Nearer term $ index outlook :

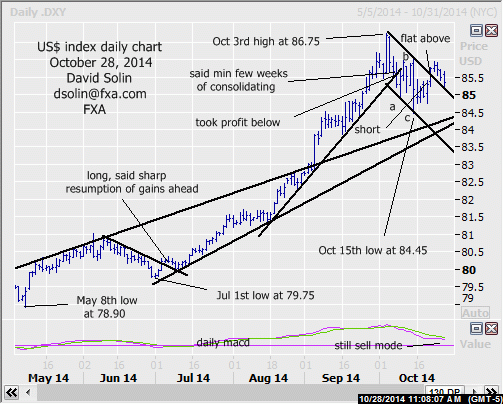

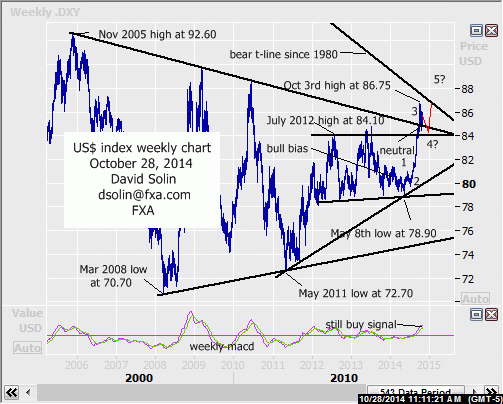

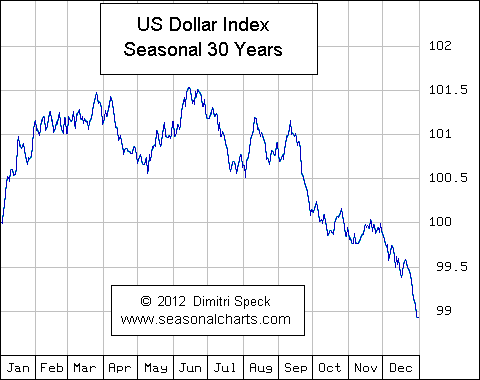

View since early Oct of an extended period of consolidating from the Oct 3rd high at 86.75 (month or more) continues to unfold, as the market corrects the last few months of sharp gains. At this point, there is still no confirmation that this period of consolidating is "complete" pattern-wise, and in turn argues at least another few weeks of such chopping/ broader ranging ahead. Note too that technicals are still bearish (see sell mode on the daily macd at bottom of daily chart below), the seasonal chart is lower into the end of the year (see 3rd chart below) and "sloppy" trade over the last few weeks, add to the view of continued chopping for now. Nearby support is seen at the broken ceiling of the bearish channel from the Oct high (currently at 84.15/25), that Oct 15th low at 84.40/50 and the 80.00/15 area (38% retracement from the Jul low at 79.75/wave 3, bullish trendline from July, broken rising t-line from May). Resistance is seen at 85.90/00 and that 86.70/80 high. Bottom line : at least another few weeks of broad consolidating ahead.

Strategy/position:

Don't forget that markets go through periods of trending and periods of consolidating, and being able to identify that can be a huge advantage (adjust approach). In this case despite no large net changes favored ahead (still seen in larger period of ranging), good profits can potentially be made by trading with a shorter term bias, and looking to fade (not chase) extremes (width of range over the last few weeks 235 ticks). In general would stay with this strategy for now in an attempt to capture some of these intra-range swings. Specifically for now with the market near the middle of the range, not seen as a good risk/reward on either side. Note was stopped on the Oct 21st sell at 85.25 on Oct 22nd above the ceiling of the channel from the high (then 85.55, closed at 85.75).

Long term outlook:

As discussed above, another few weeks of ranging/chopping is favored, but the action from the 86.75 high is seen as a correction (wave 4 in the rally from the May low at 79.75), and with eventual new highs after (within wave 5, see numbering on weekly chart/2nd chart below). Suspect that the magnitude of this downside to be relatively limited/shallow given the 3 wave fall from the high (a-b-c argues a "complex" type correction, triangle, etc.) and wave 2 which was deep (waves 2 and 4 tend to be different). Additionally, key longer term support is also in that 80.00/15 (also the multiple highs since July 2012, see weekly chart below), and is likely to be the downside limit. Bottom line : another few weeks of chopping/relatively limited downside, and with a resumption of the longer term gains after.

Strategy/position:

For now, would stay with the neutral bias (put in place on Oct 21st at 85.25 from bullish on Jan 6th at 80.65), but with the expectation of switching back to the positive side a few weeks ahead.

Current:

Near term : short Oct 21st at 85.25, stopped Oct 22 at 85.75, another few weeks of ranging ahead.

Last: long July 4 at 80.25, took large profit Oct 8 at 83.50 for 505 ticks/over 6%.

Longer term: bull bias Jan 6 at 80.65 to neutral Oct 21st at 85.25 (+460 ticks/+5.7%).

Last: bearish bias Sept 23rd at 80.45 to neutral Jan 6th at 80.65.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades slightly near 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range below $2,320

After retreating to the $2,310 area early Wednesday, Gold regained its traction and rose toward $2,320. Hawkish tone of Fed policymakers help the US Treasury bond yields edge higher and make it difficult for XAU/USD to gather bullish momentum.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.