Analysis for November 26th, 2014

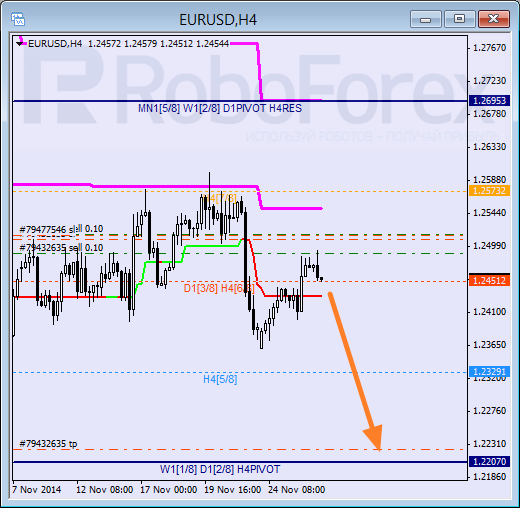

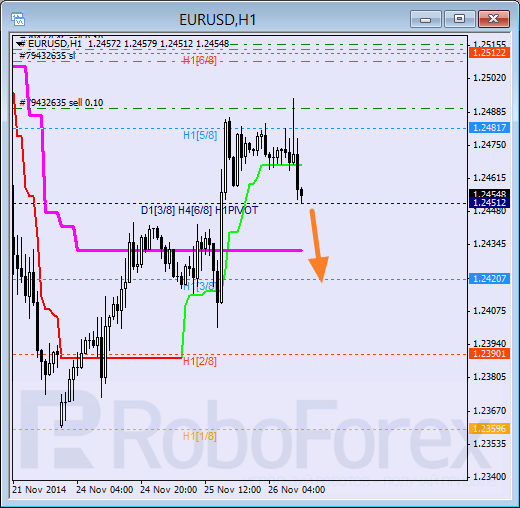

EUR USD, “Euro vs US Dollar”

After rebounding from the daily Super Trend several times and staying below it, Eurodollar attempted to resume growing, but moved downwards a little bit and started another correction. If the price is able to stay below the H4 Super Trend, the market will continue falling. The closest target is at the 4/8 level. After reaching it, the market may start a more serious pullback.

As we can see at the H1 chart, Super Trends have formed “bullish cross”. However, the pair has rebounded from the 5/8 level twice, which means that it may resume falling. I’m planning to increase my position as soon as the pair breaks the 3/8 level and stays below it.

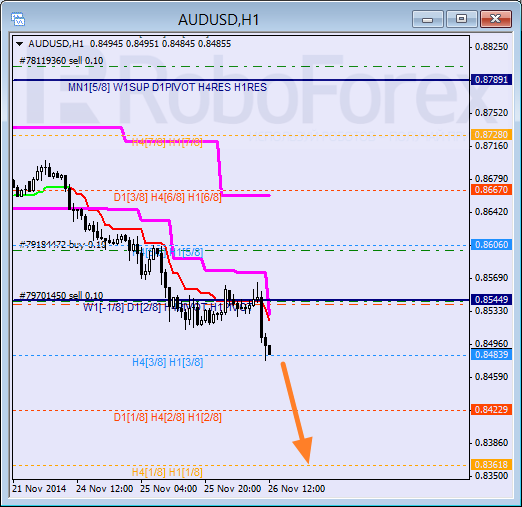

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar continues moving inside the downtrend; the market has been able to stay below the 4/8 level and right now is trying to break the 3/8 one. Earlier, during a local correction, I opened another sell order; the stop loss has already been moved to breakeven. If price is able to stay below the 3/8 level, the market will continue moving downwards.

As we can see at the H1 chart, the lines have been redrawn. The pair is supported by Super Trends. If later the price breaks the 3/8 level, the market may continue falling towards the 1/8 level or even the 0/8 one.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD tests lows near 0.6550 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is testing lows near 0.6550 after Australian Retail Sales dropped by 0.4% in March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data fails to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY rebounds to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Relief wave on altcoins likely as BTC shows a $5,000 range

Bitcoin price has recorded lower highs over the past seven days, with a similar outlook witnessed among altcoins. Meanwhile, while altcoins display a rather disturbing outlook amid a broader market bleed, there could be some relief soon as fundamentals show.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.