Excitement is brewing and the stench of nervousness is in the air as market participants look to the European Central Bank rate decision today. Depending on who you speak to ECB President Draghi doesn’t have enough left to inspire confidence, or he’s going to take his famously dovish rhetoric to a new low… or high. Certainly one may expect the latter given the credibility of the ECB is supposedly at stake. Naturally, one of the best barometers of the ECB decision and subsequent press conference will be the Euro’s performance. The EUR is currently trading near 8-month lows and poised for further losses if Draghi is able to inspire enough confidence that he and his ECB have the ability to prod the economy back into some sort of form.

Still it’s a question of expectations, and a low and falling Euro reflects just how much is riding on it. Specifically looking at the EURUSD pair, there’s a lot of fresh air below current levels and before this 8-month period, you need to go back to 2003 to witness similar levels.

At the centre of Draghi’s plan is expected to be further cuts to the official deposit rate. That is, the amount Banks need to pay to hold their funds overnight. Also it’s expected the bank will extend its quantitative easing measures.

According to Goldman Sachs (as covered by Bloomberg) Draghi’s going to hit the market with a dovish surprise, one that could drive the EURUSD down 3 big figures.

Still, it’s not all about the EURUSD pair with some analysts expecting to see the residual effects on the Euro’s major counterparts increase the chances of central bank intervention. Specifically, the Swiss National Bank who famously lifted the cap from Swiss franc against the Euro in January this year. Could a material fall in the Euro inspire the SNB to jump back into the market? There’s already speculation that they’ve stepped in last week and the SNB are not shy in coming forward about the willingness to step in and weaken the CHF.

The ECB decision will be announced at 1445 (Platform Time) with a press conference around 45 minutes later. This conference is where Draghi needs to pull out the big guns and go a little further then “whatever it takes” which has probably warn a bit thin.

A brief look at other currencies and Analyst, Adam Taylor notes the AUDCHF pair is maintaining a bullish trend throughout the higher time frames.

“Momentum is carrying the Australian Dollar after strong domestic data releases while the Swiss Franc is perhaps a victim of the SNB attempting (or rumoured) to shadow the ECB policies and purposely weaken the currency. “ He notes the recent pullback to 0.7430 area may present some buying opportunities with a med-longer term outlook of 0.7650.

AUDCHF could represent value if support holds

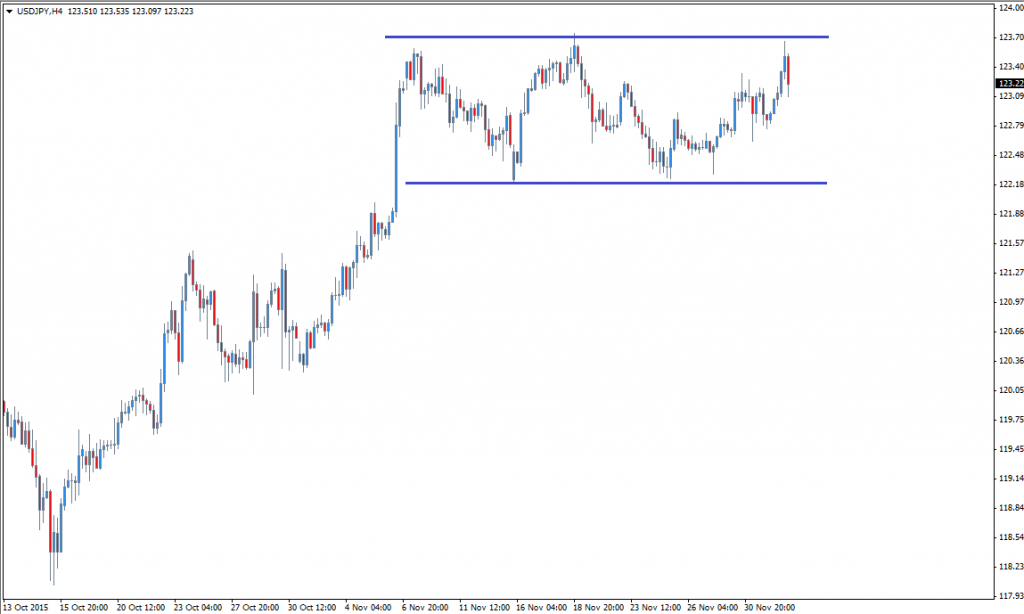

Taking a quick look at the greenback its performance against the Yen appears to be generating a triple top formation on the 4hr chart. A definitive breakout of the 123.70 region could see the pair rally higher before finding potential resistance at 124.50. Yellen’s speech tomorrow along with US ISM Non-manufacturing data could present some substantial event risk. Should the Dollar lose traction, then we may see the bottom of the range re-tested at 122.25.

USDJPY chart – Triple top? Yellen, ISM and NFP’s to shape dollars next move

Risk Warning: Trading Forex and Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. The FSG and PDS for these products is available from GO Markets Pty Ltd and should be considered before deciding to enter into any Derivative transactions. AFSL 254963. ABN 85 081 864 039.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700 as USD struggles ahead of data

EUR/USD is posting small gains above 1.0700 in the European session on Thursday. The pair remains underpinned by a sustained US Dollar weakness, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD stays firm above 1.2500 amid US Dollar weakness

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair's uptick is supported by a broadly weakness US Dollar on dovish Fed signals. A mixed market mood could cap the GBP/USD upside ahead of mid-tier US data.

Gold price trades with modest losses amid positive risk tone, downside seems limited

Gold price edges lower amid an uptick in the US bond yields, though the downside seems cushioned. A positive risk tone is seen as another factor undermining demand for the safe-haven precious metal.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.