Analysis for October 22nd, 2015

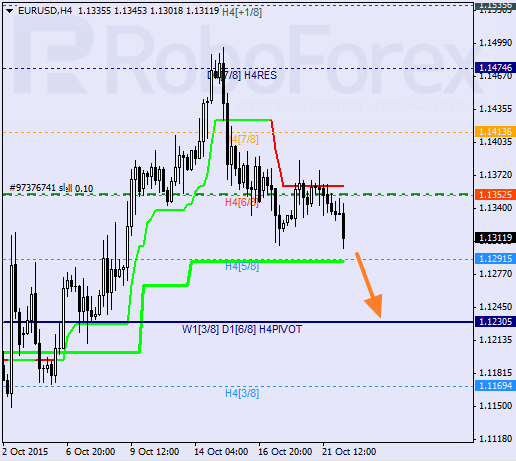

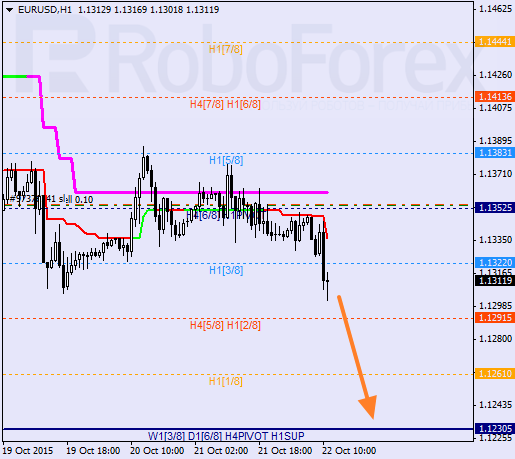

EURUSD, “Euro vs US Dollar”

Eurodollar has reached a new local low, but the pair is still moving between Super Trends. If later the price is able to break the 5/8 level, the market will continue falling towards the 4/8 one.

At the H1 chart, the pair has broken the 3/8 level and right now is trying to stay below it. If the price succeeds, the pair will continue falling towards the 0/8 level. I’m planning to open another sell order during the correction.

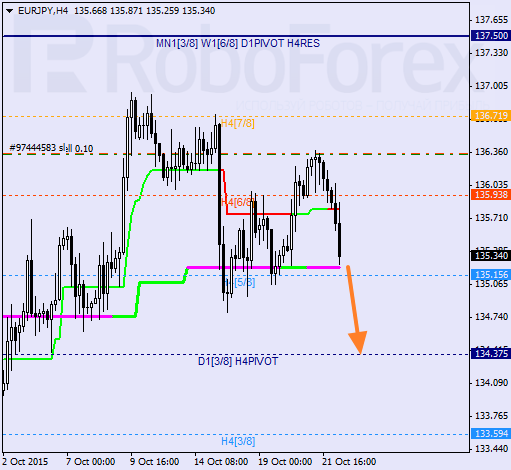

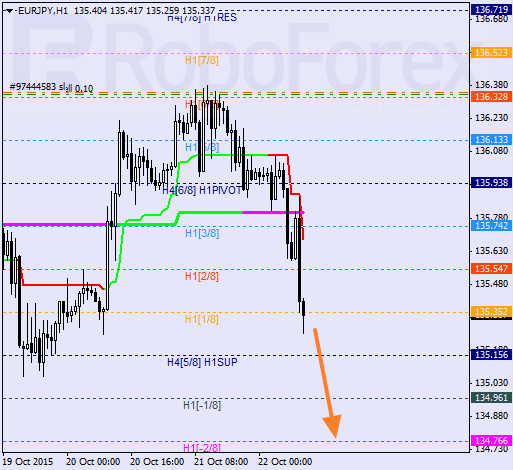

EURJPY, “Euro vs Japanese Yen”

After rebounding from the 7/8 level several times, the pair has started falling. It’s highly likely that in the nearest future the price may break the daily Super Trend. The closest target is at the 4/8 level: if the market breaks it, the pair will continue falling much deeper.

As we can see at the H1 chart, Super Trends have formed “bearish cross”. Possibly, quite soon the pair may break the 0/8 level and continue falling inside “oversold zone”. If the market breaks the -2/8 level, the lines at the chart will be redrawn.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD stays depressed near 1.0650, awaits US data and Fed verdict

EUR/USD holds lower ground near 1.0650 amid a softer risk tone and broad US Dollar strength on Wednesday. With European markets closed for Labor Day, the pair awaits the US employment data and the Fed policy announcements for the next directional move.

GBP/USD keeps losses below 1.2500 ahead of US data, Fed

GBP/USD holds lower ground below 1.2500 early Wednesday. The stronger US Dollar supports the downtick of the pair amid the cautious mood ahead of the top-tier US employment data and the all-important Fed policy announcements.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

ADP Employment Change Preview: US private sector expected to add 179K new jobs in April

The ADP report is expected to show the US private sector added 179K jobs in April. A tight labour market and sticky inflation support the Fed’s tight stance. The US Dollar seems to have entered a consolidative phase.