Analysis for January 13th, 2016

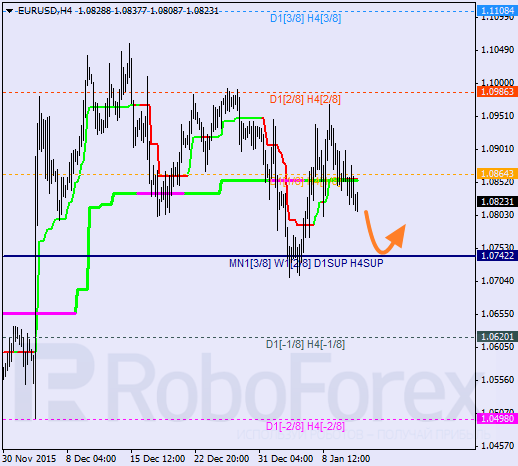

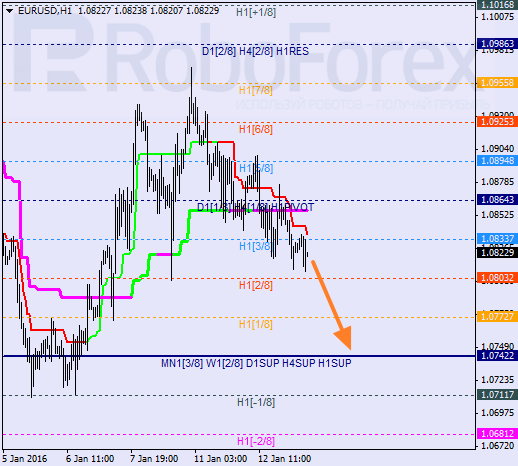

EUR USD, “Euro vs US Dollar”

Eurodollar has been able to stay under Super Trends, which means that it may start a new correction. The closest target is at the 0/8 level. If the pair rebounds from it, the market may resume its ascending movement.

As we can see at the H1 chart, Eurodollar has been able to stay under the 3/8 level, which means that it may continue falling. Moreover, Super Trends have formed “bearish cross”. On Wednesday, the market may fall towards the 0/8 level.

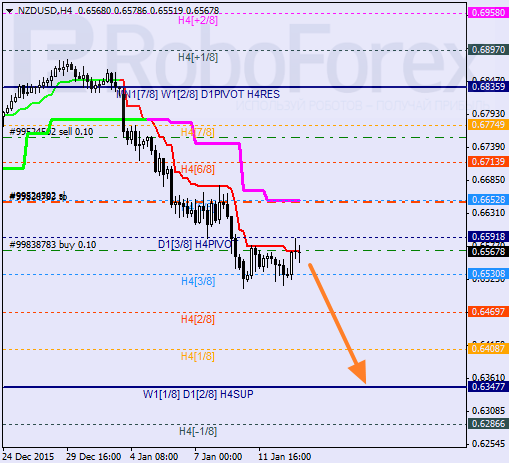

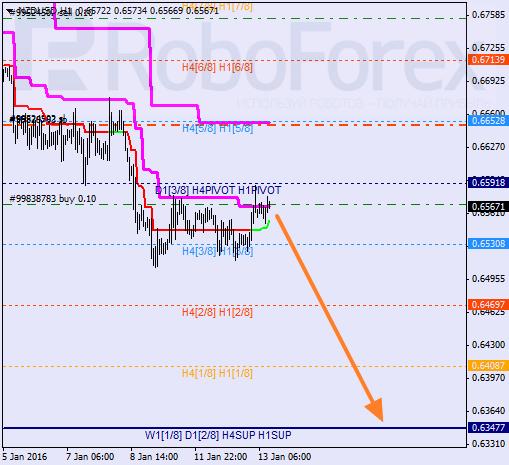

NZD USD, “New Zealand Dollar vs US Dollar”

At the H4 chart, New Zealand Dollar is moving in the middle. The current decline is supported by Super Trends. If later the price is able to stay below the 3/8 level, it may continue falling towards the 0/8 one.

The lines at the H4 and H1 charts are completely the same. I’m planning to open another sell order as soon as the pair breaks Super Trends downwards. When the price breaks the minimum, I’ll move stop losses on my sell orders to the local high.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD holds steadily as traders anticipate Australian Retail Sales, Fed’s decision

The Aussie Dollar registered solid gains against the US Dollar on Monday, edged up by 0.55% on an improvement in risk appetite, while the Greenback was crushed by Japanese authorities' intervention. As Tuesday’s Asian session begins, the AUD/USD trades at 0.6564.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

Will Bitcoin ignore major macro market developments this week?

Bitcoin price will be an interesting watch this week, with increased volatility expected amid crucial events lined up in the macro market. On Tuesday, Hong Kong will be debuting its BTC and ETH ETFs while the next day will see FOMC minutes make headlines.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.