Analysis for April 24th, 2015

EUR USD, “Euro vs US Dollar”

Eurodollar has completed another five‐wave ascending structure; the whole structure may be considered as a correction. We think, today the price may form a reversal pattern at current highs. Later, in our opinion, the market may form another descending structure to reach level of 1.0500.

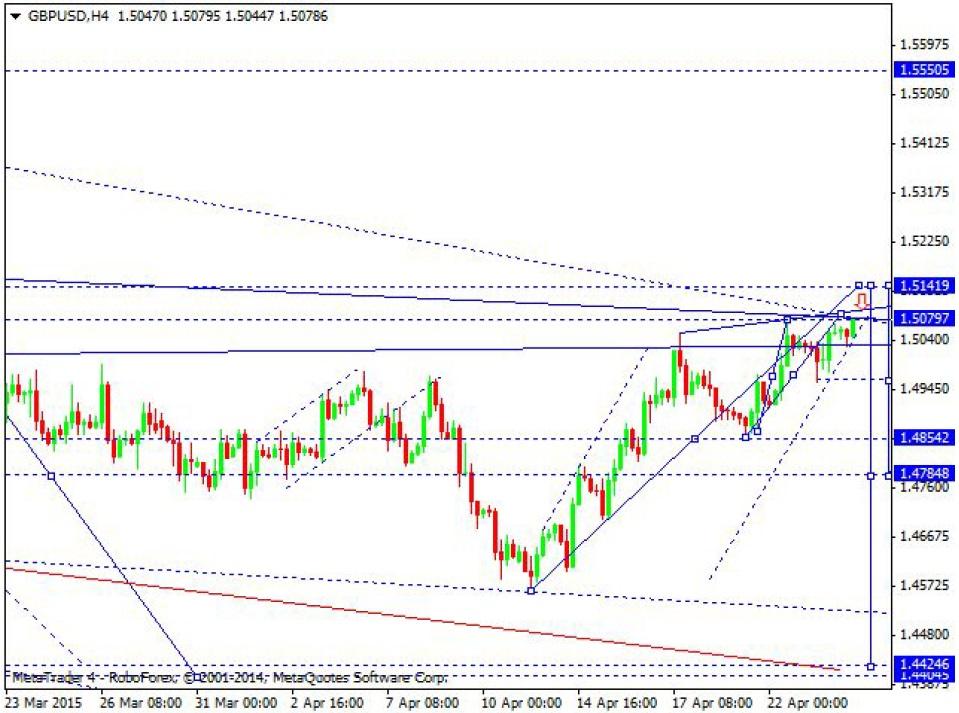

GBP USD, “Great Britain Pound vs US Dollar”

Pound has formed another ascending structure; the whole structure may be considered as a correction. We think, today the price may start forming a reversal pattern to start falling towards level of 1.4400.

USD CHF, “US Dollar vs Swiss Franc”

Franc is forming a consolidation channel inside a descending impulse. We think, today the price may grow to reach level of 0.9760 and then form a correction towards level of 0.9600. Later, in our opinion, the price may move upwards to reach level of 0.9930.

USD JPY, “US Dollar vs Japanese Yen”

Yen is still consolidating; the pair has corrected another ascending structure. We think, today the price may break this consolidation channel. If upwards – the market may reach level of 121.00; if downwards – reach level of 117.40.

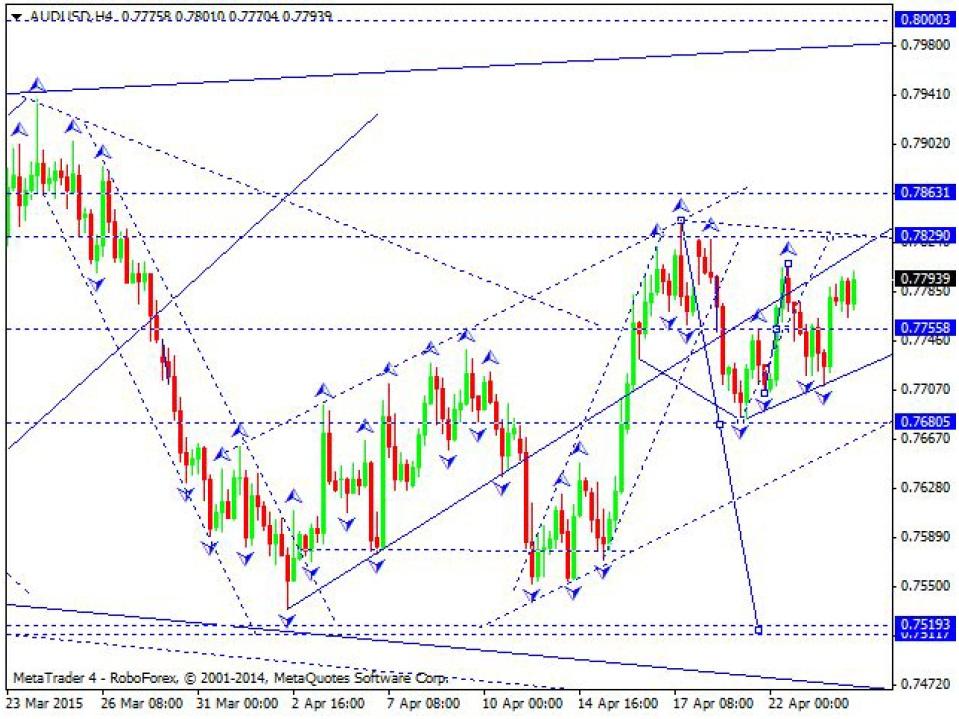

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is forming another ascending structure towards level of 0.7830. After that, the pair may form a reversal pattern for a new descending movement. The main target is to reach new lows and level of 0.7510.

USD RUB, “US Dollar vs Russian Ruble”

Ruble continues falling. We think, today the price may reach level of 46.00. After that, the market may form another consolidation channel and break it downwards to reach level of 44.00. Possibly, this structure may be extended towards level of 40.00.

XAU USD, “Gold vs US Dollar”

Gold is still forming a consolidation channel. We think, today the price may reach level of 1198. Later, in our opinion, the market may continue falling to break the minimum and expand this channel downwards. The first downside target is at level of 1168.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD stays slightly above 1.0700 after mixed US data

EUR/USD lost its traction and turned negative on the day but managed to hold above 1.0700. Although the upbeat Employment Cost Index data boosted the USD earlier in the day, the weak consumer sentiment reading limits the currency's gains.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar stays resilient against its rivals following the strong wage inflation data and doesn't allow the pair to gain traction.

Gold extends daily slide toward $2,300 as US yields edge higher

Gold stays under bearish pressure and declines toward $2,300 on Tuesday. The benchmark 10-year US Treasury bond yield stays in positive territory above 4.6% after US Employment Cost Index data, weighing on XAU/USD.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.