Analysis for July 31st, 2014

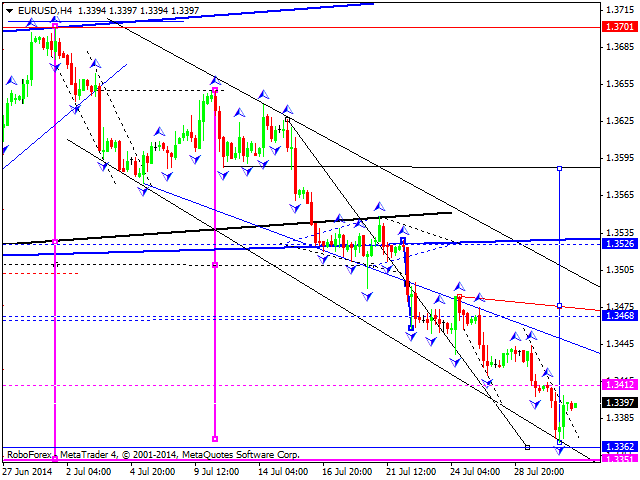

EURUSD, “Euro vs US Dollar”

Euro has started its ascending movement under the influence of recent news. Basic scenario is that price may start moving towards level of 1.3590 with the first target at level of 1.3400. Alternative scenario is that price may reach new minimums and only after reaching new minimums start ascending movement.

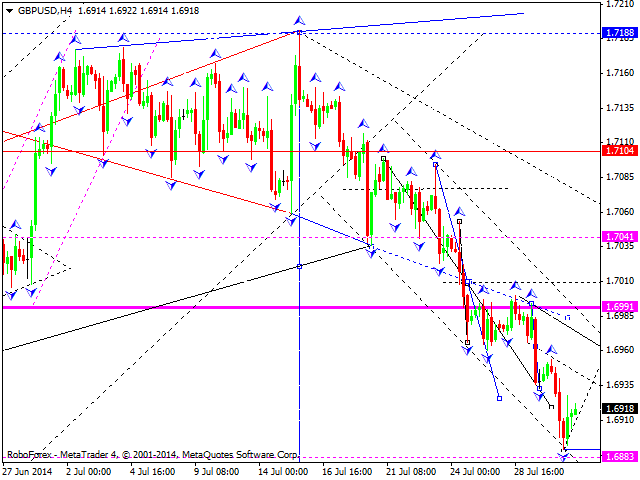

GBPUSD, “Great Britain Pound vs US Dollar”

Pound has started its ascending movement under the influence of recent news. Basic scenario is that price may reach its previous level of 1.7040. Alternative scenario, in our opinion, is that price may reach new minimums and only after reaching new minimums start ascending movement.

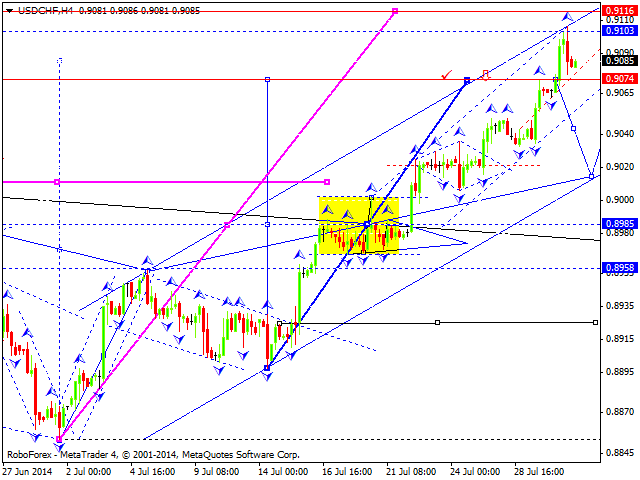

USDCHF, “US Dollar vs Swiss Franc”

Franc has started its descending movement under the influence of recent news. Basic scenario is that price may reach level of 0.8960. Alternative scenario is that price may reach new maximums and only after reaching new maximums start descending movement.

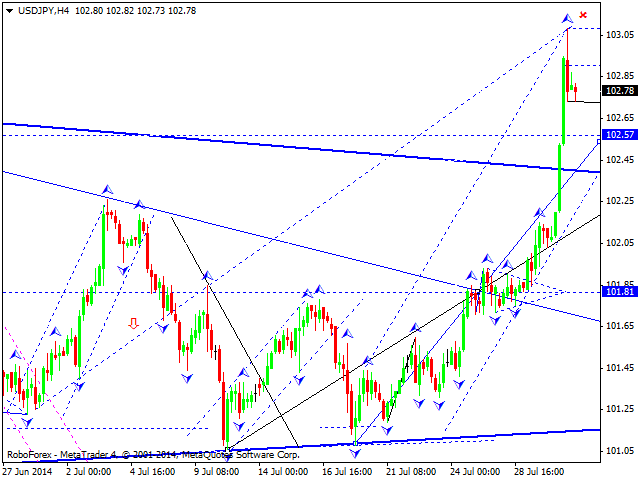

USDJPY, “US Dollar vs Japanese Yen”

Yen has reached local and strategic targets due to the ascending wave extension. Wave has three element structure and is considered by us as correction. Basic scenario, in our opinion, is that price may form new descending wave towards level of 101.70, break this level, and continue its descending movement towards level of 100.50.

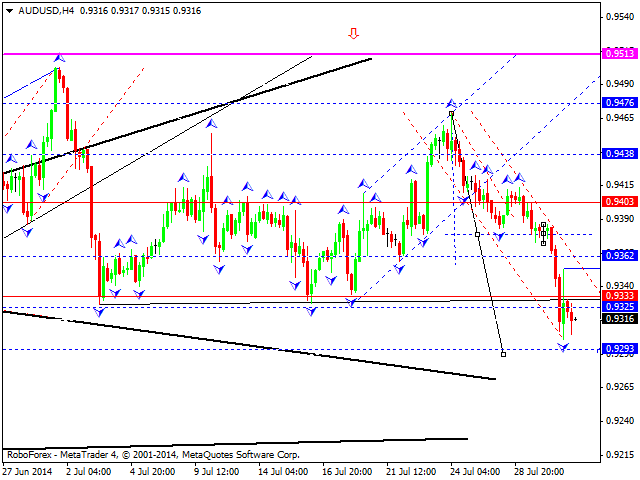

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar has extended descending channel and reached the target of correction descending movement. Today, price may form ascending wave towards level of 0.9510. As an alternative scenario, price may reach new minimums and only after reaching new minimums start ascending movement.

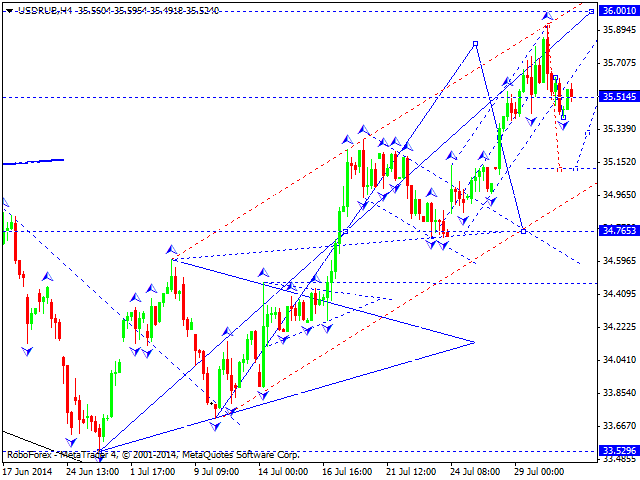

USDRUB, “US Dollar vs Russian Ruble”

Ruble is forming descending wave towards level of 34.80. Descending movement may signal new correction. Then, we expect one more ascending structure towards level of 36.00 that may complete ascending wave. In our opinion, the next structure is the descending structure with price moving towards level of 33.20.

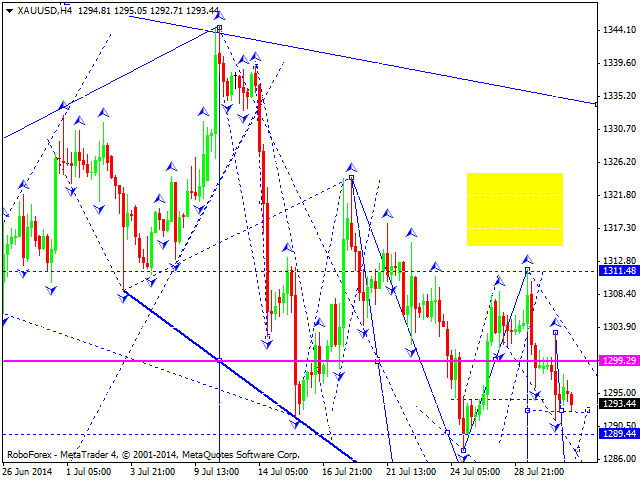

XAUUSD, “Gold vs US Dollar”

Gold continues its descending movement. We expect consolidation with breakout to the downside. The target is level of 1275.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 following the mixed macroeconomic data releases from the US. Private sector rose more than expected in April, while the ISM Manufacturing PMI fell below 50. Fed will announce monetary policy decisions next.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar stays resilient against its rivals despite mixed data releases and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold rebounds above $2,300 after US data, eyes on Fed policy decision

Gold gained traction and recovered above $2,300 in the American session on Wednesday. The benchmark 10-year US Treasury bond yield turned negative on the day after US data, helping XAU/USD push higher ahead of Fed policy announcements.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

US Federal Reserve Decision Preview: Markets look for clues about interest rate cut timing

The Federal Reserve is widely anticipated to keep interest rates unchanged. Fed Chairman Powell’s remarks could provide important clues about the timing of the policy pivot.