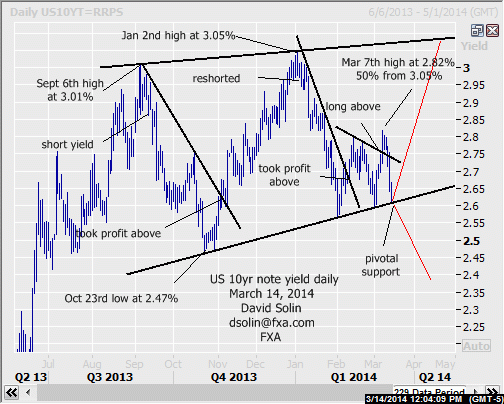

Near term US 10 year note yield outlook:

The market is sitting near critical support at the bullish trendline since Oct (currently at 2.59/61%), with its resolution likely to set the direction for at least the next few months. View 2 potential scenarios ahead. 1) a large rising wedge is forming since last Sept, with gains back to the Jan 2nd high at 3.05% and even the ceiling (currently just above) as part of this larger pattern. 2) a more important top is already in place with a downside break of this key support area potentially triggering a further, downside acceleration. "Slightly prefer" the view of this area holding, as the seasonal chart surges over the next few months (see 3rd chart below), and copper is finding some stability in that critical $3.00 area (plunge would suggest troubles for global economy). Note too that holding into early next week (get past Crimea vote) would also increase the confidence. Further support below that key trendline from June is seen at 2.55/57% (Feb 3rd low) and the Oct low at 2.47%. Nearby resistance is seen at 2.71/73% and 2.81/83% (last week's high, 50% from 3.05%).

Strategy/position:

Got a bit caught, getting long yield (short notes) the Mar 7th intraday break .02 above that multi-week bear trendline (then 2.74%, long at 2.76%). For now, would continue to stop on a close .02 below that key, bullish trendline from Jun.

Long term outlook:

As discussed above, there is scope for gains back to the Jan high at 3.05% and even slightly above. However, would be part of a larger, complex topping/potential rising wedge since Sept, and with an eventual downside resolution after (see in red on weekly chart/2nd chart below). Note too that longer term technicals continue to deteriorate (see bearish divergence, sell mode on the weekly macd), adding to this view of a more important topping. And as also mentioned above, a break/close below the base would argue such a top is already in place. Note too that the magnitude of the longer term downside (on the resolution of this multi-month topping pattern) is a question, but there is some potential for declines all the way back to the June 2012 low at 1.38% as part of a much larger period of wide consolidating. Support before there is seen at the Oct 2.45/47% low and 2.20/22% (50% from 1.38%).

Strategy/position:

With potential for another upleg back to 3.05% (as part of this large topping since Sept), would stay with the longer term bullish bias that was put in place on Mar 7th at 2.76%, but also switching to neutral on a daily close .02 below that bull trendline from Oct.

Current:

- Nearer term: long Mar 7 at 2.76%, stop on close .02 below that bull trendline from Oct (cur 2.59/61%).

- Last: short Jan 7th at 2.94%, took profit Feb 11th at 2.73%.

- Longer term: multi-month topping but scope for a month or 2 of upside back toward 3.05% (Jan high).

- Last: bear bias Sept 18th at 2.87% to neutral Jan 28th at 2.75%.

_20140314165641.png)

US-Notes (10 Year) Yield

_20140314165726.png)

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.