- Euro tumbles following surprise Greek news, volatility almost guaranteed

- Forex volatility prices jump to their highest since “flash crash” of May, 2010

- Our strategy-trading bias unclear given extensive market uncertainty

The Euro looks almost certain to see significant volatility in the week ahead, and traders should keep an eye on these pairs given uncertainty surrounding Greece.

A surprise announcement from the Greek government on Friday sent the Euro significantly lower at Sunday’s open, and the resulting confusion makes further volatility exceedingly likely ahead of a planned referendum on Sunday, July 5.

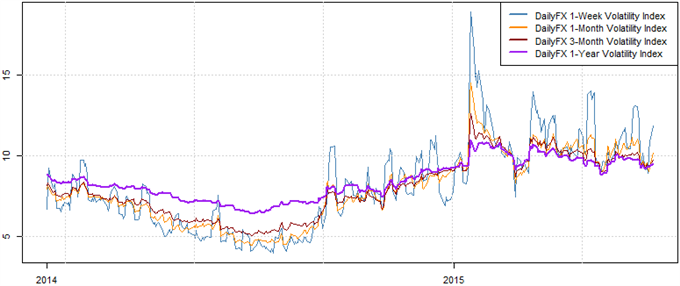

FX options traders quickly sent Euro 1-week volatility prices to their highest levels in five years as markets opened on Sunday night, and indeed broader expectations point to potential turbulence in the week ahead.

Forex Volatility Prices Tumble after Big Week, but Greece Negotiations Represent Key Risk

Data source: Bloomberg, DailyFX Calculations

In many cases we would argue that the sharp jump in volatility prices might produce good market conditions for our volatility-friendly Breakout2 trading strategy. And yet the clear difficulty in this instance is that it is especially challenging to predict how markets will react to ongoing Greece-related headlines and the potential for a material market gap this coming weekend.

This isn’t to say there won’t be any trading opportunities ahead of the weekend’s referendum, but we would avoid outsized positions in the Euro—particularly against the safe-haven US Dollar, Japanese Yen, and Swiss Franc. Price action for the EUR/CHF is further complicated by the fact that the Swiss National Bank publicly announced it had intervened in order to protect against excessive CHF appreciation.

Expect more noise out of global central banks in what promises to be an eventful week for financial markets. Even beyond Greece, Thursday brings what is often the most-market-moving event in the US Nonfarm Payrolls report. It seems wise to keep risk tight ahead of a critical stretch for broader markets.

Recommended Content

Editors’ Picks

EUR/USD stays in positive territory above 1.0850 after US data

EUR/USD clings to modest daily gains above 1.0850 in the second half of the day on Friday. The improving risk mood makes it difficult for the US Dollar to hold its ground after PCE inflation data, helping the pair edge higher ahead of the weekend.

GBP/USD stabilizes above 1.2850 as risk mood improves

GBP/USD maintains recovery momentum and fluctuates above 1.2850 in the American session on Friday. The positive shift seen in risk mood doesn't allow the US Dollar to preserve its strength and supports the pair.

Gold rebounds above $2,380 as US yields stretch lower

Following a quiet European session, Gold gathers bullish momentum and trades decisively higher on the day above $2,380. The benchmark 10-year US Treasury bond yield loses more than 1% on the day after US PCE inflation data, fuelling XAU/USD's upside.

Avalanche price sets for a rally following retest of key support level

Avalanche (AVAX) price bounced off the $26.34 support level to trade at $27.95 as of Friday. Growing on-chain development activity indicates a potential bullish move in the coming days.

The election, Trump's Dollar policy, and the future of the Yen

After an assassination attempt on former President Donald Trump and drop out of President Biden, Kamala Harris has been endorsed as the Democratic candidate to compete against Trump in the upcoming November US presidential election.