Analysis for March 21st, 2016

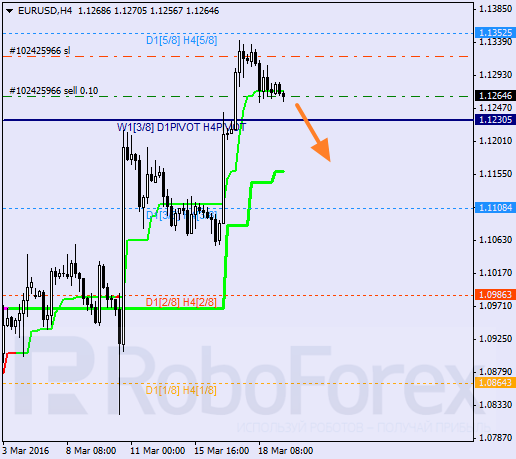

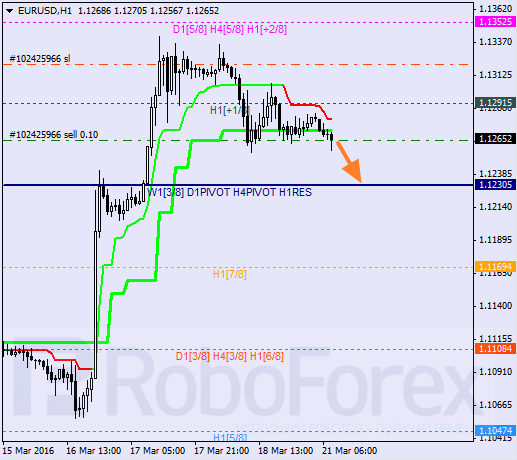

EURUSD, “Euro vs US Dollar”

Eurodollar is consolidating near the H4 Super Trend. Earlier, after rebounding from the 4/8 level, the pair wasn’t able to reach the 5/8 one. If later the price breaks the 4/8 level and stays under it, the pair may resume its decline with the first target at the daily Super Trend.

At the H1 chart, Eurodollar is moving inside “overbought zone” and trying to say under Super Trends. Possibly, the pair may test the 8/8 level during the day. If the price breaks this level and stays below it, the market will fall towards the 7/8 one.

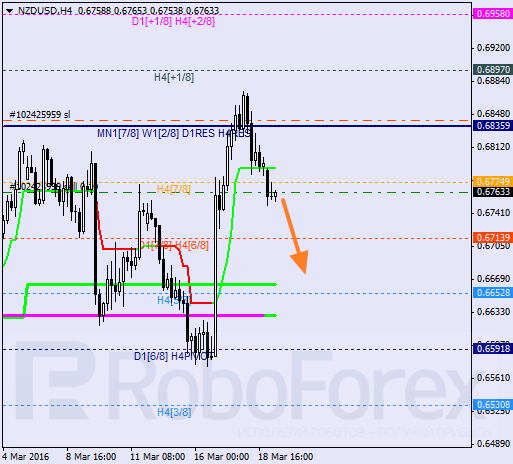

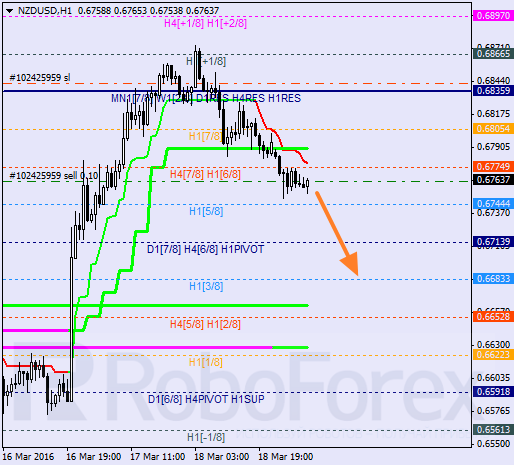

NZDUSD, “New Zealand Dollar vs US Dollar”

New Zealand Dollar has been able to stay above the 8/8 level and right now is moving under the 7/8 one and the H4 Super Trend. It’s highly likely that in the nearest future the market may move towards the daily Super Trend. If the pair beaks it, bears will return to the market.

At the H1 chart, Super Trends have formed “bearish cross”. Earlier, the pair rebounded from the +1/8 level. On Monday, after finishing the local correction, the pair may fall towards the 3/8 level.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.