Talking Points:

US Dollar Index sets a 3-day high on RBA caution over Aussie

Greenback losses to Euro, Pound unwound despite a more peaceful Putin

A look back at the past 24 hours of Forex trading using movements in the US Dollar Index:

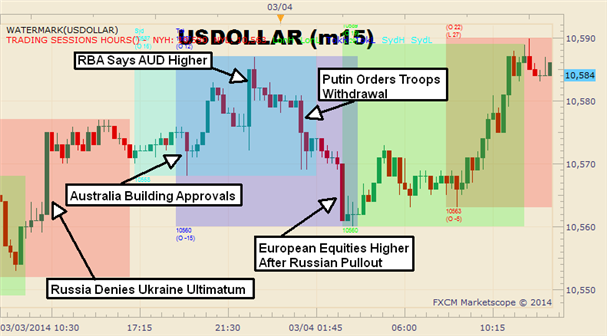

US Dollar 15-Minute 12:00 03/03 to 12:00 03/04 EST

The Dow Jones FXCM US Dollar Index has risen to a 2-day high in Tuesday’s trading despite some initial losses to the Euro and Pound on a less aggressive signal from Russia.

In the second half of NY trading on Monday, the US Dollar gained about 25 pips against the Euro and Pound, possibly signaling a worse sentiment regarding the tensions in Ukraine. Slightly before the greenback gains, Russian President Putin had denied that he set an ultimatum for Ukrainian soldiers to surrender in Crimea, but that news should have been slightly positive for European currencies.

The US Dollar then rose higher in the Tokyo session, as the RBA reported no change in monetary policy but commented that the Australian Dollar is higher by historical standards. The Australian Dollar initially rose 25 pips on the news of the unchanged policy, but AUD/USD was quickly slammed 30 pips lower on the currency comment.

Finally, the US Dollar Index fell below the Tuesday open, as Putin denied sending troops into Crimea. The less-aggressive tone from Putin seemed to quell market fears, and the Euro and Pound each rose higher. Those gains were furthered as European equities opened significantly higher following the most recent Ukraine related headlines.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.