Hello, dear traders. Today we are going to look into the US dollar against the Canadian dollar chart pattern. Deep corrective move from support at 1.0620 eventually drew a resistance line at 1.0985 which is a more than 2–month high and extended in sideways trading. The falling trend line as we can see has been long before breached signifying the bullish weakness. Currently the Simple Moving Averages are below prices providing an extra support and together with the rising trend line suggest that upside bias is strong.

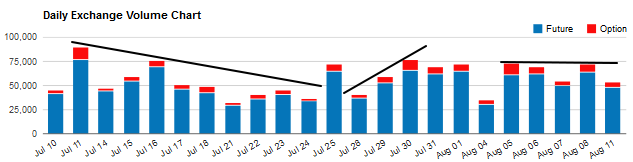

Furthermore, at the below chart we can see the daily volumes of futures and options traded on the Chicago Mercantile Exchange. We can see that during the recent trading sessions with the currency pair being in range the volume of trading is mostly steady. The latter indicates that the bulls and bears are of equal power at the time being. It is likely that the range could develop to a “flag” trading pattern which is a continuation pattern in technical terms.

Looking at the oscillators, the Stochastic has retraced from the overbought zone and that provides the chance to prices to continue their upward path. The MACD is in positive ground and the OsMA is gradually falling suggesting weakness. In our opinion, chances are slightly favoring the continuation of previous upside structure. However, that should be confirmed by a valid breach of the upper boundary at 1.0985. A break of that level coupled by a high volume of trading is considered valid. Alternatively, should the USDCAD prices penetrate the lower boundary at 1.0903 that could indicate reversal of the rising development and chances would favor downside trajectory.

_20140812135050.png)

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.