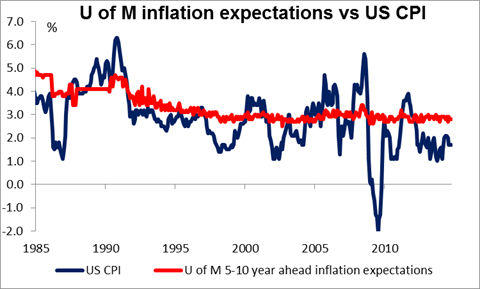

Dollar lower on lower US rates: US retail sales surprised on the upside and US bond yields began to rise, pulling the dollar up along with it. The figure added to market expectations of a strong Q3 GDP figure for the US, in contrast to the anemic Q3 growth figure published for Europe on Friday. (Market consensus for Q3 US GDP is currently 3.2%. The figure will be released on Nov. 25th.) But the impact of the report faded quite quickly. As 10-year yields approached 2.40 (peak = 2.375%), a resistance point recently, the market reversed, because investors can no longer imagine a high inflation rate. Then later in the US day gold started to rise sharply as a poll out of Switzerland showed the “yes” vote getting more support than expected. This hit USD and the dollar began to plunge. EUR/USD traded between 1.2399-1.2546 in four hours or 1.2%, compared to a 1.8% range for the whole month of November up to that point. While all of this was going on in the FX and bond market, equities remained dull; once again the S & P 500 closed almost unchanged.

The 10-year bond finished the US day at 2.32% and this morning in early European trading is quoted at 2.28%, which may explain in part why the dollar is lower against all its G10 counterparts. On the other hand, rate expectations as shown by the Fed funds futures barely budged, so there has not been a major rethink about the short-term course of Fed policy, just the longer-term equilibrium level of interest rates as the outlook for inflation changes.

The G20 meeting had nothing to say about FX rates. The leaders agreed to plans drawn up by their finance ministers in February, known as the Brisbane Action Plan, to boost their collective GDP growth by at least 2% by 2018. They will do this by increasing “investment, trade and competition.” They said that “the global economy is being held back by a shortfall in demand.” In that case, fiscal policy should be the solution. On that subject they said “(w)e will continue to implement fiscal strategies flexibly, taking into account near-term economic conditions, while putting debt as a share of GDP on a sustainable path.” Something for everyone: the French can point to “flexibly,” while the Germans can point to “sustainable path.” At the end of the day, everyone can do whatever they want. Perhaps the most significant statement was that “(w)e will monitor and hold each other to account for implementing our commitments,” which means there will be plenty of opportunity for finger-pointing in coming months. The fact is, raising global growth has been an aim of the G20 all year and in prior years as well, but growth is still anemic, particularly in Europe. When was the last time you heard a politician stand up and say “we have to do X, Y and Z to meet our G20 commitments?” I can’t remember.

Today’s indicators: Speaking of anemic growth, Japan’s Q3 GDP came in at -1.6% qoq SAAR, a big disappointment (market expectation: +2.2%) after the -7.1% qoq SAAR plunge in Q2 following the hike in the consumption tax. This makes it more likely that PM Abe will call a snap election as a referendum on increasing the consumption tax again and will use his re-election as an excuse to delay it. He will reportedly hold a press conference tomorrow to make the announcement. The implications for JPY are negative: a delay should be good for the stock market, which means a higher USD/JPY (weaker yen), and it also means less economy-wide savings, hence a smaller current account surplus.

During the European day, Eurozone’s trade balance for September and Norway’s trade balance for October are coming out. In Sweden, the official unemployment rate for October is forecast to increase a bit, in line with the recent increase in the PES unemployment rate for the same month.

From the US, industrial production for October is expected to rise mom but at a slower pace than in September. The Empire State manufacturing PMI for November is expected to improve.

We have four ECB speakers on Monday’s agenda: Executive Board member Yves Mersch, Executive Board member Peter Praet and the very, very talkative Executive Board member Benoit Coeure. In addition, ECB President Mario Draghi gives his quarterly testimony to the Committee on Economic and Monetary Affairs (ECON) of the European Parliament in Brussels. At the press conference following the latest ECB meeting, Draghi made it clear that the ECB is open to embarking on new measures if needed, so we do not expect any surprises at this event.

Rest of the week: The highlight will be the Fed minutes from its October FOMC policy meeting on Wednesday. The minutes will provide details of the decision to end the QE3 and the improvement in the labor market. Any reference to when the members expect to start raising rates could be USD-bullish.

On Tuesday, we get UK’s CPI for October and the forecast is for the inflation rate to remain unchanged. From Germany we get the ZEW survey for November. On Wednesday, besides the Fed minutes, the Bank of England publishes the minutes of its November policy meeting. As for the indicators, the US housing starts and building permits for October are forecast to increase, suggesting an improved housing sector activity. Wednesday the Bank of Japan holds its policy meeting, but following the surprise increase in its market operations at the end of October, it will probably be some time before there is another change in policy.

Thursday is global PMI day. During the Asian time, we have China’s preliminary HSBC manufacturing PMI for November and during the European day, Eurozone’s preliminary PMIs also for November are released just after the figures from Germany and France are announced. Later in the day, we get the US preliminary Markit manufacturing PMI for November. US CPI for October is forecast to ease somewhat.

Finally on Friday, Canada’s CPI for October is expected to remain unchanged in pace from September. This could prove CAD-supportive.

The Market

EUR/USD rebounds from 1.2400

EUR/USD rebounded from the 1.2400 (S2) line on Friday and today, during the Asian morning, it emerged above the resistance (turned into support) of 1.2530 (S1). Nevertheless, the advance was halted by our resistance hurdle of 1.2575 (R1), defined by the high of the 4th of November. Even though our near-term oscillators support the case for further upside, I would expect any extensions of Friday’s recovery to remain limited near the 200-period moving average and the 1.2620 (R2) line, which is the 50% retracement level of the 15th of October – 7th November down wave. The RSI moved above its 50 line and is pointing up, while the MACD crossed above both its zero and signal lines. As for the broader trend, the price structure on the daily chart still suggest a downtrend, but I can spot positive divergence between both of our daily momentum studies and the price action, something that reveals decelerating bearish momentum. Hence, I would prefer to stay flat for now and wait for more actionable signs to convince me that the downtrend is back in force and will most probably continue.

Support: 1.2530 (S1), 1.2400 (S2), 1.2360 (S3)

Resistance: 1.2575 (R1), 1.2620 (R2), 1.2750 (R3)

GBP/USD finds support near 1.5600

GBP/USD hit the support line of 1.5600 (S1) on Friday and rebounded. Today, during the Asian morning the rebound was stopped slightly above the 1.5730 (R1) resistance barrier, which happens to lie fractionally close to the 61.8% retracement level of the July 2013 – July 2014 uptrend. However, I see signs that the short-term recovery may continue a bit more, perhaps towards the support-turned-into-resistance line of 1.5800 (R2). On the 4-hour chart, the RSI exited its oversold territory, edged higher, and is now heading towards its 50 line, while the MACD, although negative, appears willing to move above its trigger. On the daily chart I see a possible hammer candle. As for the broader trend, I maintain the view that as long as Cable is trading below the 80-day exponential moving average, the overall path remains to the downside and I would treat any possible extensions of the current rebound as a corrective move before sellers pull the trigger again. A clear break below the 1.5600 (S1) support will probably trigger downside extensions towards the psychological bar of 1.5500 (S2).

Support: 1.5600 (S1), 1.5500 (S2), 1.5430 (S3)

Resistance: 1.5730 (R1), 1.5800 (R2), 1.5950 (R3)

EUR/JPY declines after hitting 146.50

EUR/JPY tumbled after finding resistance at 146.50 (R1) and during the early European morning appears ready to challenge the 145.00 (S1) line as a support this time. In my view, the rate is most likely to move below that line and perhaps target the 143.40 (S2) barrier, which stands slightly below the 23.6% retracement level of the 16th of October – 17th of November rally. Our short-term oscillators support the notion. The RSI exited its overbought field and is pointing down, while the MACD has topped and could move below its signal line any time soon. However, the overall outlook of this pair remains positive in my view and I would see the present pullback or any possible extensions of it as a downside corrective wave before the bulls take the reins again.

Support: 145.00 (S1), 143.40 (S2), 142.00 (S3)

Resistance: 146.50 (R1), 147.00 (R2), 148.00 (R3)

Gold surges above the key line of 1180

Gold shot up, breaking back above the key area of 1180 (S1), but found resistance at 1195 (R1), pretty close to the 50% retracement level of the 21st October – 7th of November down wave. The move above 1180 (S1) confirms a higher high on the 4-hour chart and alongside our momentum signs amplifies the case for further upside. On the daily chart, the 14-day RSI moved higher and looks ready to challenge its 50 line, while the MACD crossed above its trigger and is pointing up. A clear move above 1195 (R1) is likely to target the next resistance at 1205 (R2), which lies slightly below the 61.8% retracement level of the aforementioned decline. However, regarding the broader trend, I still see a longer-term downtrend. Hence, on the absence of any major bullish trend reversal signal, I would prefer to adopt a “wait and see” stance as far as the overall outlook of the yellow metal is concerned.

Support: 1180 (S1), 1146 (S2), 1132 (S3)

Resistance: 1195 (R1), 1205 (R2), 1222 (R3)

WTI challenges the 76.00 area as a resistance this time

WTI found some buy orders near the 73.35 (S1) line and rebounded to test the 76.00 area as a resistance this time. On the daily chart the price structure remains lower peaks and lower troughs below both the 50- and the 200-day moving averages, thus I still see a negative overall outlook. I would expect the recent rebound or any possible short-term extensions of it to provide renewed selling opportunities. A clear and decisive dip below the 73.35 (S1) obstacle would signal a forthcoming lower low and perhaps see scope for extensions towards our next support at 71.00 (S2), defined by the lows of July and August 2010.

Support: 73.35 (S1), 71.00 (S2), 70.00 (S3)

Resistance: 76.00 (R1), 78.00 (R2), 80.00 (R3)

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Recommended Content

Editors’ Picks

AUD/USD tests lows near 0.6550 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is testing lows near 0.6550 after Australian Retail Sales dropped by 0.4% in March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data fails to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY rebounds to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.