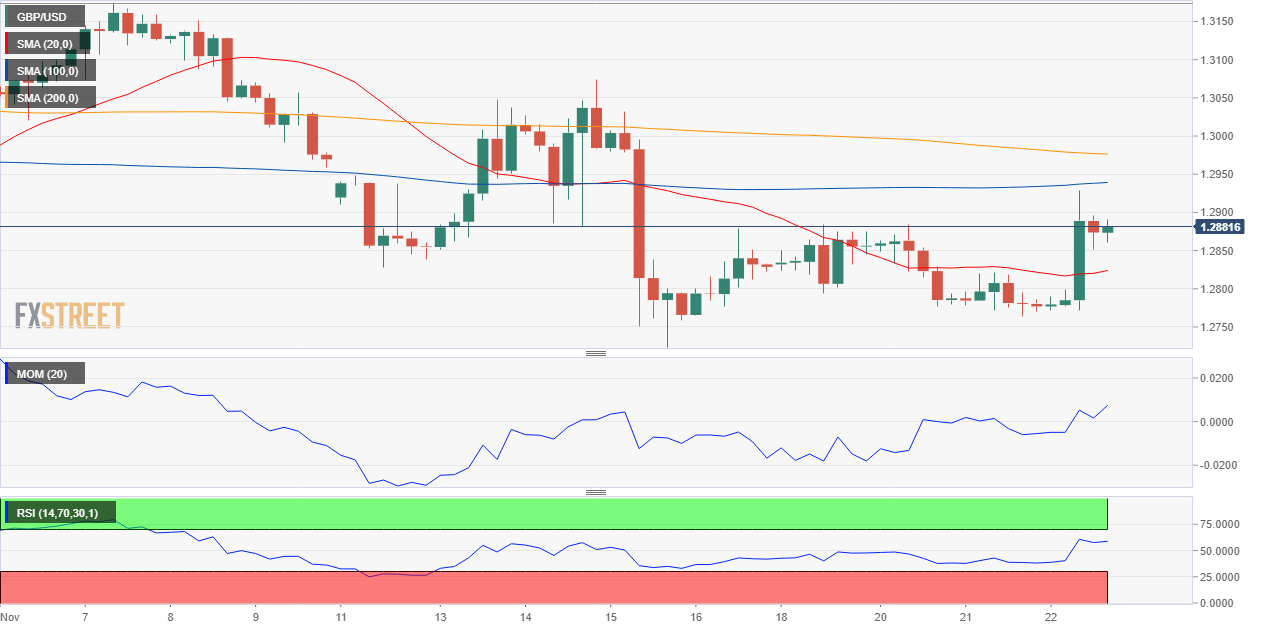

GBP/USD Current price: 1.2866

- Scottish First Minister Nicola Sturgeon said that the Brexit deal is full of ‘unicorns’ rather than facts.

- Spain said to likely vote against the current Brexit proposal amid lack of clarity on Gibraltar.

The Sterling Pound was the best performer this Thursday, rallying during London trading hours up to 1.2927 against the greenback, its highest for this week, amid encouraging Brexit headlines. News agencies leaked the EU's declaration on the future bilateral relationship with the UK, in where the Union talks about "a free trade area, combining deep regulatory and customs cooperation." Details on how this will done, or when, however, were missing. The bullish movement faded, with the pair settling in the 1.2880 price zone. Meanwhile, the deal meats opposition from locals and foreign. Scottish First Minister Nicola Sturgeon said that the Brexit deal is full of ‘unicorns’ rather than facts, and will damage the local fishing industry. Also, and according to people familiar with the matter, Spain will likely vote against the current proposal amid the lack of clarity on Gibraltar. UK PM May spoke before the UK Parliament once again but failed to convince MPs. In fact, half of Tory backbenchers have publicly indicated that they won't vote for the deal. Next chapter on the Brexit drama will be written over the weekend.

The GBP/USD pair holds on to gains ahead of the Asian opening, but the upward potential seems well limited according to technical readings in the 4 hours chart, as the rally stalled well below a mild bearish 200 EMA, although above a directionless 20 SMA, while technical indicators entered positive ground before losing directional strength. Given the Brexit situation, the upward potential for the Pound is quite limited, with spikes being taking as selling opportunities by speculative interest.

Support levels: 1.2840 1.2800 1.2765

Resistance levels: 1.2890 1.2930 1.2965

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0800 ahead of key events

EUR/USD stays in a consolidation phase at around 1.0800 early Tuesday after closing in positive territory on Monday. Market participants await ZEW sentiment data from Germany and the EU, producer inflation data from the US and Fed Chairman Powell's speech.

GBP/USD trades at around 1.2550 after UK jobs data

GBP/USD struggles to build on Monday's gains and hovers around 1.2550 in the European session on Tuesday. The data from the UK showed that the Unemployment Rate edged higher to 4.3% in the three months to March as forecast, failing to trigger a reaction.

Gold price gains ground ahead of US PPI data, Fed’s Powell speech

Gold price rebounds despite the consolidation of the US Dollar on Tuesday. The upside of yellow metal might be limited as traders might wait on the sidelines ahead of key US inflation data this week.

Top meme coins post gains following increased social activity amid GameStop pump

Meme coins in the crypto market saw impressive gains on Monday following a recent surge in GameStop stock. The increased attention surrounding these tokens signifies a potential resumption of the meme coin frenzy of March.

Entering a crucial run of data for financial markets

We are entering a crucial period for financial markets and forecasters as Americans' near-term inflation expectations rise again. Upcoming reports on the CPI and PPI for April, along with new data on retail sales and industrial production, will provide valuable insights.