Analysis for April 17th, 2015

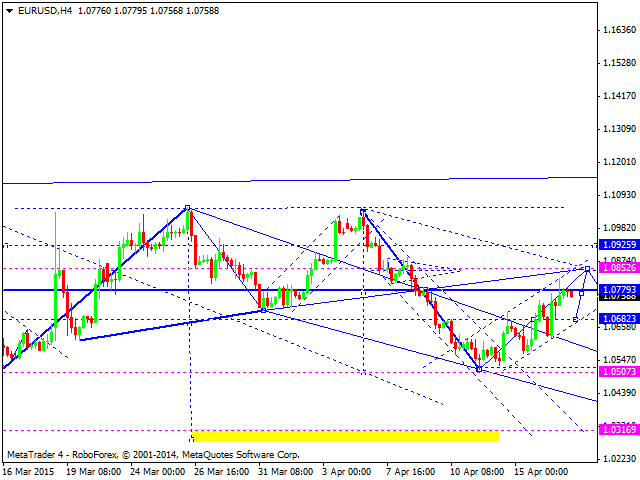

EURUSD, “Euro vs US Dollar”

Eurodollar is still moving inside an ascending structure, which may be considered as a correctional one. We think, today the price may fall to reach level of 1.0507. An alternative scenario implies that the pair may make another ascending movement to reach level of 1.0852 and then start falling towards new lows.

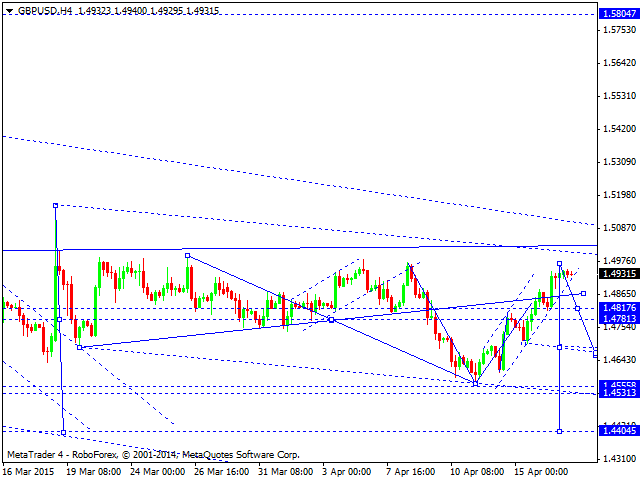

GBPUSD, “Great Britain Pound vs US Dollar”

Pound continues growing. We think, today the price may fall and form a reversal pattern to reach the main target at level of 1.4400.

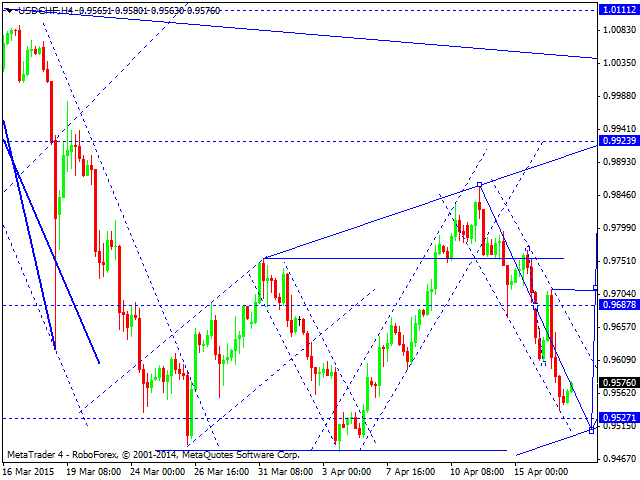

USDCHF, “US Dollar vs Swiss Franc”

Franc is still falling. We think, today, the price may reach level of 0.9527 and then start forming another ascending wave to reach level of 0.9930.

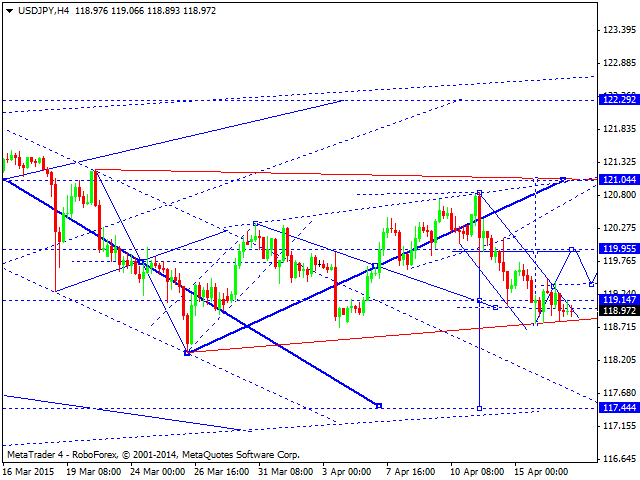

USDJPY, “US Dollar vs Japanese Yen”

Yen continues falling; the pair is forming a consolidation channel near the lows. If later the market breaks the channel upwards, it may form an ascending wave with the target at level of 121.00; if downwards – extend this descending structure towards level of 117.40.

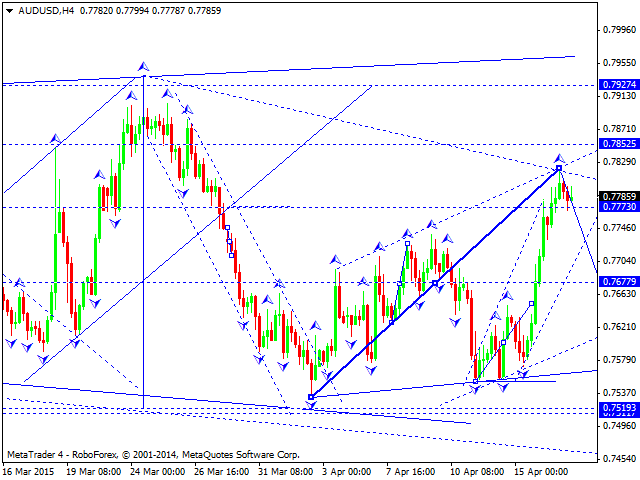

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar is still growing. We think, today the price may move upwards to reach level of 0.7852 and then complete this descending wave by forming another descending structure with the target at level of 0.7510. After that, the market is expected to start a serious correction.

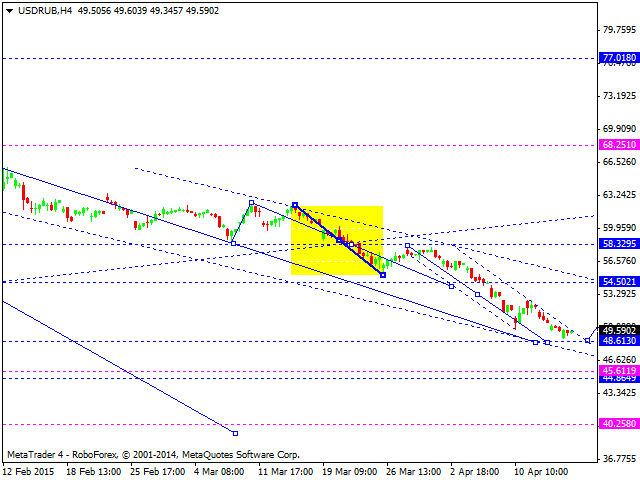

USDRUB, “US Dollar vs Russian Ruble”

Ruble is still moving downwards. We think, today the price may reach level of 48.50 and then start a technical correction. After that, the market may resume falling to reach the target at level of 44.00.

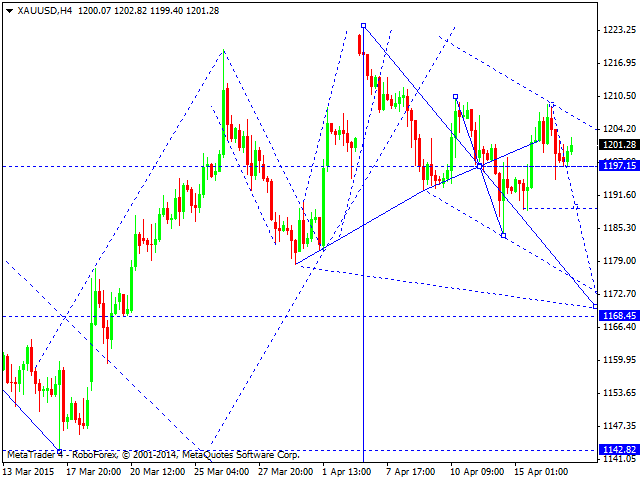

XAUUSD, “Gold vs US Dollar”

Gold is still forming a consolidation channel. If the market breaks it downwards, it may continue falling towards level of 1168. Later, in our opinion, the market may return to level of 1197 to test it from below and then continue falling to reach level of 1113.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

Fed’s Powell said further conviction that inflation is returning to the target is needed before start cutting rates – LIVE

Chair Powell reiterated that the Fed's policy rate remains restrictive, although further confidence that inflation is retreating towards the bank's target is needed before deciding on reducing rates.

EUR/USD extends gains above 1.0700 on Powell’s presser

The selling bias in the Greenback gathers extra pace as Powell’s press conference is under way, lifting EUR/USD to daily tops past the 1.0700 hurdle.

GBP/USD rises above 1.2500 on weaker Dollar

The resumption of the upward pressure sends GBP/USD back above 1.2500 the figure in response to increasing selling pressure hurting the Greenback.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.