Yesterday the data on growing February CPI were released in the US. In theory, it points to increased likelihood of interest rate hike, so the dollar stopped falling. However we do not rule out the downtrend and would like to draw your attention to the USD/CAD currency pair. Canadian GDP (YoY) in the forth quarter rose 2.4 as core CPI increased 0.6%. US Gross Domestic Product (Q4) will be released on Friday, analysts forecast 2.4% growth. According to yesterday's report, American CPI added 0.2% in February which is that that much, compared to Canada. Taking into account interest rates (0.25% in the US and 0.75% in Canada) we assume that the Canadian dollar may strengthen. To be mentioned, no important macroeconomic releases are expected in Canada. We believe that USD/CAD dynamics will determined by the news from the US.

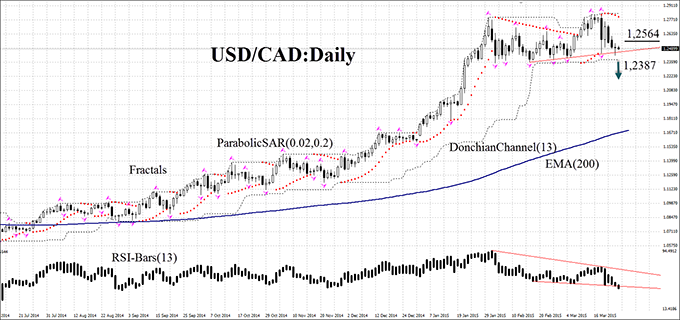

USD/CAD has been traded in a range for 2 months on the D1 chart. Now it has moved to its lower boundary, traced by support line together with Parabolic and Donchian Channel. RSI bars indicates the bearish divergence: it is located below 50. USD/CAD deviated upward from the moving average. We do not rule out further bearish momentum if Doncian support and fractal low are breached at 1.2387: a sell pending order may be placed here. Stop loss may be placed below the average line between Donchian Channel and the local fractal low, which currently acts as support line - 1.2564. After pending order placing, Stop loss is to be moved every four hours near the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets Stop loss level without reaching the order, we recommend cancelling the position: market sustains internal changes which were not considered.

- Position Sell

- Sell stop below 1,2387

- Stop loss above 1,2564

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.