Analysis for December 2nd, 2015

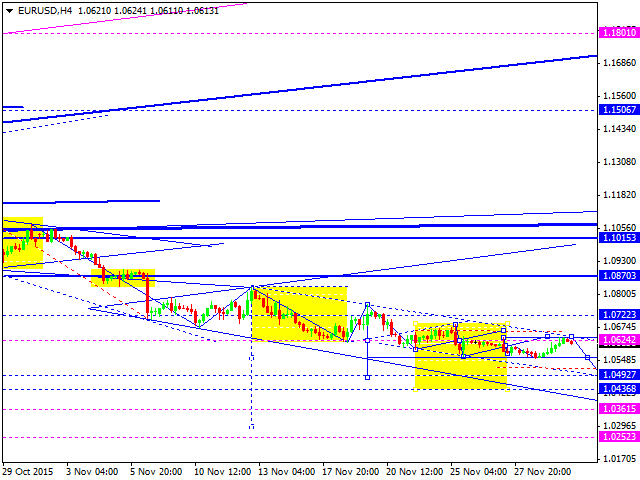

EUR USD, “Euro vs US Dollar”

Eurodollar has almost completed the correction inside its consolidation channel and right now is moving downwards. We think, today, the price may reach new lows at 1.0500. Later, the pair may test 1.0540 and then continue falling inside the downtrend with the target at 1.0300.

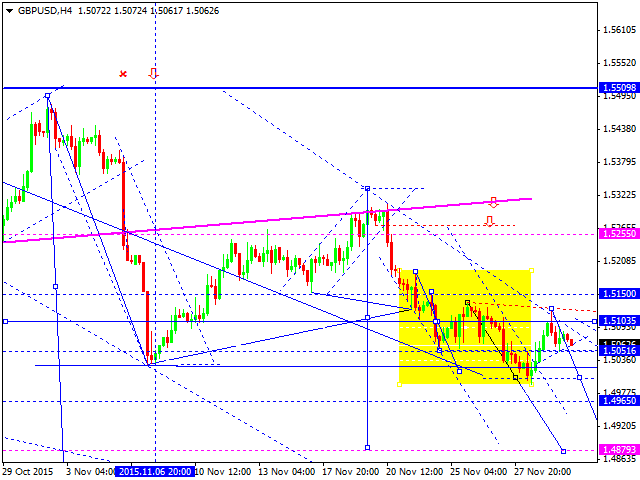

GBP USD, “Great Britain Pound vs US Dollar”

Pound has finished the first ascending impulse and corrected it, thus defining the borders of a new consolidation structure. If later this channel is broken upwards, the market may continue the correction to reach 1.5255; if downwards - continue falling inside the downtrend towards its next target at 1.4880.

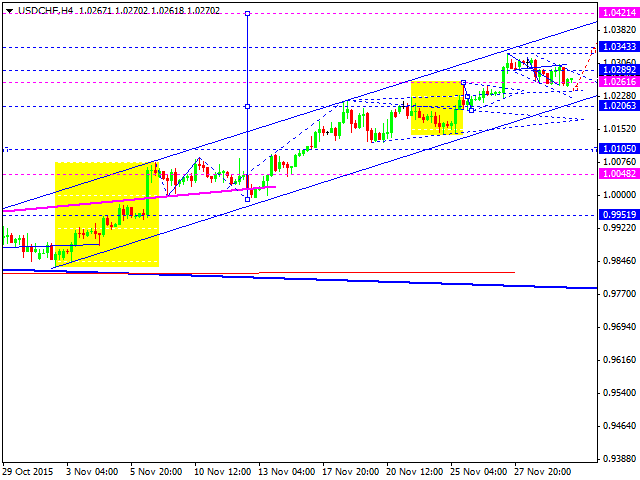

USD CHF, “US Dollar vs Swiss Franc”

Franc has completed its correction and right now is moving upwards. We think, today, the price may break the top, reach 1.0343, and then continue growing inside the uptrend to reach its next target at 1.0400.

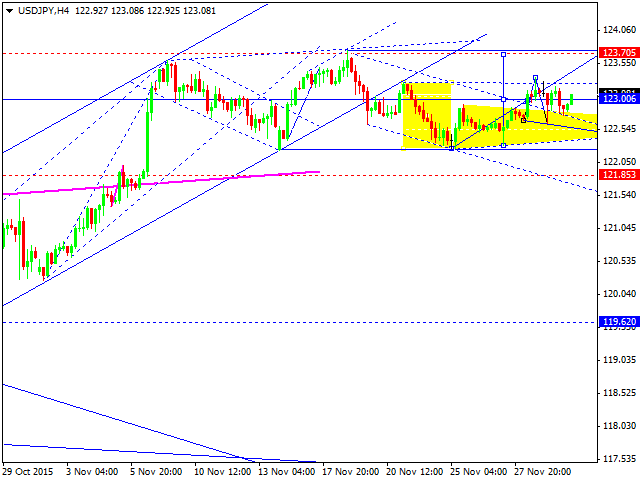

USD JPY, “US Dollar vs Japanese Yen”

Yen is still consolidating around 123.00. We think, today, the price may grow to reach 123.70 and then return to 123.00 to test it from above. After that, the pair may continue growing to reach 124.50.

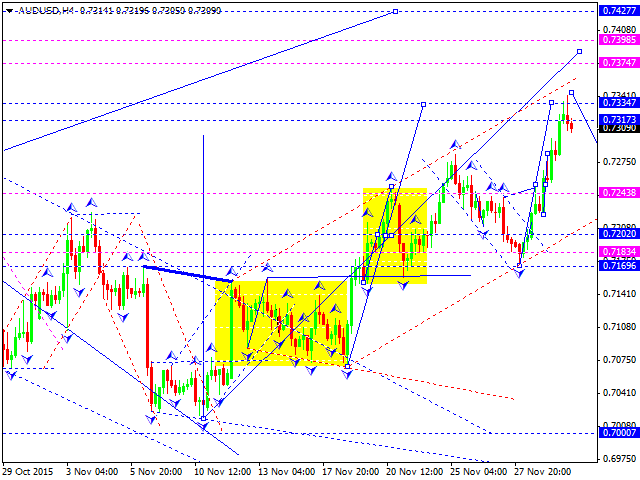

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar has almost reached its upside local target. We think, today, the price may be corrected downwards to reach 0.7200 and then continue growing towards 0.7400.

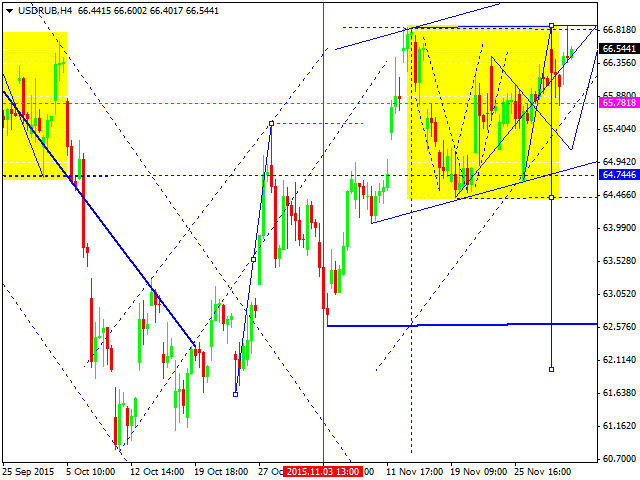

USD RUB, “US Dollar vs Russian Ruble”

Russian Ruble is moving close its top. We think, today, the price may stop consolidating and move towards the lower border to start another descending wave with the target at 60. Alternative scenario implies that the market may reach new highs and then start a new decline.

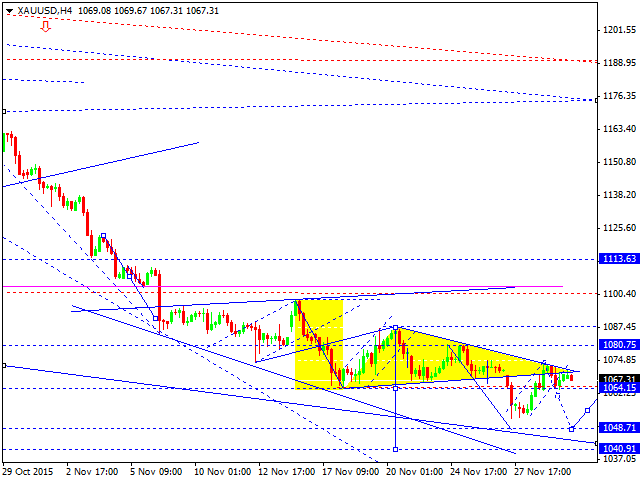

XAU USD, “Gold vs US Dollar”

Gold has almost completed its correction and right now is falling. We think, today, the price may break 1064 and then continue falling inside the downtrend to reach the next target at 1048. After that, the instrument may form another consolidation channel. The main target is at 1015.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD holds steady above 1.0650, awaits US data and Fed verdict

EUR/USD is trading sideways above 1.0650 amid a softer risk tone and broad US Dollar strength on Wednesday. With European markets closed for Labor Day, the pair awaits the US employment data and the Fed policy announcements for the next directional move.

GBP/USD flatlines below 1.2500 ahead of US data, Fed

GBP/USD is off the lows but stays flatlined below 1.2500 early Wednesday. The US Dollar strength caps the pair's upside amid a cautious mood ahead of the top-tier US employment data and the all-important Fed policy announcements.

Gold treads water below $2,300, as Fed decision looms

Gold price is catching a breather below $2,300 on Wednesday, having hit a fresh four-week low at $2,281. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

ADP Employment Change Preview: US private sector expected to add 179K new jobs in April

The ADP report is expected to show the US private sector added 179K jobs in April. A tight labour market and sticky inflation support the Fed’s tight stance. The US Dollar seems to have entered a consolidative phase.