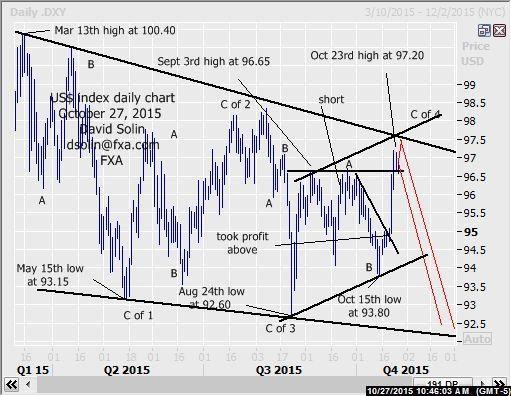

Nearer term $ index outlook:

The market has continued upward from that Oct 15th low at 93.80, accelerating on a break above that bearish trendline from Oct 1st and trying to consolidate from the Oct 23rd high at 97.20. Still seen part of the very long discussed, extended period of wide ranging since the March high at 100.40. Though eventual new highs above 100.40 are favored, there remains scope for another month or 2 of this broad ranging first (see longer term below). Short term with the market near term overbought and lots of resistance just above that recent 97.20 high in the 97.40/65 area (62% retracement and bearish trendline from that March high at 100.40, top of bull channel from late Aug), any further gains would likely be limited/part of a topping. Note too that there is scope for a more important top to form as a larger wedge-like pattern since March may be in process. Though these are reversal patterns, they break down into 5 legs and raises scope for declines all the way back to the Aug 24th low at 92.60 and even slightly below within that final leg (see in red on daily chart below). Nearby support is seen at 96.50/65 (broken highs from Sept). Bottom line: any further gains may be limited/part of a topping (and potentially more major topping).

Strategy/position:

Took profit on Sept 22nd sell at 96.30 on Oct 21st above that bear trendline from Oct 1st (then 94.85, closed at 95.05 for 125 ticks). For now with any further upside seen limited and potential of a more significant top forming, would sell here (currently at 96.90). Initially stop on a close 20 ticks above that bearish trendline/top of potential wedge from March (to allow for more nearby topping).

Long term outlook:

Very long held view of an extended period of wide consolidating (number of months) from that March high at 100.40 as the market consolidates the huge surge from the May 2014 low at 78.90 (wave IV in the rally from the May 2011 low at 72.70), and with eventual new highs after (within wave V), continues to play out. But as been discussing more consolidating is favored first, "ideally" into the end of the year before resuming that longer term upmove. Note that long term technicals remain bearish (see sell mode on the weekly macd) and the seasonal chart is lower into the end of the year (see 3rd chart below) and with both supporting the view of another few months of broad ranging before resuming that long term upmove. Also, that long mentioned, major support remains just below the Aug low at 92.60 in the 92.00/25 area (38% retracement from the May 2014 low at 78.90/wave III and the base of that potential wedge since March). Markets have a way of reaching these key area, declines there "fits" the shorter term view (see above) and would be an "ideal" area to form a more major bottom (see in red on weekly chart/2nd chart below). Bottom line: trade from March seen as a large correction with eventual new highs above 100.40, but with scope for as much as another few months of wide ranging/consolidating "ideally" into the 92.00/25 area.

Strategy/position:

With scope at least some further declines below the 92.60 low as part of this larger period of wide consolidating, would stay with the longer term bearish bias that was put in place on Aug 26th at 94.75. However with the magnitude of further downside a question, will be looking to reassess on such further lows.

Current:

Near term: short Oct 27th at 96.90, topping (potentially important topping) seen in process.

Last: short Sep 22 at 96.25, took profit Oct 21 above t-line from Oct 1 (94.85, closed 95.05, 125 ticks).

Longer term: bearish bias Aug 26th at 94.75, but magnitude of downside below 92.60 a question.

Last: bear bias Jun 23rd at 95.50 to neutral Jul 15th at 97.15.

US Dollar Index

Recommended Content

Editors’ Picks

AUD/USD stays defensive below 0.6500 ahead of Fed

AUD/USD is on the back foot below 0.6500, consolidating the previous decline early Wednesday. China's holiday-led thin conditions and pre-Fed policy decision caution trading leave Aussie traders on the edge.

USD/JPY holds higher ground near 158.00, Fed in focus

USD/JPY holds the rebound near 158.00 in Asian trading on Wednesday. The US Dollar remains on the bid amid a risk-off market environment, underpinning the major. The interest rate differential between Japan and the US is likely to maintain a bullish pressure on the pair ahead of the Fed decision.

Gold snaps two-day losing streak above $2,280 ahead of Fed rate decision

Gold price posts modest gains around $2,288 on Wednesday during the Asian session. The precious metal edges higher as markets turn to a cautious mood ahead of the Federal Reserve's monetary policy meeting on Wednesday.

Bitcoin price dips into $60K range as spot traders flock to Coinbase Lightning Network

Bitcoin price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area. It comes as markets continue to digest the performance of Hong exchange-traded funds after their first day of issuance.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.