Good afternoon, dear traders. Today at 14:30 CET we expect the release of Building Permits m/m, Canada. The indicator is published on a monthly basis, and represents the core interest for long-term institutional investors. The index is based on data of the number of permits for new construction issued by the Government of Canada last month. The fundamental indicator provides a potential growth assessment of the real estate sector, and consequently, estimates changes in consumption of after-market demand goods and commodities of the technology sector. Positive trends in construction sector can provide an additional momentum for both domestic consumption and manufacturing. We expect the index could have a significant impact on the on USD/CAD rates.

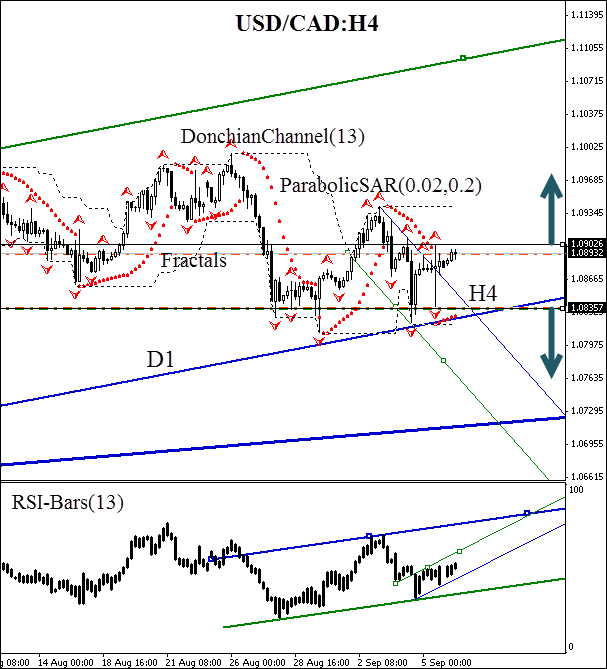

Here we consider the USD/CAD behavior on the H4 chart. The price is moving within the daily uptrend, and has crossed the H4 bearish trend line directed to the green zone. This model is the first sign of the trend reversal, especially as ParabolicSAR confirms the direction. There is no contradiction on the part of the RSI-Bars oscillator: a narrow uptrend channel has been formed. We expect the H4 trend development together with the fractal resistance breach at 1.09026. This key mark is confirmed by Parabolic historical values and can be used to open a pending buy order. Risks are limited by the fractal support at 1.08357, which is located at the daily trend line intersection.

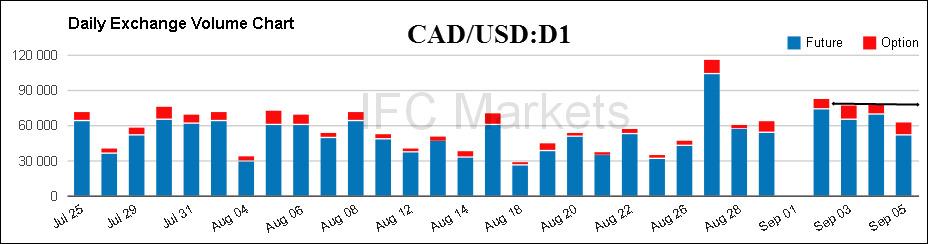

Little probable, but possible the trend to be changed radically, only in case the Building Permits indicator outperforms significantly the expected values. In this case an opposite order can be opened in a symmetrical way, at the daily trend line intersection. Note that the trading volume of Canadian dollar has not increased: for confirmation of a large-scale daily trend you should wait for the level breach of 80 000 contracts. You can monitor the volumes of USD/CAD futures and options traded on the Chicago Mercantile Exchange by clicking here.

After position opening, Trailing Stop is to be moved after the ParabolicSAR values, near the next fractal trough (long position), or peak (short position). Updating is enough to be done every day after the formation of 5 new H4 candlesticks, needed for updating the Bill Williams fractal. Thus, we are changing the probable profit/loss ratio to the breakeven point.

Dear traders. You can see the detailed report of the author’s account by clicking here. The opened position of the author is indicated with the dotted lines on the chart.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.