Analysis for August 26th, 2014

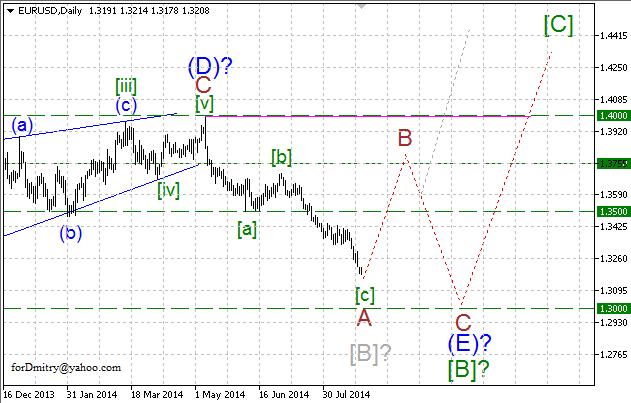

EURUSD, “Euro vs US Dollar”

One of the possible scenarios implies that Euro is forming the final descending wave (E) of [B], which may take the form of a large zigzag, flat or some double pattern. Right now, the pair is expected to start an ascending correction B of (E) of [B].

Probably, the price finished a descending impulse [c] of A and the whole zigzag A, which may be followed by an ascending zigzag B.

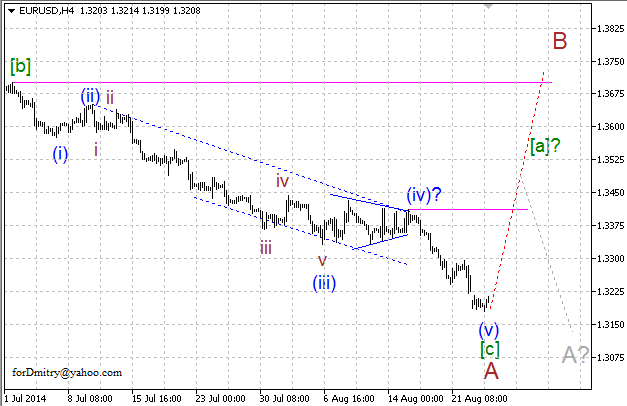

Possibly, the pair completed (or is completing) a descending impulse (v) of [c] of A and the whole zigzag A. Right now, the price is expected to start an ascending zigzag B.

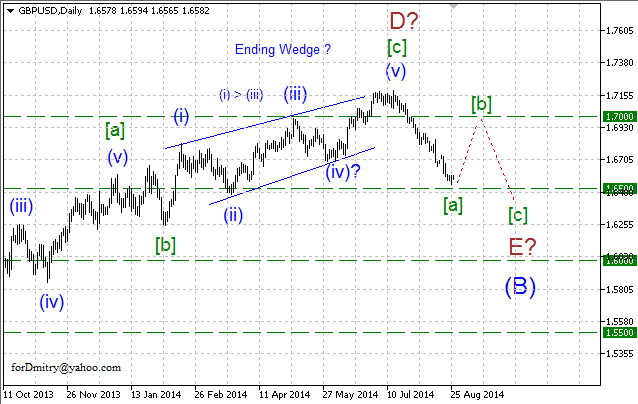

GBPUSD, “Great Britain Pound vs US Dollar”

Probably, Pound completed the final wedge [c] of D of an ascending zigzag D of (B) of a large skewed triangle (B). Right now, the pair is forming the final descending wave E of (B), which may take the form of (double) zigzag.

Possibly, the price is forming an impulse [a] of E of the final descending wave E of (B), which may be followed by an ascending zigzag [b] of E.

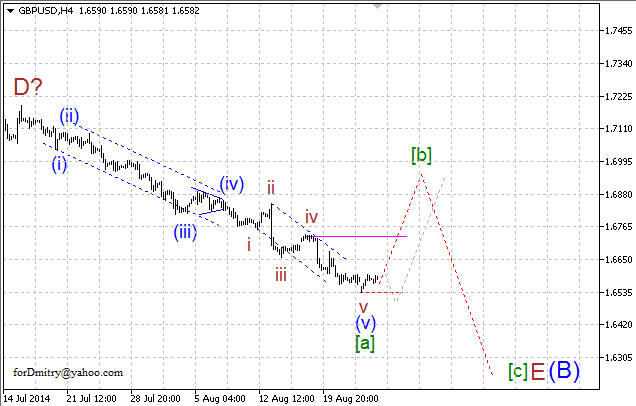

Probably, the pair completed (or is completing) a descending impulse v of (c) of [a], which may be followed by an ascending zigzag [b].

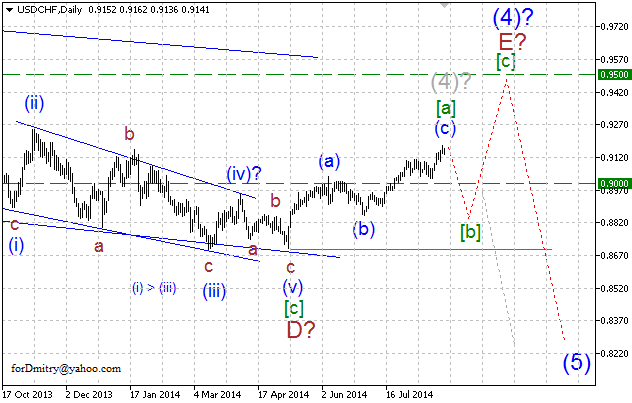

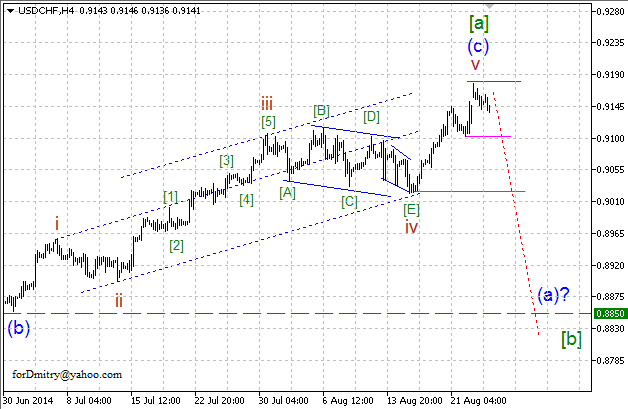

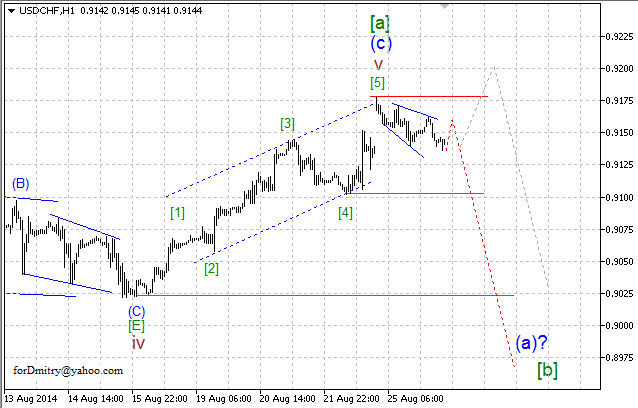

USDCHF, “US Dollar vs Swiss Franc”

One of the possible scenarios implies that Franc is forming the final ascending wave E of (4), which may take the form of a large zigzag, flat, or some double pattern. Right now, the price is expected to start a descending correction [b] of E of (4).

Probably, the pair finished an ascending zigzag (c) of [a] and the whole zigzag [a], which may be followed by a descending zigzag [b].

Possibly, the pair completed (or is completeing) an ascending impulse v of (c) of [a] and the whole zigzag [a], which may be followed by a descending zigzag [b].

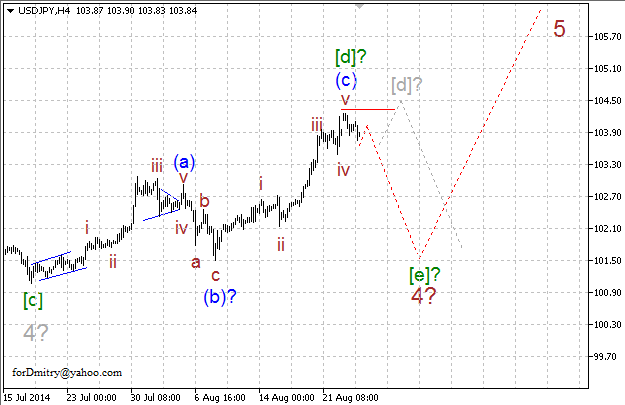

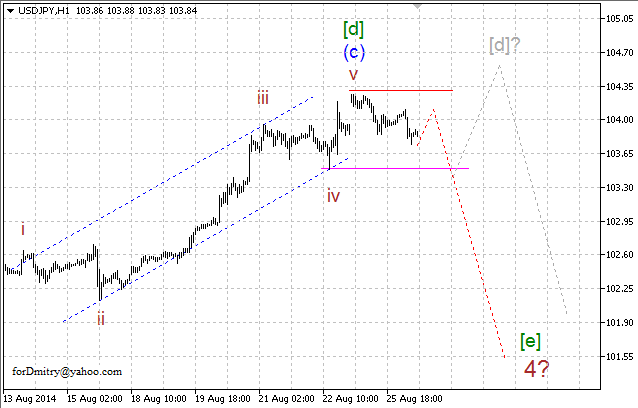

USDJPY, “US Dollar vs Japanese Yen”

Probably, right now Yen is expected to start forming a descending zigzag [e] of 4 of (A) of a long horizontal correction 4 of (A). In this case, later the price is expected to start the final ascending movement inside wave 5 of (A).

Probably, the pair completed (or is completing) an ascending zigzag [d] of 4, which may be followed by the final descending zigzag [e] of 4.

Possibly, the price finished (or is finishing) an ascending impulse (c) of [d] of and the whole zigzag [d]. If this assumption is correct, then later the pair is expected to start the final descending zigzag [e] of 4.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.