Analysis for October 31st, 2013

AUD/USD

Australian Dollar is trying to rebound from the channel’s lower border. I opened a short-term sell order, but it’s quite risky, because the price is still moving below the Super Trends. I’ll increase my position right as soon as the pair breaks the daily Super Trend.

The lines at the H4 and H1 charts are completely the same. The market rebounded from the 3/8 level and right now is moving between the Super Trends. We can’t exclude a possibility that in the nearest future the pair may grow up towards the 5/8 level. The future scenario depends on how the price will move at this level.

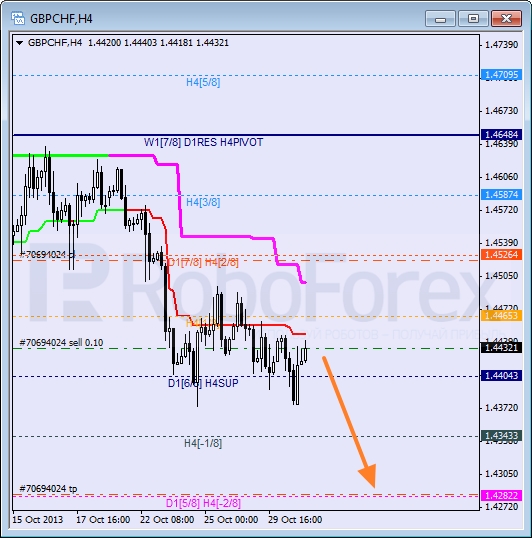

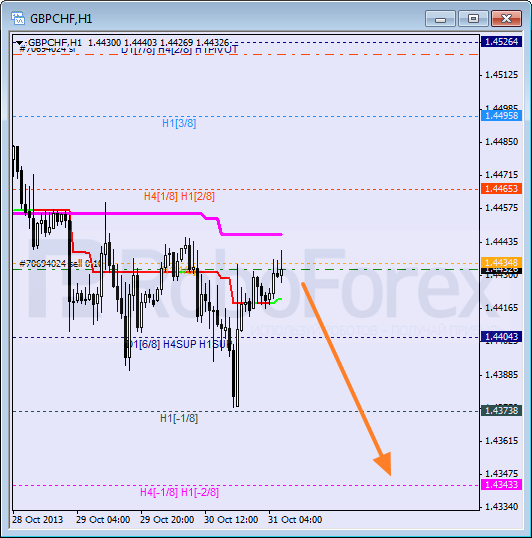

GBP/CHF

The pair has been consolidating for several day; the bears are supported by the H4 Super Trend. There is a possibility that the price may stay inside an “oversold zone” and continue falling down towards the -2/8 level.

At the H1 chart, the price also tried to inside an “oversold zone”, but failed. If later the pair breaks the ‑2/8 level, the lines at the chart will be redrawn.

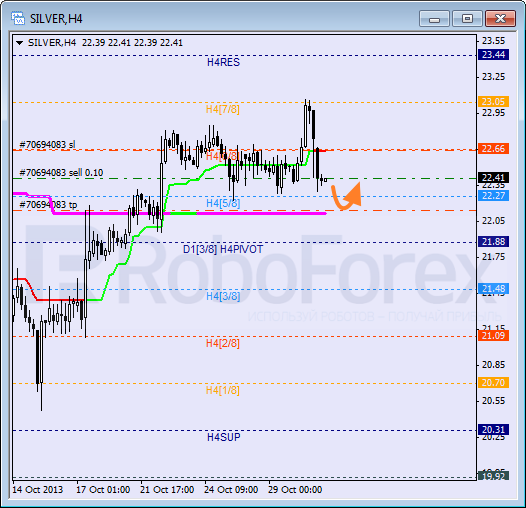

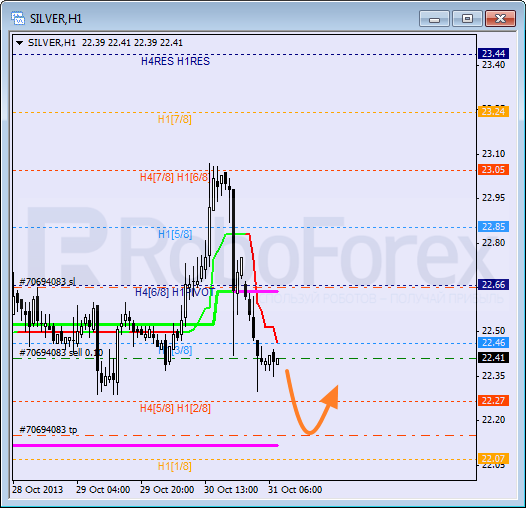

SILVER

Silver wasn’t able to break the 7/8 level and started a correction. The stop on my buy order opened earlier worked, and after that, I opened another buy order with the target at the daily Super Trend. If the price rebounds from it, the bulls will return to the market.

At the H1 chart, the Super Trends formed “bearish cross”. Earlier the price rebounded from the 6/8 level. During a local correction, I opened a short-term sell order. I’m planning to move the stop into the black as soon as the price breaks the minimum.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.