Analysis for October 8th, 2014

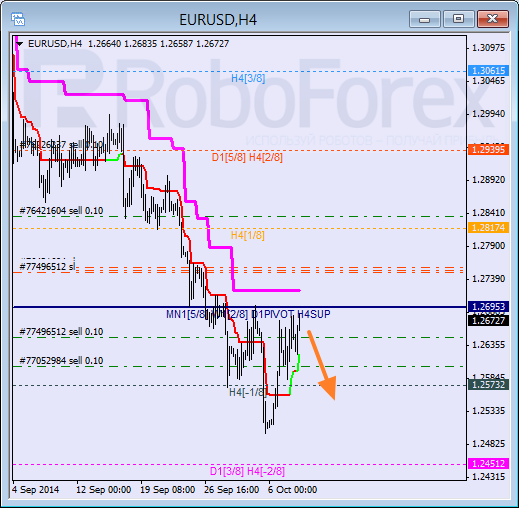

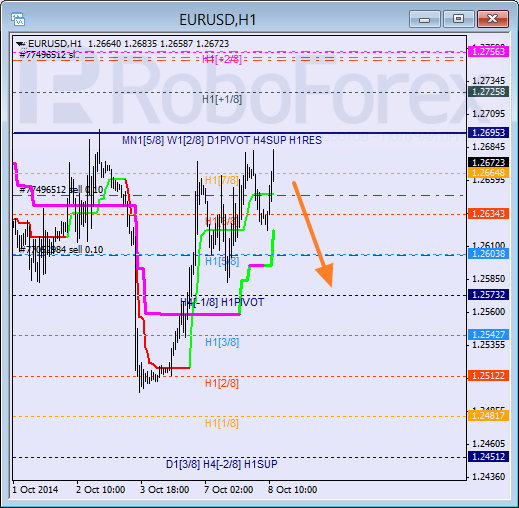

EUR USD, “Euro vs US Dollar”

Eurodollar is still consolidating inside “oversold zone”. In addition to that, Super Trends are still influenced by “bearish cross”. If the price breaks the H4 Super Trend during the day and stays below it, I’m planning to increase my short position.

As we can see at the H1 chart, the pair is getting closer to the 8/8 level. Possibly, it my rebound from this level and resume falling. Another signal to confirm a new descending movement is Super Trends’ returning into “red zone”.

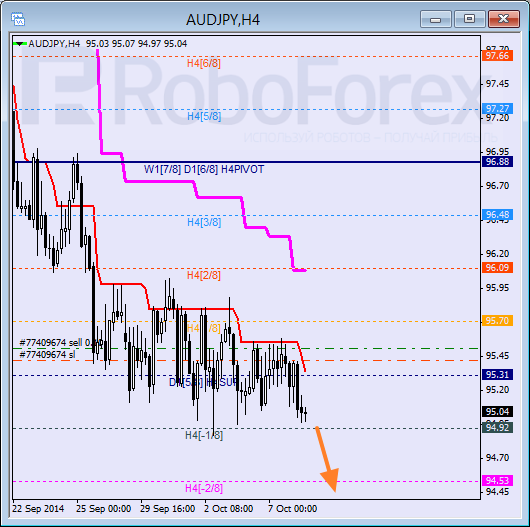

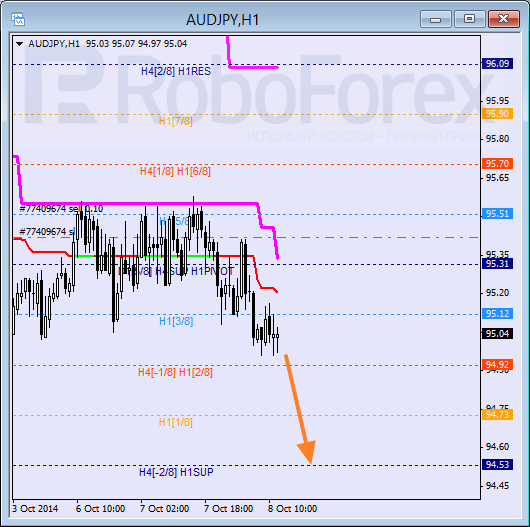

AUD JPY, “Australian Dollar vs Japanese Yen”

The pair has broken a local minimum, allowing me to move the stop loss on my sell order to breakeven. Possibly, in the nearest future the price may break the -2/8 level. In this case, the lines at the chart will be redrawn.

At H1 chart, the pair is trying to stay below the 3/8 level, which means that the market may continue falling towards the 0/8 one. If it breaks this level, the price may fall much lower.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.