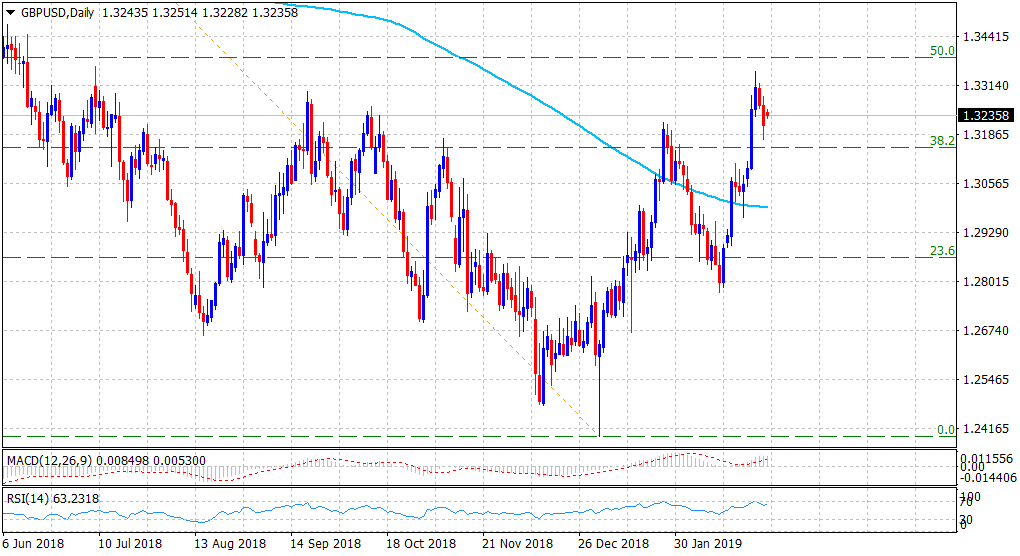

From a technical perspective, the recent pull-back might still be categorized as corrective in nature, given the recent upsurge of over 575-pips from Feb. monthly swing lows. Moreover, the bullish resilience below the 1.3200 area further reinforces the bullish outlook and hence, any meaningful slide might still be seen as a buying opportunity. The mentioned handle might continue to protect the immediate downside, below which the corrective slide could get extended but seems more likely to find decent support, rather remain limited near the 1.3100 round figure mark.

On the flip side, the 1.3255-60 region, followed by the 1.3300 handle now seems to act as immediate resistance, which if cleared might lift the pair back towards testing multi-month swing highs, around mid-1.3300s. A follow-through buying has the potential to continue boosting the pair further towards the 1.3385 hurdle - marking 50% Fibonacci retracement level of the 1.4377-1.2396 downfall.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 ahead of US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The US Dollar holds its ground following the Fed-inspired decline as market focus shifts to mid-tier US data releases.

GBP/USD holds steady above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside ahead of Unit Labor Costs and Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.