Analysis for April 28th, 2016

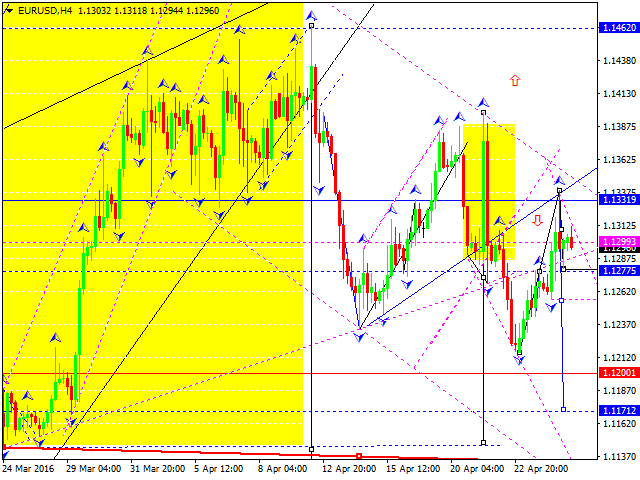

EURUSD, “Euro vs US Dollar”

Being under pressure, Eurodollar is moving upwards. We think, today the price may choose an alternative scenario and grow to reach 1.1377. After that, the pair may continue falling inside the downtrend towards 1.1200.

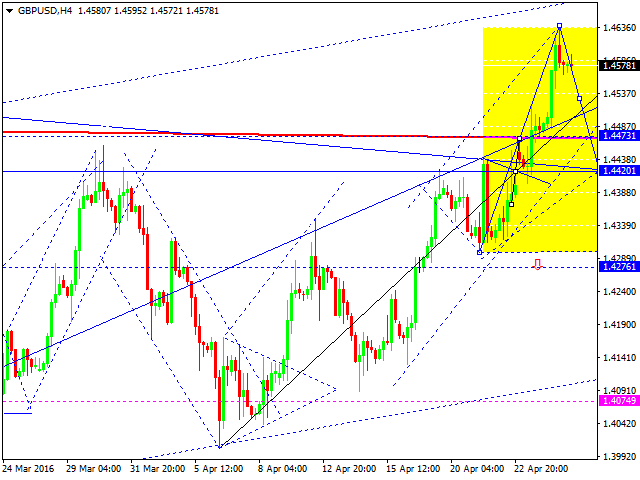

GBPUSD, “Great Britain Pound vs US Dollar”

Pound is moving above 1.4460. We think, today the price may be corrected to return to the above-mentioned level; he market is expected to fall as a correction, which already has two impulses, te second of which is now being corrected. Later, in our opinion, the market may form the third impulse to reach the target.

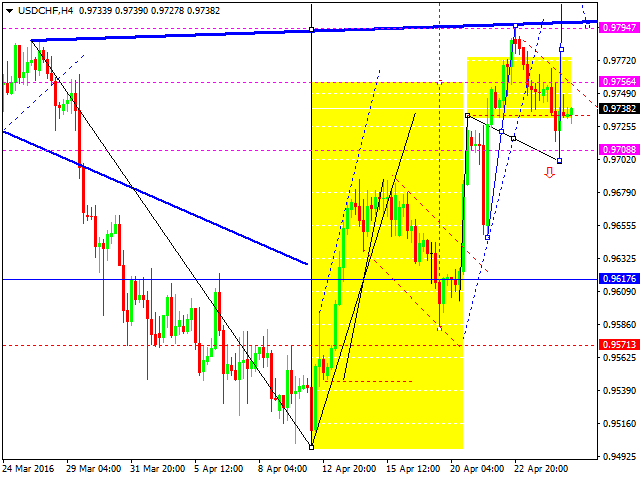

USDCHF, “US Dollar vs Swiss Franc”

Franc is still being corrected towards 0.9617. We think, today the price may reach 0.9667 and then return to 0.9700. After that, the pair may fall to reach the target of the flag correctional pattern.

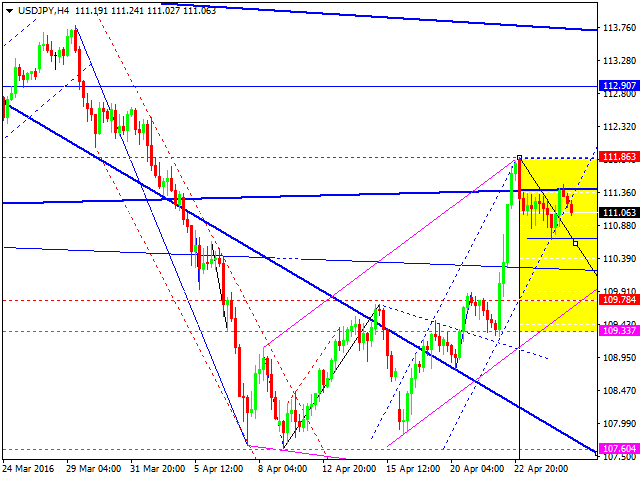

USDJPY, “US Dollar vs Japanese Yen”

Yen is falling fast towards 107.00, but it’s just a half of the wave. The main target is at 104.00.

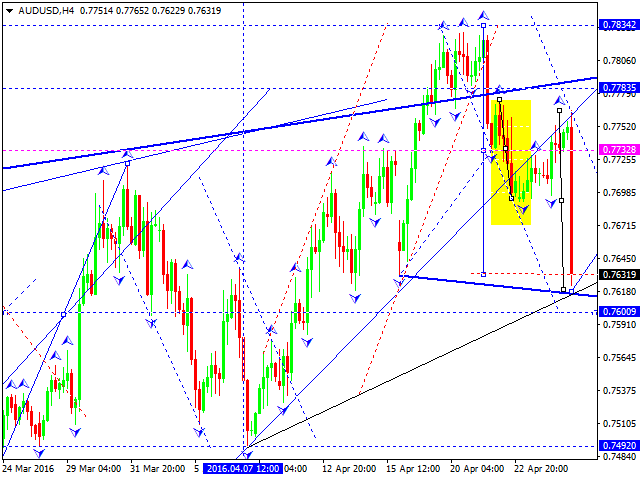

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar is attempting to return to 0.7732. However, this growth should be considered as an alternative scenario. The main scenario still implies that the price may continue falling inside the downtrend to reach 0.7470.

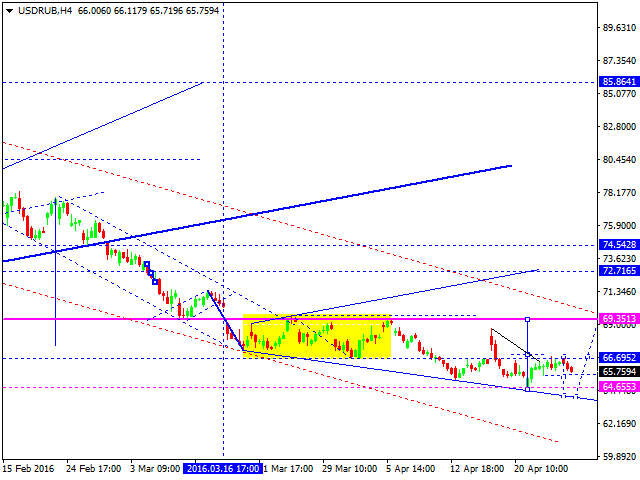

USDRUB, “US Dollar vs Russian Ruble”

We think, today Russian Ruble may reach 63.85. Later, in our opinion, the market may be return to 69.00.

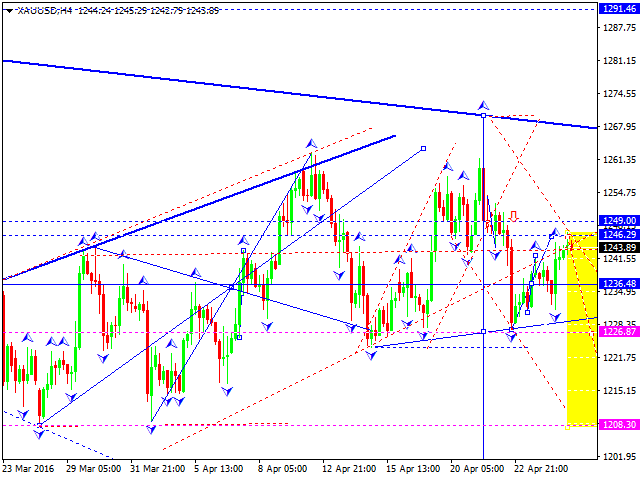

XAUUSD, “Gold vs US Dollar”

Gold has extended the correction towards 1255. We think, today the price may fall to reach 1200 and then return to 1226. Later, in our opinion, the market may continue falling inside the downtrend to reach 1182.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0700 ahead of key EU inflation, GDP data

EUR/USD is keeping the red near 1.0700, undermined by a broad US Dollar rebound and a mixed market mood early Tuesday. Germany's Retail Sales rebound fail to impress the Euro ahead of key Eurozone inflation and GDP data releases.

GBP/USD remains pressured toward 1.2500 on US Dollar rebound

GBP/USD is extending losses toward 1.2500 in European trading on Tuesday. A cautious risk tone and a decent US Dollar comeback weigh negatively on the pair. The focus now shifts to mid-tier US data amid a data-light UK docket.

Gold struggle with $2,330 extends, as focus shifts to Fed decision

Gold price is looking to build on to the previous downside early Tuesday, as traders continue to take profits off the table in the lead-up to the US Federal Reserve (Fed) interest rate decision due on Wednesday.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

Data fuels China optimism

China's factory activity has expanded for a second consecutive month, marking the best streak in over a year and fueling optimism for the sustainability of the world's second-largest economy's recovery.