The top reasons for gold's decline are US dollar strength and expected interest rate hikes from the US and UK pushing investors away from the yellow metal (which doesn't pay interest!). However, at these levels, it’s hard to not contemplate if market has gone too far. In 2015, gold has declined from its peak $1,302 to the $1,100 mark, a drop over 15%. Furthermore, half of the $200 drop occurred in just one month (last seen $1,200 June 20).

Looking ahead, on Wednesday 29th July, the FOMC will announce interest rates at 18:00 GMT which is followed by the Feds monetary policy statement. This may have a big impact on the future direction of gold, since its current decline is fueled by interest rate hikes on the horizon. If the statement is in-line with previous statements, that rates are set to hike, the price of gold may not react since the market have already factored this in. However, if the Fed hint that their stance has changed and they want to wait before rising, we may see gold make a come-back. Either way volatility may rise regardless of market direction!

Volatility is an important factor to consider when trading gold. The Gold Volatility Index (GVX), measuring the 30-day expected volatility in gold price, has risen over four points in the past 10 days, from 15.10 to 19.66, a near 30% increase. See graph below.

How to trade volatility? You may buy or sell option contracts on gold, depending on your market outlook.

If you believe that volatility is here to stay and might even increase, you may want to buy options because as volatility increases an option's value increases. The 'type' of option, Call or Put, that you buy depends on the market direction you want to take. If you expect gold price to rise you may buy a Call and if you expect the price to fall you may buy a Put. The following provides two example trades using Put options.

Trading a falling price & rising volatility - Buying a Put

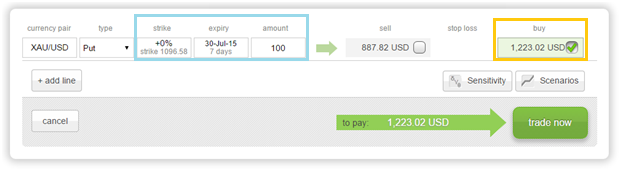

A Put gives the right to sell at a certain price over a certain period of time. The image below is an example traded on the ORE platform. It is a Put trade, with the right to sell 100 ounces of gold, at the current levels of $1096 (strike 0%) over the next 7-days (expiry), as highlighted by the blue box.

The cost of this option is 1,223.02 USD which is the maximum risk for this position.

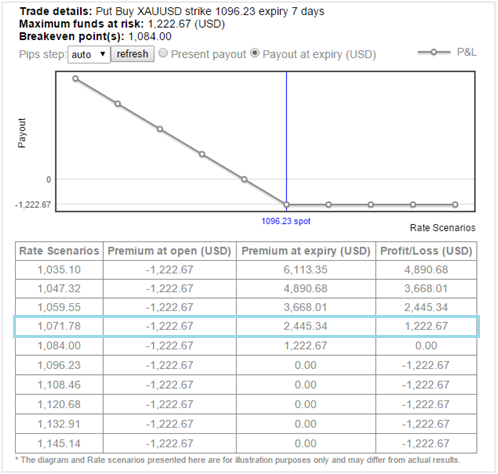

The below Scenarios chart and table, shows the profit or loss of the Put trade over a range of gold price. If gold price falls profit will grow with 100% profit made if gold reaches $1071, by expiry. If gold price does not fall a limited loss is made.

Trading a rising price & falling volatility - Selling a Put

If you believe that volatility will decline, you may sell options and benefit from a stabilizing market. In addition, you will choose the 'type' of option (Call or Put) depending on market direction. For example, if you expect the market to rise you may sell a Put option.When you sell an asset you want the value of the asset to fall. When you sell an option, for each day that goes by the option's value declines and hence you collect premium. An option's value also depends on market direction: If you sell a Put and the price of gold rises, the Put's value will decline (since a Put becomes less valuable in a rising market). However, if the price of gold falls the Put will increase in value hence the seller is exposed to risk.

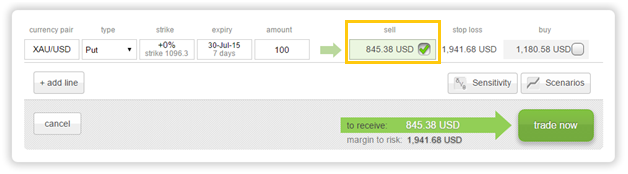

For example, if you sold a Put option with strike 0%, expiry 7-days and amount 100 ounces (as shown in the image below) you will profit if the price of gold stays above the strike by expiry. You would even profit if the price did not move i.e. you are trading a decrease in volatility. The maximum profit you can reach is the sell price of the option, in this example that is 845.38 USD as highlighted in the orange box.

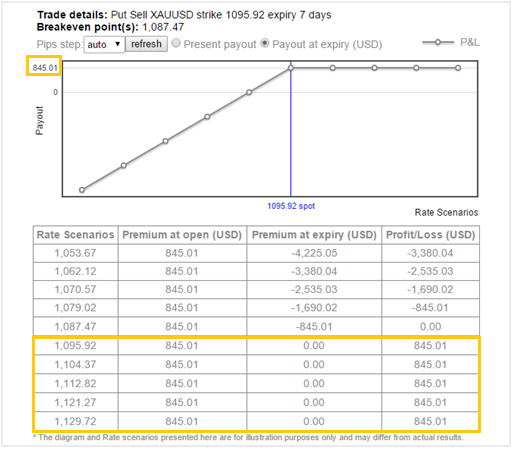

The Scenarios chart and table below shows the Put trade's profit or loss over a range of gold prices at expiry. If the price of gold expires at or above the current market price, then the trade will return maximum profit. On the other-hand, if the price of gold falls the trade moves into a losing position. A stop-loss order may be used to manage maximum loss.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.