S&P 500 (cash) near term outlook:

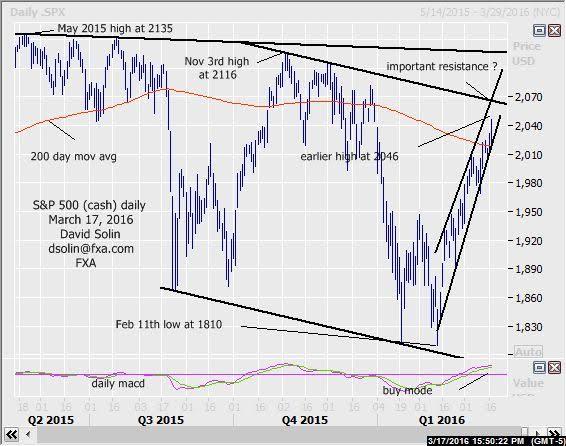

In the March 10th email, once again said there was no confirmation of even a short term top "pattern-wise" and the market has indeed continued higher, up from that Feb 11th low at 1810, and still within that very long discussed, extended period of wide ranging from last May (see longer term below). With no confirmation of a top and still positive technicals (see buy mode on the daily macd) there is scope for further upside. However, the market is no doubt overbought after the surge since Feb and along with a potential rising wedge-like pattern from a the lows (reversal pattern) suggest that risk in the upside is clearly rising. Additionally, the market is quickly nearing potentially important resistance at the ceiling of the bearish from last Aug (currently at 2063/68, also the ceiling of the wedge-like pattern from the low), a "potential" area to form a more important top. A final note, within this extended period of ranging there has tended to be a few weeks of chopping at the extremes before sharply reversing (see daily chart below). This suggests there will plenty of time to reverse the view (and position) and versus having to attempt to capture the exact top. Nearby support remains at that bullish trendline from Feb 12th (adjusts for the Feb 11th spike, currently at 2015/18, close clearly below would argue a top is in place). Bottom line : still no confirmation of a top but risk in the upside is rising.

Strategy/position:

Though there is scope for further, near term gains, just too much increasing risk to warrant chasing the market higher from here. So for now, would await a better risk/reward entry (expected to be on the short side). Note too as mentioned above, there has tended to be a few weeks of consolidating at the extremes of this nearly year long period of wide ranging, so would not give up much potential by being a bit more patient for higher confidence of a top before selling. Also had previously used a break 3 pts below that bullish trendline from Feb 12th as a signal to get long with did not occur.

Long term outlook:

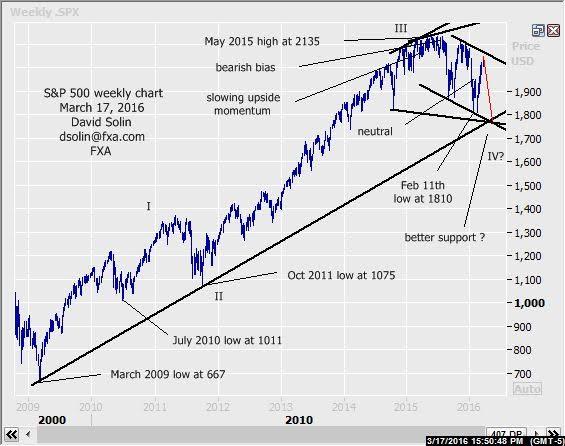

Very long discussed, extended period of wide chopping (and with good sized swings in both directions) since that May high at 2135 continues to play out. Still seen as a large correction (wave IV in the rally from the July 2010 low at 1011) and with new (but likely limited) highs above 2135 after (V). Note too the sloppy/messy trade over that time adds to the view of a large correction (a characteristic). However, there remains scope for another few months of this wide chopping and even a break below that Feb 11th low at 1810 first (may be limited and part of this longer term correction, if it does indeed occur). At this point, there is still no confirmation that this nearly year long correction is "complete" and it has lasted less than a year but is correcting a rally that lasted 3 1/2 years (wave III from the Oct 2011 low at 1075, and may not be long enough "time-wise"). Finally, that long discussed major support lies just below the 1810 low in the whole 1725/75 area (38% retracement from the Oct 2011 low at 1075/wave III, base of the bearish channel from Oct 2014 and bullish trendline from the March 2009 low) and markets have a way of eventually reaching these major, long term areas (see in red on weekly chart/2nd chart below). Bottom line : more important top may also be nearing with some potential for declines below that Feb low at 1810 (as part of the huge correction from May 2015).

Long term strategy/position:

With some potential of a more important top also nearing, looking to switch the longer term bias to the bearish side. But with no confirmation of even a near term top so far, would be a bit more patient before entering.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.