Analysis for February 23rd, 2015

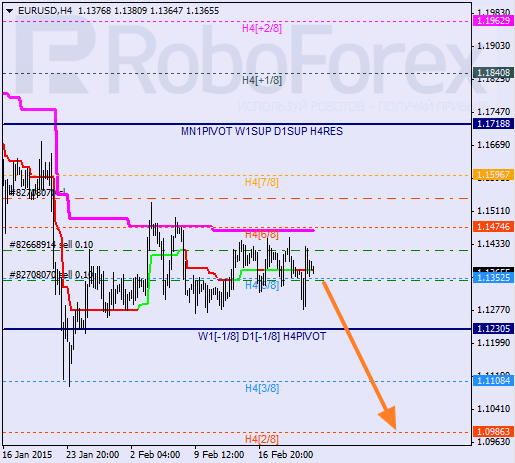

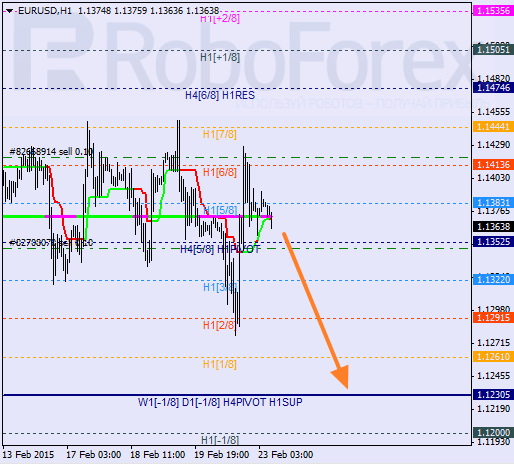

EURUSD, “Euro vs US Dollar”

Euro is still being corrected below the H4 Super Trend. The lines at the chart have been redrawn and right now the closest target is at the 2/8 level. If the market breaks it, it may continue falling and reach the 0/8 one. I’m planning to move my stop losses after the market.

As we can see at the H1 chart, the market has rebounded from the 7/8 level three times, which means that it may resume falling. Earlier, Super Trends formed “bearish cross”. I’m planning to increase my short position as soon as the pair is able to stay below the 3/8 level.

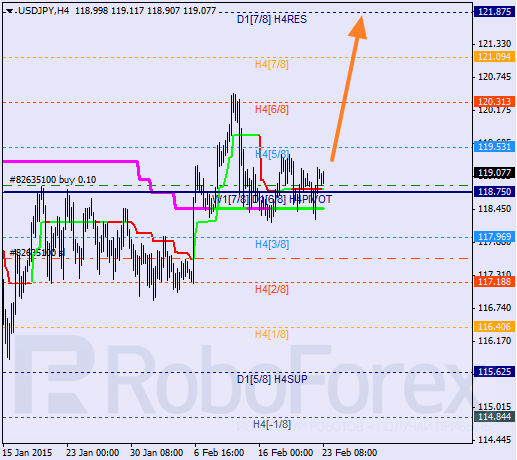

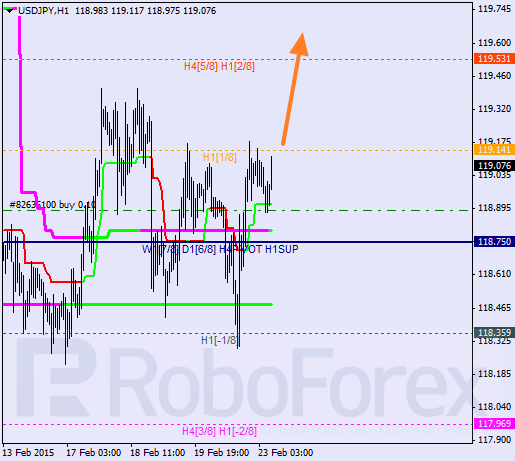

USDJPY, “US Dollar vs Japanese Yen”

The pair is still being corrected; Super Trends are still influenced by “bullish cross”. As soon as the market is able to stay above the 5/8 level, the pair may continue growing towards the 8/8 one.

Some targets at the H4 and H1 charts are completely the same. It looks like the pair is going to break the 2/8 level in the nearest future and continue growing towards the 4/8 one. I’m planning to move the stop losses on my buy order after the market.

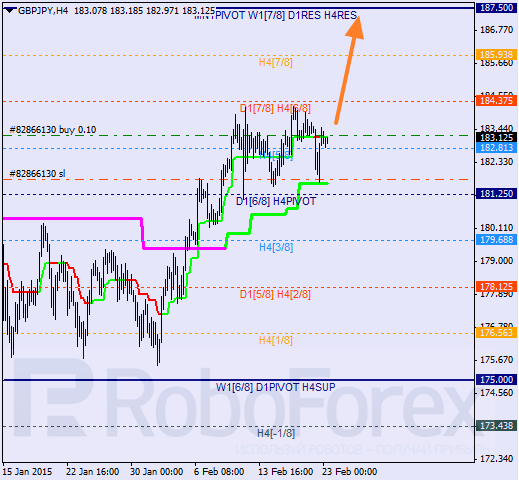

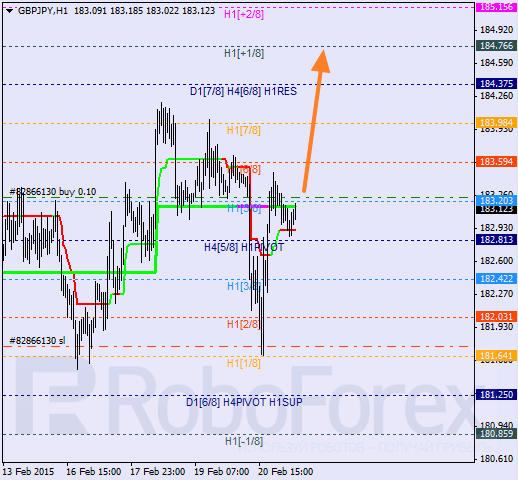

GBPJPY, “Great Britain Pound vs Japanese Yen”

The main trend is still bullish. If the pair is able to stay above the 5/8 level, it may continue growing to reach the 8/8 one and then start a more serious correction.

The price is moving in the middle of the H1 chart. If the market is supported by Super Trends and later is able to stay above the 5/8 level, it may continue growing towards the 8/8 one.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700 as USD struggles ahead of data

EUR/USD is posting small gains above 1.0700 in the European session on Thursday. The pair remains underpinned by a sustained US Dollar weakness, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD stays firm above 1.2500 amid US Dollar weakness

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair's uptick is supported by a broadly weakness US Dollar on dovish Fed signals. A mixed market mood could cap the GBP/USD upside ahead of mid-tier US data.

Gold price trades with modest losses amid positive risk tone, downside seems limited

Gold price edges lower amid an uptick in the US bond yields, though the downside seems cushioned. A positive risk tone is seen as another factor undermining demand for the safe-haven precious metal.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.