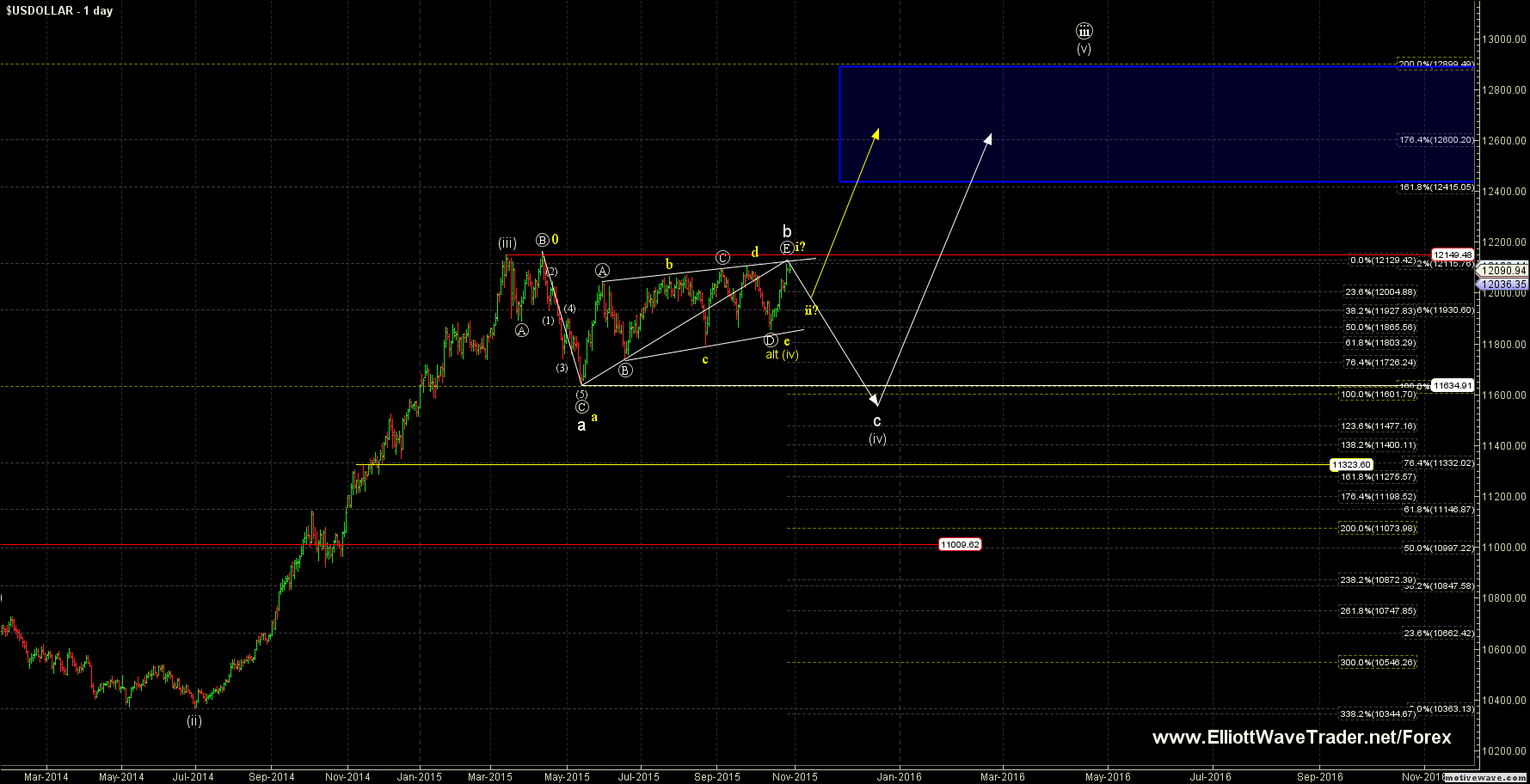

From an Elliott Wave perspective this consolidation pattern that we have seen since the May 13th low could be viewed in one of two ways. The first of which is that the May 13th low was the wave a of (iv) and this consolidation pattern was a b wave triangle after which we expect a c wave down to complete wave (iv) into the 11,600 area before continuing back higher in our larger degree bullish pattern. This is my preferred count at this time and is shown in white on the attached charts. Now with that being said given the strong push off of the October 14th low we cannot rule out that this low was in fact a more significant turning point on the USDOLLAR index.

Under this alternate case in which the October 14th low was indeed a more significant turning point in the USDOLLAR index then we would count the entire consolidation pattern that began on May 13th as a larger running triangle in which the October 14th low would have marked a larger degree wave (iv) low of the overall bullish pattern in the USDOLLAR index. Not only should we not breach the October 14th low under this case but we should ideally stay over the 11,919 level if on all retraces before moving higher. This represents the 76.4 retracement level from the October 14th low to the highs that we saw on October 29th.

So while the bigger picture is still very bullish in nature as we can see on the more intermediate timeframe we the pattern is still not entirely clear. Of course given that we appear to be towards the tail end of this consolation pattern we should have resolution on the intermediate timeframe in the not so distant future.

*Note: The FXCM USDOLLAR index is not to be confused with the DXY Index as they are two different indexes. The FXCM US Dollar index is an equally weighted index of the EUR/USD, GBP/USD, USD/JPY and AUD/USD. The DXY index is heavily weighted in European currency pairs with the EUR/USD representing 57% of the index as a whole. This is not to say that one index is better than the other just that they two indexes that are measuring different currency pairs against the US Dollar in an attempt to judge the strength of the US Dollar as a whole.

The commentaries and analysis represent the opinions of the analyst nd should not be relied upon for purposes of effecting securities transactions or other investing strategies, nor should they be construed as an offer or solicitation of an offer to sell or buy any security. You should not interpret these opinions as constituting investment advice. Our analysts may have personal positions in the instruments mentioned.

Recommended Content

Editors’ Picks

EUR/USD remains on the defensive near 1.0680 on Dollar strength

The solid performance of the Greenback keeps the price action in the risk-associated universe depressed so far on turnaround Tuesday, sending EUR/USD to multi-day lows in the 1.0680 region.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar stays resilient against its rivals following the strong wage inflation data and doesn't allow the pair to gain traction.

Gold maintains its bearish note and challenges $2,300

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.