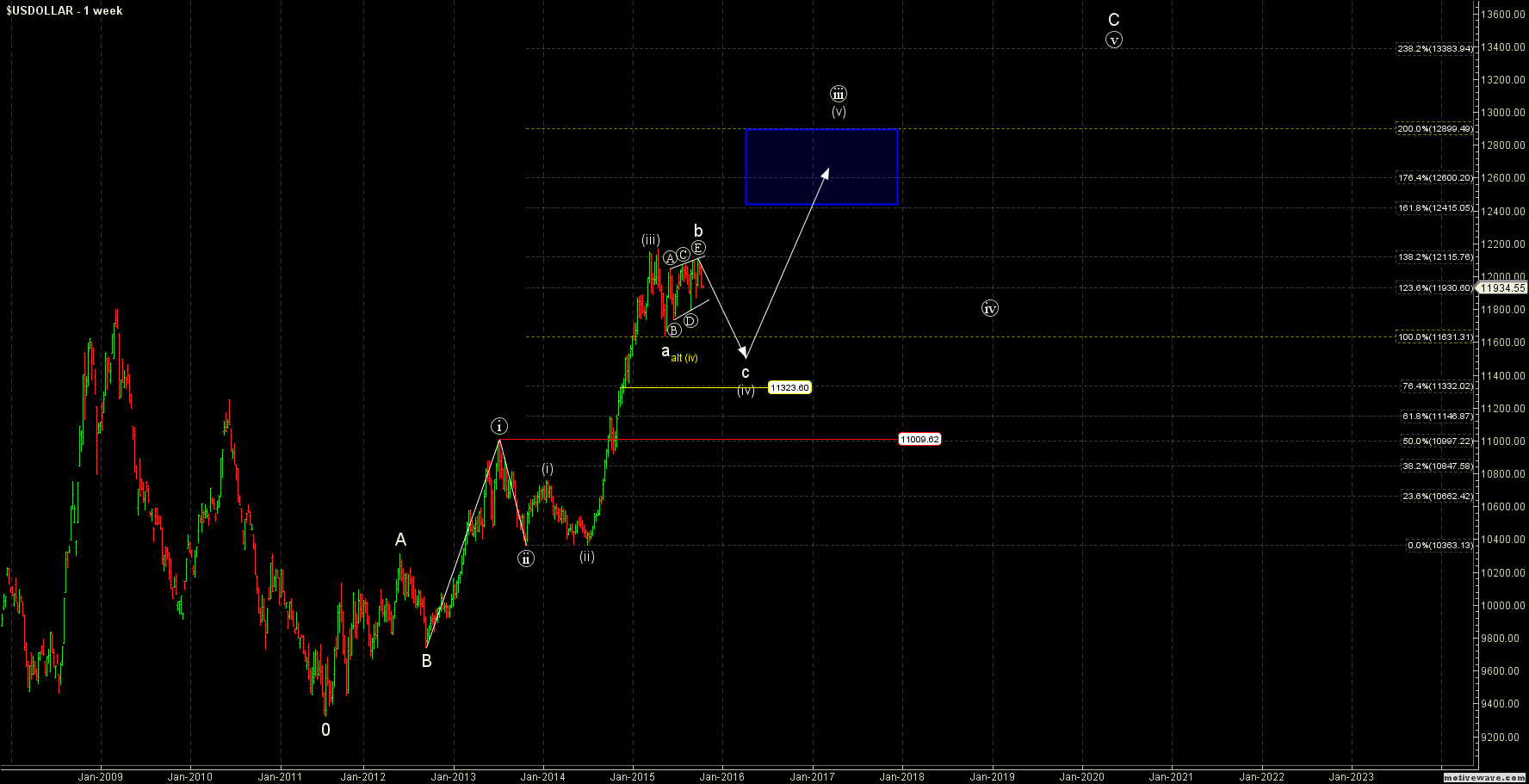

Looking at the bigger picture of both the DXY and the FXCM USDOLLAR we will notice that they have both been in consolidation patterns since the top in the spring of this year. The consolidation patterns in the two pairs, however, differ significantly from this top. In the DXY what we see is a wxy pattern in which the August 24th low made a new low under the May 13th low. The FXCM USDOLLAR Index did not. This could suggest that the FXCM USDOLLAR index will still see further downside action before a larger degree bottom is in place.

My base case on the FXCM USDOLLAR is that the consolidation that we have seen since the May 2015 bottom was a larger b wave that took the shape of a triangle. The top of this wave ((E)) of this triangle would have come in at the 12,104.50 level. Initial confirmation that the triangle is, in fact, breaking down would come with a break of the 11,865 level. This puts initial targets for wave c of (iv) at the 11,589 level, which is the 100 extension of the wave a that ended in May of 2015.

The next major support level below the 100 extension comes in at the 11,323. After we bottom in the wave (iv) we would then expect another rally that exceeds the March 2015 high with ideal targets for the top of wave (v) of ((iii)) in the 12,415 -12,899 range. Alternatively, a break of the 11,009 level would be an invalidation of the larger impulsive structure to the upside and suggest that we have a larger degree top in place on this FXCM USDOLLAR Index.

The commentaries and analysis represent the opinions of the analyst nd should not be relied upon for purposes of effecting securities transactions or other investing strategies, nor should they be construed as an offer or solicitation of an offer to sell or buy any security. You should not interpret these opinions as constituting investment advice. Our analysts may have personal positions in the instruments mentioned.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.