- The year-end threatens a liquidity crunch in US Dollar lending markets

- Past quarter-ends have provided similar crunches, produced elevated borrowing costs

- Traders should be wary of holding outsized positions into the year-end

The end of the calendar year threatens to force a liquidity crunch in US Dollar markets, and traders should note risks of elevated financing costs in major FX pairs.

Why Might Rollover Rates Rise Sharply in the Coming Weeks?

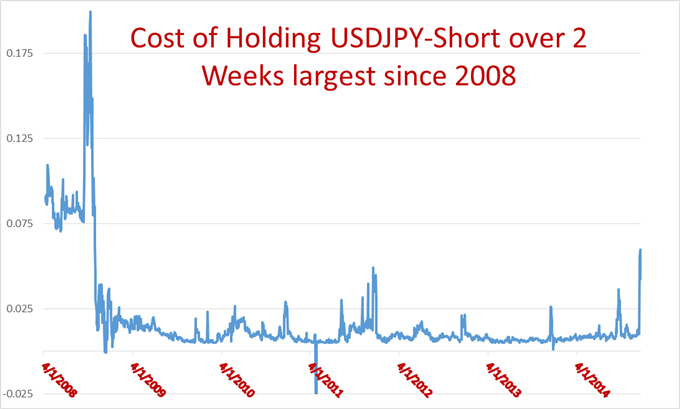

A look at interbank forward markets shows that holding Euro and US Dollar-short positions short positions versus the Japanese Yen is near its most expensive since the heights of the global financial crisis in 2008.

If a trader is long the USDJPY they could theoretically collect this difference, but in practice these relative rates are guided by supply and demand and past experience has shown otherwise.,

Cost of Holding USDJPY-Short Position Surges into Year-End

Indeed we saw similarly pronounced surges into the end of the second quarter in Euro pairs; at the time we noted that a single day’s EURUSD financing charge was the rough equivalent of the combined 25 days prior. It seems as though traders may continue to expect similar spikes at month and quarter end. The effect is likewise pronounced in Yen pairs, and in addition to the USDJPY the EURJPY looks especially stretched.

Interbank forwards pricing show that holding a EURJPY-short position for two weeks would cost the most in financing charges since episodes of Euro funding troubles in 2011.

As with the USDJPY, a trader should theoretically be able to collect this difference, but experience over similar episodes showed otherwise.

Given that FX market volatility typically drops significantly in the final weeks of the calendar year, these charges represent an especially large cost to a trader looking to capture smaller currency moves. Indeed, the sharp changes in interbank lending markets could in some cases make the difference between a winning and losing trade.

Understanding Forex Rollover

Trading forex on leverage involves borrowing one currency in order to purchase another. In effect this means traders will pay interest rates for the currency which they sell, while they receive interest rate payments for the currency which they buy. In FX terminology this is most often called “Rollover” or “Swaps”.

Overnight interest rates will guide whether the trader will ultimately pay to hold a position or earn interest on the trade, and typically these interbank rates will track a central bank’s target quite closely. Yet sharp changes in the supply or demand for a specific currency can shift interbank borrowing rates in a hurry.

Traders should be wary of these elevated costs headed into the final weeks of the trading year.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.