An options value declines over time. This is good for an option seller since they collect this as profit for each day that the option position is open. However, overall profit or loss will depend on other market factors as well.

Volatility also affects option price; if the market expects volatility in the underlying asset to fall then the option price falls. This is good for a seller.

In summary the three main factors to consider are time, volatility and underlying market direction. With the latter depending on the ‘type’ of option sold; a Call falls in value when the underlying market falls and a Put falls in value when the market rises.

Lastly, the profit from selling is limited since an option price can only fall as far as zero. However, potential loss may be significant since an option price can rise substantially (and infinitely for Calls). On MT4, risk can be limited using a stop-loss order or, by ‘covering’ through buying an identical option of the same type but at a different strike level or, through trading in the underlying asset.

Selling a Call (C) Option

When you sell an option you receive the price upfront. As a seller you are on the other side of the buyer's trade; if the buyer is making a profit, the seller is losing and vice-versa.

In terms of direction, the seller of a Call wants the underlying market rate to expire at or below the option's strike rate. When this happens the option expires worthless hence the seller has collected the entire option price (i.e. the price sold at open).

For example, a weekly EURUSD Call with a strike of 1.0900 is shown in the image below. If you sold this option you would receive 0.00328 (32.8 pips). If the underlying market expires at or below 1.0900, the Call option would be worthless, and as a seller, you would profit. The maximum profit potential is equal to the sell (bid) price at open (32.8 pips in this case).

Selling a Put (P) Option

In terms of direction, the seller of a Put wants the underlying market rate to expire at or above the option's strike rate. When this happens the option expires worthless hence the seller has collected the entire option price (i.e. the price sold at open).

For example, a weekly EURUSD Put with a strike of 1.0800 is shown in the image below. If you sold this option you would receive 0.00253 (25.3 pips). If the underlying market expires at or above 1.0800, the Call option would be worthless, and as a seller, you would profit. In this case, the maximum profit potential is 25.3.

Trading a Trend

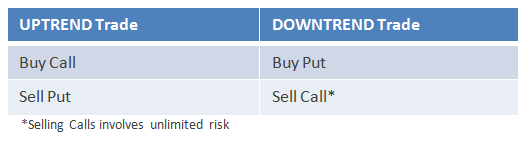

As demonstrated, you can buy or sell a Call or Put option to trade a trend in the underlying market.

Here is an overview:

Options trading is available on MT4 platforms, ask your broker for more details.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD clings to small gains above 1.0700 ahead of data

EUR/USD trades marginally higher on the day above 1.0700 on Tuesday after EU inflation data for April came in slightly stronger than expected. Market focus shifts to mid-tier US data ahead of the Fed's policy announcements on Wednesday.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. Investors await macroeconomic data releases from the US.

Gold extends daily slide toward $2,310 ahead of US data

Gold stays under bearish pressure and declines toward $2,310 on Tuesday. The benchmark 10-year US Treasury bond yield holds steady at around 4.6% ahead of US data, making it difficult for XAU/USD to stage a rebound.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.