Murray levels analysis on 29 February 2016

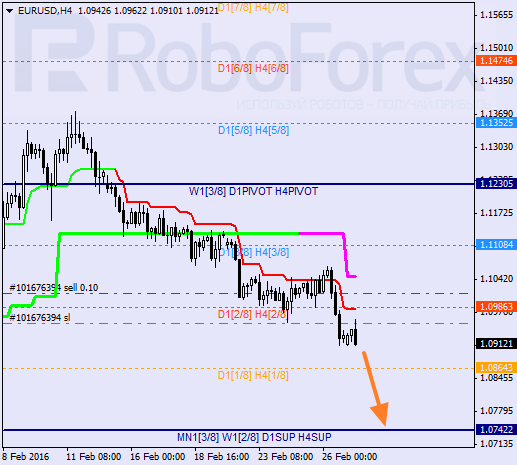

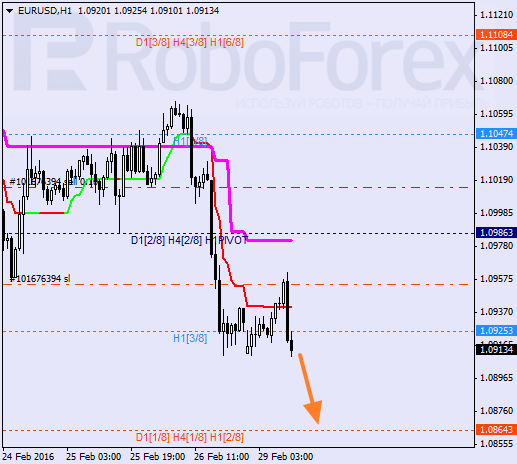

EUR USD "Euro to US dollar"

The Eurodollar continued to decline. Earlier the SuperTrend lines formed a "bearish cross". In the short term a further decrease in quotations towards the 0/8 mark is likely. However, if the price constitutes a retreat from the 1/8 level, a beginning of an upward correction will be possible.

The price was unable to gain a foothold above the SuperTrend lines, and is trading below the indicator line again. In the short term a fall to around 2/8 is likely, a retreat from which would be the signal to a local ascending correction.

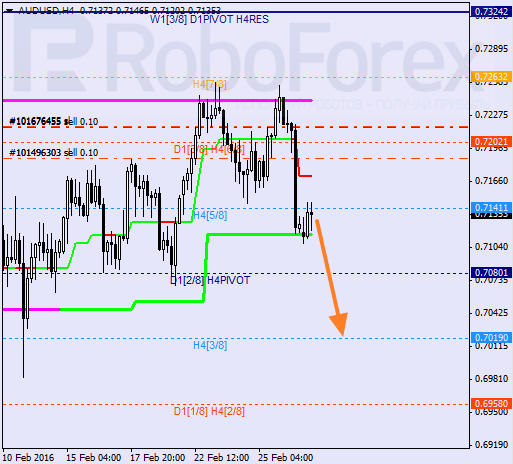

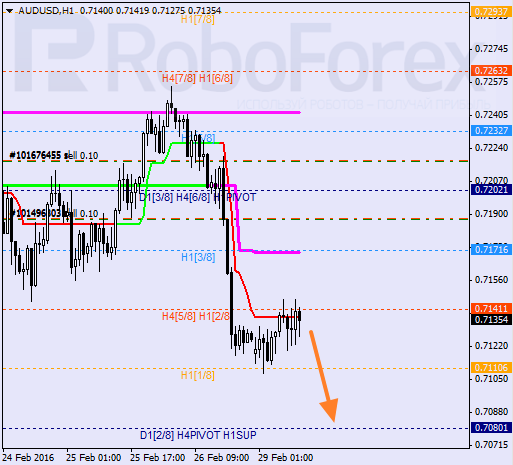

AUD USD "Австралийский доллар к доллару США"

After a series of rebounds from the week long SuperTrend, the Aussie is trying to resume its decline. After a local correction, further fall in prices is possible. The immediate goal for bears is the 3/8 mark.

On the hourly chart the price is trading in the lower part of the building of levels. Earlier, the SuperTrend lines formed a "bearish cross". During Monday a resumption of decline towards the 0/8 mark is likely.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades slightly near 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range below $2,320

After retreating to the $2,310 area early Wednesday, Gold regained its traction and rose toward $2,320. Hawkish tone of Fed policymakers help the US Treasury bond yields edge higher and make it difficult for XAU/USD to gather bullish momentum.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.