Analysis for May 25th, 2015

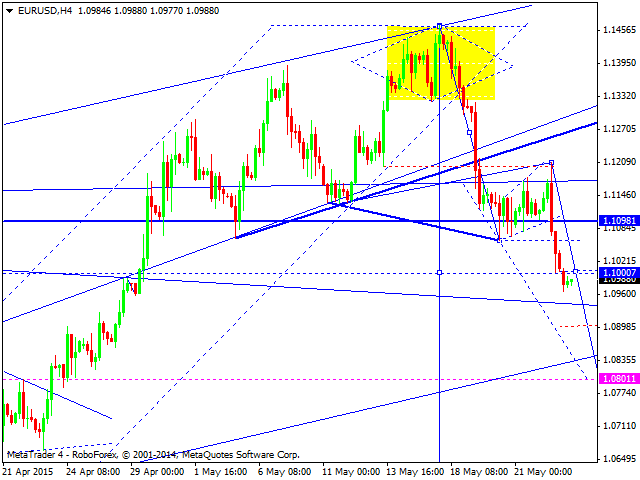

EUR USD, “Euro vs US Dollar”

Eurodollar has broken Friday’s minimum and right now is still consolidating. We think, today, the price may form a downside continuation pattern as the third structure; the target is at level of 1.0800. Later, in our opinion, the market may start a correction to return to level of 1.1000 and then continue falling inside the downtrend towards level of 1.0540.

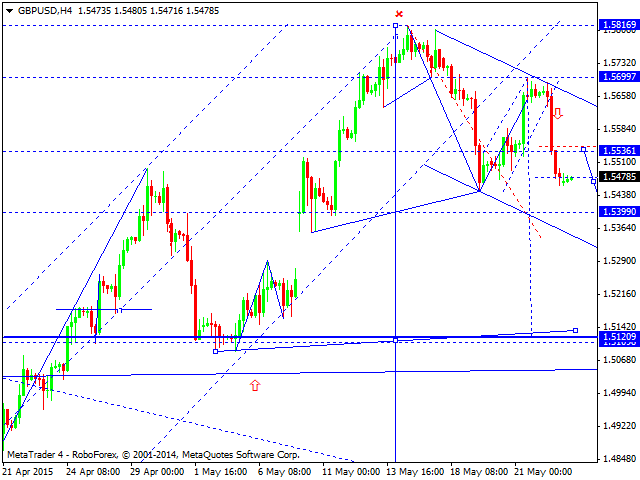

GBP USD, “Great Britain Pound vs US Dollar”

Pound is forming another descending structure to reach level of 1.5399. After reaching this level, the price may form another consolidation channel, break it downwards, and then reach the local target at level of 1.5121.

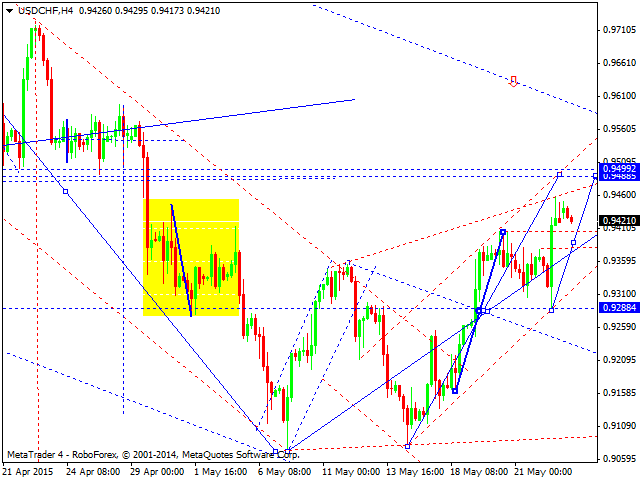

USD CHF, “US Dollar vs Swiss Franc”

Franc continues forming an ascending structure towards level of 0.9490. Later, in our opinion, the market may return to level of 0.9288 and then continue growing towards level of 0.9500.

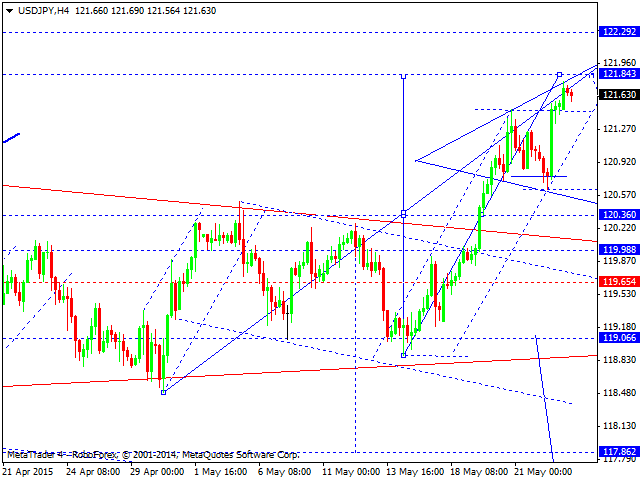

USD JPY, “US Dollar vs Japanese Yen”

Yen has expanded its consolidation channel upwards and may continue moving towards the target at level of 122.30. We think, today, the price may reach level of 121.84. Later, in our opinion, the market may return to level of 120.36 and then continue growing towards the above-mentioned target.

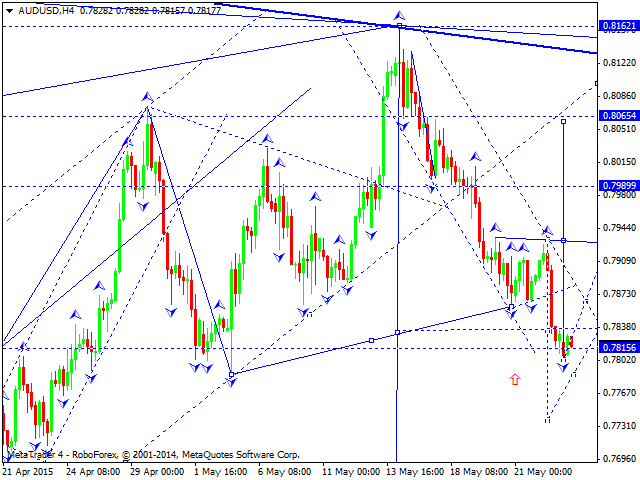

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar has broken the channel and reached its target. We think, today, the price may continue forming an ascending structure to return to level of 0.7990. An alternative scenario implies that the market may form a consolidation channel at the current lows, break it downwards, and then extend this wave towards level of 0.7500.

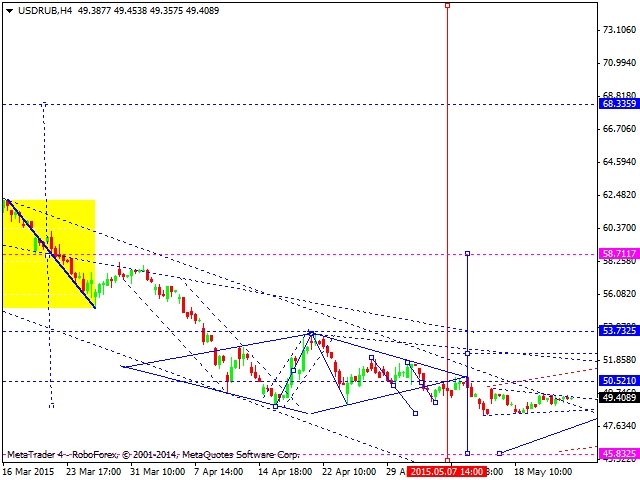

USD RUB, “US Dollar vs Russian Ruble”

Ruble has broken its descending channel and may continue forming an ascending correction. The target of this correction is at level of 58.50. however, so far the pair is consolidating near level of 50.00 without any particular direction. The regulator is assumed to take measures to avoid market fluctuations.

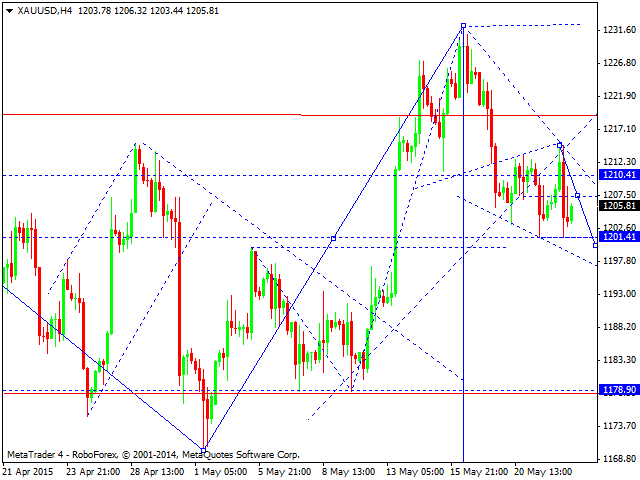

XAU USD, “Gold vs US Dollar”

Gold is still consolidating. If the price breaks the channel downwards, it may continue falling inside the downtrend towards level of 1178; if upwards (an alternative scenario) – grow towards level of 1210.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.