Analysis for December 21st, 2015

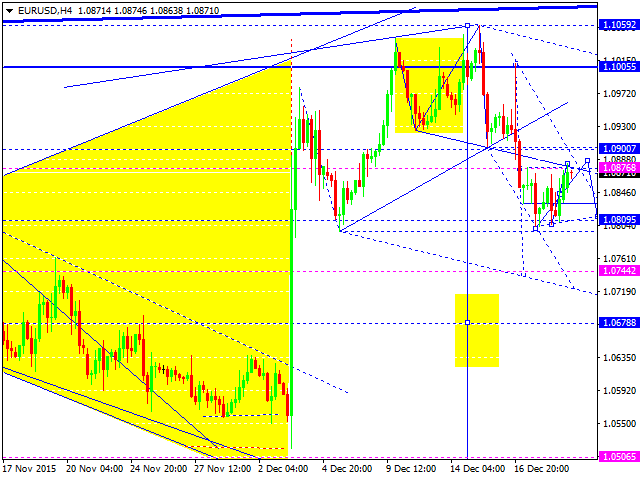

EURUSD, “Euro vs US Dollar”

Eurodollar is consolidating; at the moment, the market is forming an ascending structure to expand the channel upwards. We think, today, the price may test 1.0900 to test it from below and then start another descending wave with the local target at 1.0740.

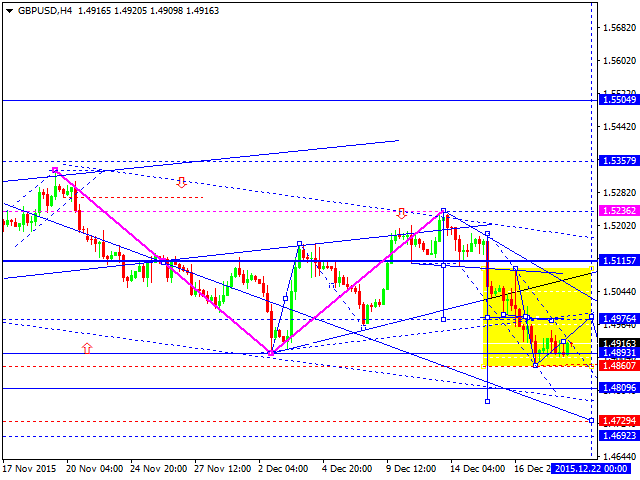

GBPUSD, “Great Britain Pound vs US Dollar”

Pound is consolidating. We think, today, the price may test 1.4976 from below and then form one more descending wave to reach 1.4809. The main target of this descending structure is at 1.4730.

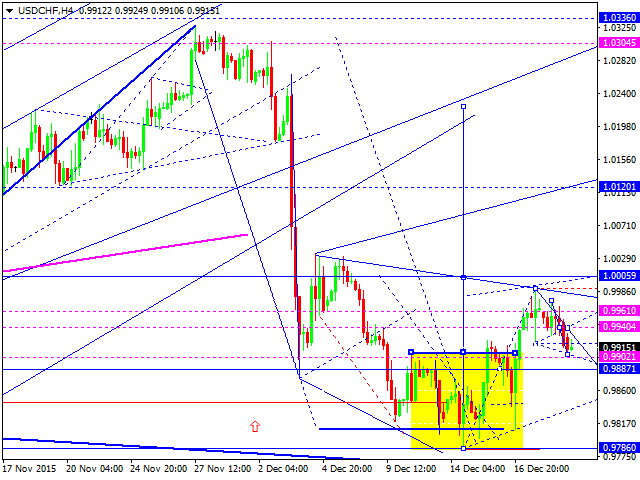

USDCHF, “US Dollar vs Swiss Franc”

Franc is expanding its consolidation channel downwards. We think, today, the price may reach 0.9888 and then continue growing to reach 1.0000. Later, in our opinion, the market may consolidate for a while and then continue moving upwards to reach 1.0120.

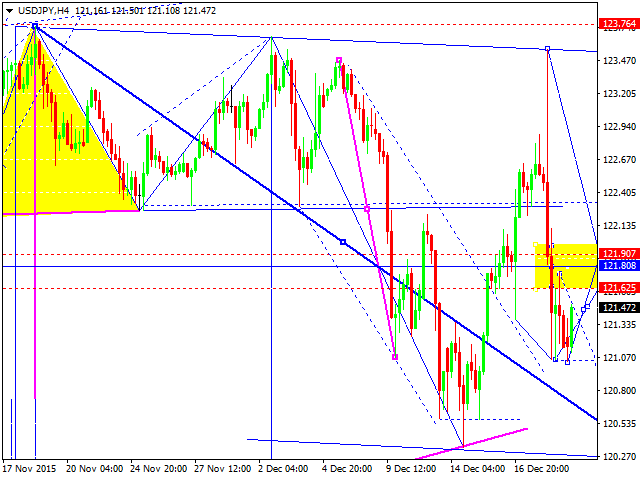

USDJPY, “US Dollar vs Japanese Yen”

Yen is consolidating as well. We think, today, the price may expand the channel upwards to reach 121.90 and then continue falling inside the downtrend towards the target at 120.25.

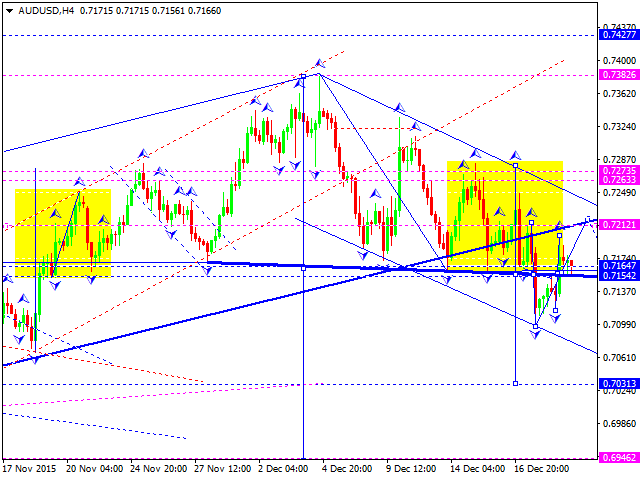

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar is returning to the center of its consolidation channel. Later, in our opinion, the market may continue falling inside the downtrend with the target at 0.7030.

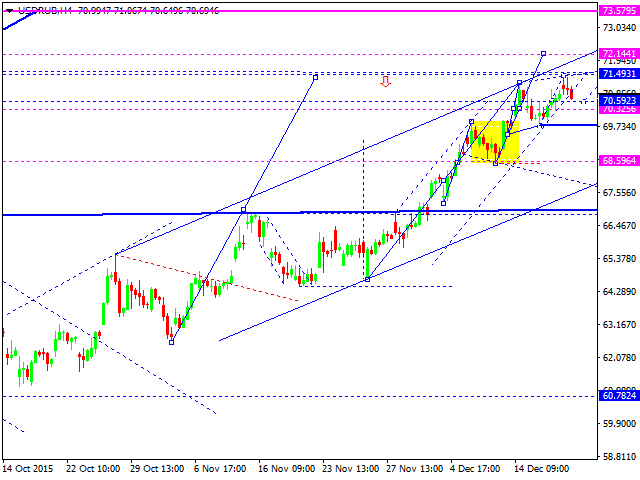

USDRUB, “US Dollar vs Russian Ruble”

Russian Ruble is growing and expected to form another consolidation channel to reach new highs and lows. We think, today, the price may form a reversal pattern. After reaching new highs, the market may start falling at any moment towards 60.

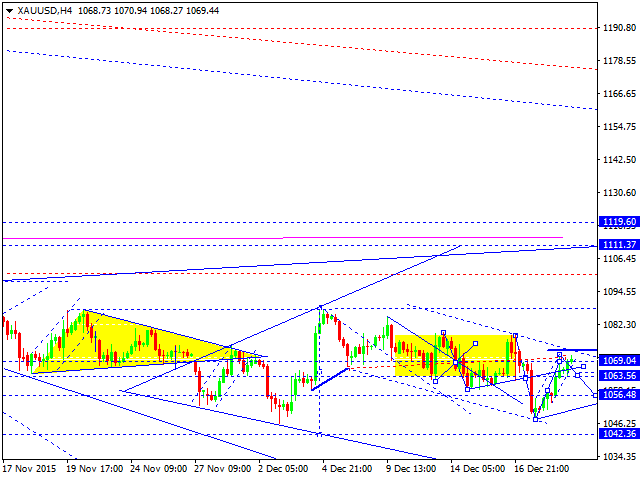

XAUUSD, “Gold vs US Dollar”

Gold has grown and returned to the center of its consolidation range. We think, today, the price may fall towards 1056 and then form another consolidation channel. If the market breaks this consolidation channel downwards, it may continue falling inside the downtrend to reach 1015; if upwards – continue the correction towards 1110.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD remains on the defensive near 1.0680 on Dollar strength

The solid performance of the Greenback keeps the price action in the risk-associated universe depressed so far on turnaround Tuesday, sending EUR/USD to multi-day lows in the 1.0680 region.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar stays resilient against its rivals following the strong wage inflation data and doesn't allow the pair to gain traction.

Gold maintains its bearish note and challenges $2,300

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.